Choosing the appropriate apps for quick cash is crucial for a business owner. From micro-funding to cash prizes, the best economic applications can help you accomplish your financial objectives. To assist you in making an informed selection, I have produced a list of my top seven money-making applications and evaluated and reviewed each so you can find the one that best suits your needs.

Isn’t knowing that you can generate money using your smartphone is exciting? Apps that let you earn money are a great way to accomplish that. The average person uses their smartphone every day for four and a half hours. Rather than wasting time on social networking and news websites, why not put your skills to work and earn money?

These ranks cover a wide range of apps that can help you make money:

- You may earn free money by completing basic activities on iPhone apps.

- You may save money by using these apps!

- Investing plus passive income can be generated through personal finance applications.

- Everyday purchases can now be rewarded with cashback via new apps.

Before we review apps, you can try to test Cash App, which is one of the most used apps in the U.S. Please read our article Where Can I Load My Cash App Card to learn how and where you can load your Cash App.

Let’s get started now with making money apps.

The Best Apps for Making Money

I’ve compiled a list of the most acceptable applications for creating money this year.

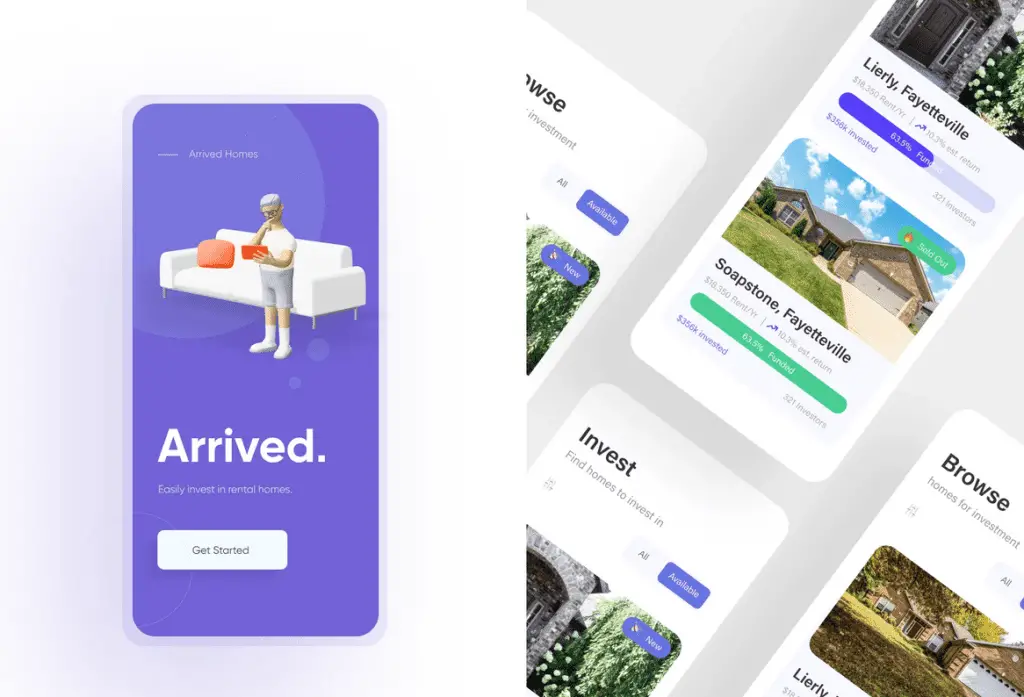

Arrived homes App

So, without becoming a landlord, one can learn how to participate in the land market. Stop your search using this application. Arrived Homes lets you buy property shares and generate rental income as a stockholder without trading with traditional real estate difficulties. I appreciate that this application offers an easy and passive approach to earning additional revenue and is the most interesting money-making application on the list. Arrived Homes is my best recommendation for making money with an app.

The concept behind the App is that it enables users to purchase assets and earn rental earnings as shareholders. You will also receive a yield on your investment if the home grows. Arrived handles all property maintenance and preservation aspects, so you have nothing to worry about. Arrived in the software for you if you desire steady monthly wages without spending on a time-consuming, intimidating project. Find a possession in their portfolio that interests you and start to be paid immediately.

How do Arrived Homes assess prospective transactions?

Each Arrived home member has been evaluated for their investment potential. While Arrived administers the properties, you can purchase shares online and share in the rental income and appreciation.

Who Can Invest in Arrived Homes?

Arrived does not restrict participation to institutional or accredited investors; any U.S. citizen or resident over 18 may invest. Investors require only $100 to get started.

Arrived homes App Key attributes:

- Get Began Easily – Browse available possessions and get on track in follow-ups.

- Make Passive Money – As a stockholder, earn rental returns.

- REIT Eligibility—As a Real Properties Investment Trust, the Arrived team is qualified to offer you all the advantages of this investing strategy.

- “Each property owned by Arrived Homes is structured as a REIT. Other public REITs are one-size-fits-all, but with Arrived, investors may construct a portfolio according to their desired investment location. Because each property is a REIT, Arrived investments have the same tax advantages as any REIT.”

Arrived homes App Advantages:

- A superior real estate investment method reduces the money and time required.

- A team with extensive skills in real estate, technologies, marketing, and finance guarantees Arrived’s protection and profitability.

- You can believe in the company’s ultimate success because international shareholders support it.

Arrived homes App Disadvantages

- A minimum of five to seven years is not optimal for short-term investors.

- A limited number of available rental homes

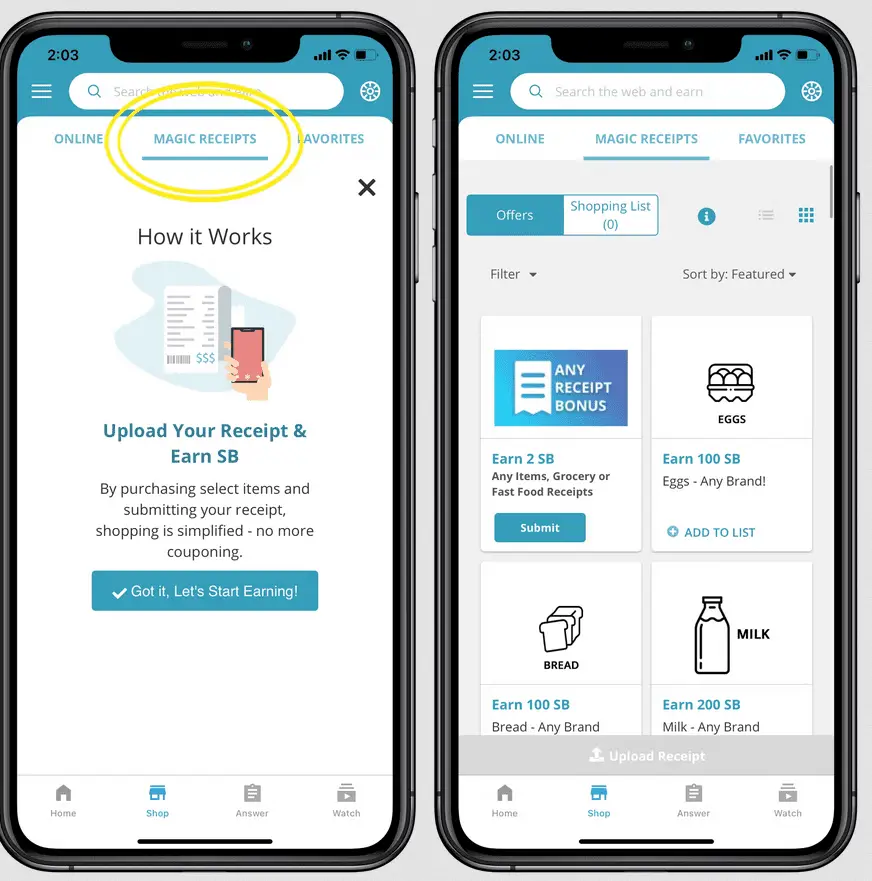

Swagbucks App

I recommend Swagbucks if you want to earn online quickly and easily. This innovative network allows users to get Swagbucks, which can be exchanged for cash or gift cards. Earn money with an online shop, paid reviews, video viewing, etc.

Swagbucks enables you to make money quickly through online shopping, web browsing, and video viewing. You can also participate in accessible surveys, opinion polls, and playoffs to make more money. The incentives can be redeemed for specific products, cash, or gift cards.

Following are the Swagbucks methods for earning a gift card

- Online businesses like Amazon, Target, Walmart, and Starbucks offer online shopping.

- Respond to surveys to get gift cards.

- Earn points and gift cards with special discounts and promotions.

- Utilize the Swagbucks search engine powered by Yahoo! to explore the web.

- Play the games and mark purchases within them.

Swagbucks is active in the United States, India, France, Germany, Australia, Spain, Canada, and Portugal (Britain, Australia, Ireland, and New Zealand). You may also sign up for Swagbucks using Facebook; otherwise, your email address is free. You can also earn additional points through recommendations. If you make Swagbucks your preferred search engine, options for earning extra Swagbucks will appear.

The best method to begin earning is to make Swagbucks your default search engine (rather than Google or Bing). You’ll automatically earn points for using their browser to surf the web as you usually would (if you’re concerned about efficiency, it’s powered by Yahoo, so don’t fret!).

For every 10 to 20 searches, you may expect to earn 10 to 20 S.B. points. The final sum will depend on the queries entered. After six months of daily quests, this can amount to approximately $300.

Swagbucks Key Attributes

- Gold Surveys show the time required to finish a review and the number of points that can be earned.

- Daily Poll – By frequently responding to a poll, you can make 1 Swagbucks per day.

- Swagbucks allows you to cash out on time for a minimum of $3, which means that you will receive your payment quickly.

Swagbucks Advantages

- Gift cards are available for Amazon, Walmart, Freecharge, Expedia, and PayPal. For every twenty minutes of video watched, 2 Swagbucks points are awarded.

- It also provides highlighted stores and Groupon shopping bargains.

- Signing up is free, and you receive a $10 incentive.

- Swagbucks provides numerous simple ways to earn rewards, and there is no redemption period. After redemption, payments typically come within ten business days.

- You can receive a $10 incentive with a $25 qualifying purchase when you join.

Swagbucks Disadvantages

- Earning Swagbucks is not a quick way to increase your bank account balance. It takes time to accumulate enough points for a substantial cash payout.

- Those who want to organize everything may find the mystery surrounding search engine points a bit of a problem.

- One S.B. is about equivalent to a penny. Because many activities are worth pennies, earning a significant income can take considerable time and work. In addition, you will not qualify for every survey or assignment. Users frequently report being interrupted in the middle of surveys. According to Swagbucks, this may be attributed to demographics or dishonest or inconsistent responses.

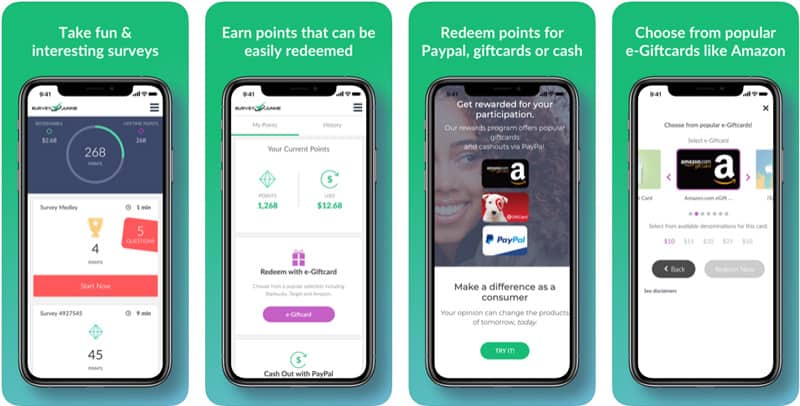

Survey Junkie

Do you enjoy taking surveys and being paid additional money? Thus, Survey Junkie is a site worth investigating. You may earn money through Survey Junkie by providing feedback on numerous companies and items. It is simple to get on track; you can also make extra money immediately. Survey Junkie allows you to inspire brands by voicing your opinion in exchange for additional compensation.

It assists you in completing surveys tailored to your side view and pays you with virtual points. The practical issues can be transferred to PayPal or redeemed for electronic gift cards.

Your funds can be transferred immediately to your bank account. You can also receive payouts via Amazon gift cards, PayPal, and other methods.

Survey Junkie Key Attributes:

Wide-ranging gift cards – Sells gift cards from various brands, such as Amazon, Sephora, Walmart, iTunes, Target, Starbucks, and Groupon.

You can estimate the time needed to perform a survey plus the number of points you can earn.

Survey Junkie Advantages

- All accessible surveys can be viewed on a dashboard only.

- The user interface is straightforward.

- The responses will be 100% confidential.

- Registration and participation in surveys are free.

Survey Junkie Disadvantages

- Some survey incentives were not included in my account despite my not being disqualified from the survey.

- Despite the meager incentives, there is a high cash-out minimum.

- It would help if you qualified for each survey in advance.

- Insufficient evidence that Survey Junkie is genuinely worth the effort.

Comparison of Swag Bucks and Survey Junkie

- Swagbucks and Survey Junkie are great ways to make money in your spare time.

- Swagbucks gives you more ways to make money, and when you join and meet the requirements, you get a $10 bonus.

- Survey Junkie doesn’t have a signup bonus, but they get more points when a new member fills out their profile.

- Survey Junkie and Swagbucks let you cash out in several ways, such as through gift cards and PayPal. In some countries, Survey Junkie members may also be able to set up direct bank payments.

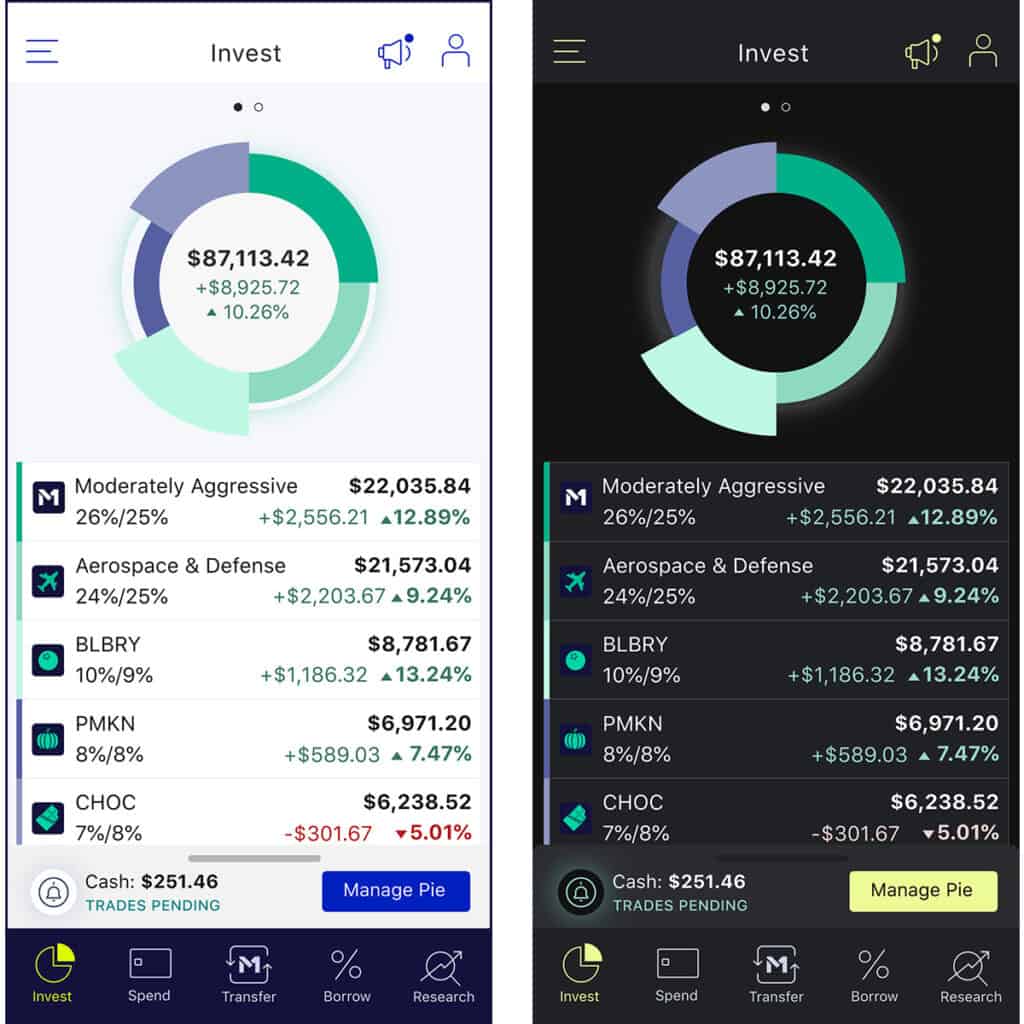

M1 Finance app

Exclusive perks and benefits enable you to earn, access, and receive more benefits and savings. The first year is complimentary (a $125 value). There is no catch, and registration takes a second barely.

For individuals who are interested in investing, I mention M1 Finance. This is an investment platform that facilitates capital growth with low risk. M1 could be suitable if you want to protect by creating small, consistent investments.

M1 Finance offers a variety of financial solutions for managing to spend, borrowing, and investing,

Additionally, it helps you manage and rebalance your portfolio. In addition, its clever automation provides the most potent investment instruments and the cheapest borrowing possibilities. You can start a credit streak that you can use for as little as two percent with a $10,000 investment.

You can also receive 1% cash back on every dollar spent. Additionally, M1 Finance offers an APY 25 times the state average. It enables you to make the same sum from a large bank in two weeks in one year.

M1 Finance app Key Attributes

After taking over $25,000 in your share portfolio, you may engage in the morning and the afternoon.

No Investing Commission – No origination fees or share commissions are associated with the services.

M1 Finance app advantages

- Repay your mortgages in line with your preferences.

- It transfers the settlement monies to the bank account automatically.

- It permits borrowing at meager interest rates.

- On some debit card procurements, you earn a generous reward.

- You will not be required to participate until your account balance hits $100, and there will be no further broker fees or commissions.

M1 Finance app disadvantages

- The M1 Finance platform is a hybrid one. It does not attempt to compete with Charles Schwab and Fidelity Investments as a comprehensive online brokerage. Neither provides a complete Robo-advisor experience, as Wealth Front or Betterment does.

- A potential mismatch between consumers’ expectations and the platform’s services may contribute to M1 Finance’s disadvantages. If you wish to actively trade stocks, bonds, or ETFs, M1 Finance will not meet your needs. Users who require financial advice, tax-loss harvesting, awareness of their financial goals, and risk tolerance should go elsewhere.

- The lack of telephone customer assistance is a considerable drawback. Chatbots are limited and usually lack the code to respond to client questions appropriately. Despite M1 Finance’s assurance of prompt email responses, speaking with a live agent might be helpful.

M1 Finance, apart from Acorns, allows free trades. Milliken, this site’s top Robo-advisor, delivers automated investing based on your predefined investment choices.

Acorns App

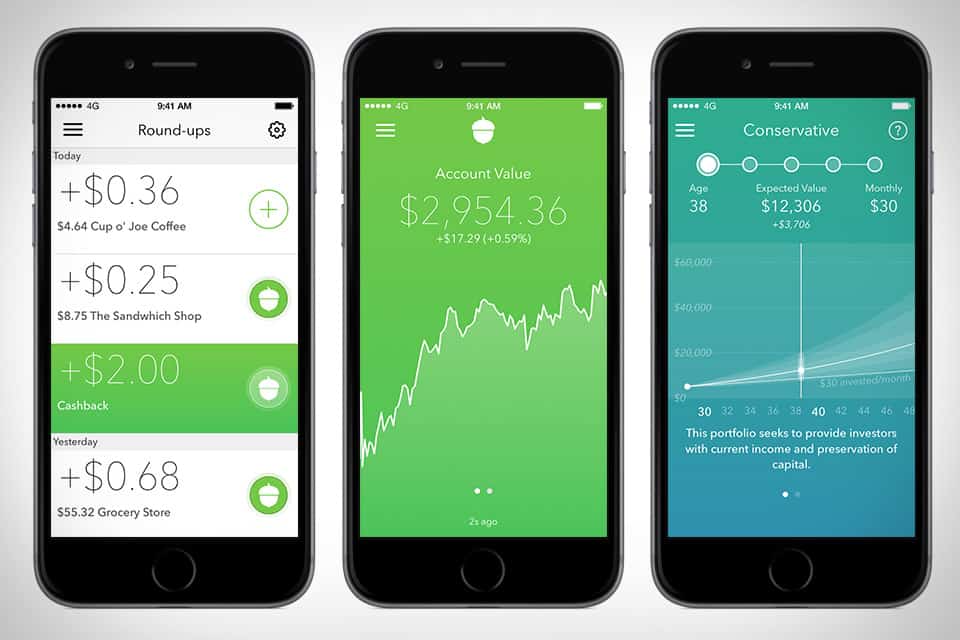

Do you need your savings to work but have a limited investment amount? There is no need to look beyond Acorns. This application enables you to support an additional change from daily buying in a diversified stock and bond portfolio. I like the Apps app since all you need to do to get Apptrack is analyze how you may change your daily spending to begin saving.

Acorns is a micro-financing website that allows you to invest your leftover change from daily purchases.

Create an account in minutes and diversify your portfolio by investing in stocks and bonds. Deposit a minimum of $1.

- You can finance by transferring funds with Acorns.

- Investment classes

- More than 7,000 stocks and bonds of leading firms

Security is also not a concern. It offers bank-level safekeeping, 256-bit encryption, and 2-factor authorization to secure your funds. Its thorough articles and videos also help you comprehend the complexities of investment.

Acorns App Key Attributes:

Acorns Advanced – It automates your investing and helps you build a substantial retirement nest egg in minutes.

Consultancy—Acorn’s support team comprises certified advisors who will assist you in achieving your financial objectives by participating in the appropriate funds.

Acorns App Advantages

- It offers bank-grade safekeeping.

- Get cashback at a select number of stores.

- You can earn extra investments by purchasing with more than 350 businesses.

- You can sign up for as little as $1/month.

Acorns App Disadvantages

- Priority one is the tiered fee system, which is excessive for beginners with low balances.

- Paying $36 a year in fees is a lousy deal when you have a few hundred invested. Betterment offers a no-minimum, lower-fee alternative to many Robo-advisors that need a $500 or $1,000 account minimum.

There are three price options for Acorns:

- Standard: The $1/month lite plan consists of a single investing account.

- Individual: The $3/month personal plan includes a bank account, an investing account, and a retirement account.

- Family: $5 monthly. The family plan includes an investing account, a checking account, a retirement account, and a savings account for young investors.

Comparison of M1 Finance and Acorn

M1 Finance and Acorns both provide commission-free trades.

There are no account fees at M1. Depending on needs, acorns have small monthly account fees ranging from $1 to $3.

M1 Finance offers one more type of finance account than Acorns, like a Trust account.

Worthy Bonds App

Worthy Bond is an investing platform that provides small businesses with loans. You can invest in corporate bonds and receive a set % interest rate of 5%.

The straightforward investment tool enables you to profit with as little as a $10 investment and no additional fees. It uses your funds to provide American businesses with secured loans—a beneficial situation for both parties involved—you and minor businesses.

Using theApprthy Bonds App, you may track Appur’s actual interest rate, around a 36-month lock-in term. However, you may redeem your bonds to fund your financial needs and objectives without incurring any costs or drawbacks.

Worthy Bond Key Attributes:

Reliable Loans – Reduce the danger of your investment by securing the loan amount with corporate assets.

Computerized Investment—Your spare change can be invested automatically. It gathers loose change until it reaches $10, automatically purchasing a bond on your behalf.

Worthy Bond Advantages

- All of its transactions are protected by 128-bit SSL encryption.

- It delivers a mobile application with an intuitive user experience.

- phone and live chat assistance

- It credits weekly interest.

- Liquidate your assets without restriction.

- Completely free service.

Worthy Bond Disadvantages

- Accounts Are Not FDIC-Guaranteed.

- There is no way to purchase corporate or government bonds.

- All investors, including accredited investors, are subject to purchase limits.

- In a relatively high market, returns could be less competitive.

Google Opinion Rewards App

This program is based on rewards in which participants are compensated for completing Google reviews. It suggests short surveys that pay anytime they are completed.

The awards are distributed as PayPal credits or Google Play. You receive surveys on various subjects, such as opinion polls, guesthouse evaluations, and merchant fulfillment surveys.

It typically provides location-based local surveys. Each survey may take between ten seconds and 1 minute to complete. The acclaims are valid for one year, and the App will alert you when they close to expiring.

Google Opinion Rewards App Advantages

- Buy applications, eBooks, movie rentals, and games with Play Store credits.

- Its smartphone app is likewise compatible with iOS, and payouts may be made to PayPal.

- You have a whole day to finish a survey.

- Install the free mobile application and get on the go immediately.

Google Opinion Rewards App Disadvantages

- However, the obvious disadvantage is that these polls do not offer much in return.

- Even less than with well-known applications and websites. You do not receive cash, but rather, you receive a credit for Google services.

Quick evaluation

- Age requirement: 18 years and older

- Mobile-compatible devices (iOs and Android)

- $1 is the average payout per survey.

- The duration of the survey is less than one minute.

- Minimum cashable earnings: $2

- Options for payment include PayPal and Google Play credit

- When your account balance hits $2, automated payments are initiated.

- Zero signup bonus

App Inventors Persistently Explore Methods to Reward Users

These are only a few apps that can be used to generate income. New applications are constantly being introduced. Be cautious with the files you download and the information you submit.

If you don’t mind removing the effort and filling out several registration forms over the next hour, you can immediately start with many of the things on the list and monetize from your phone in no time.

Bottom line

Making money is becoming a fundamental feature of life. It is challenging to live a healthy and happy life without sufficient funds. Therefore, making money has become virtually everyone’s first objective.

Then, instead of wasting time on social media apps, why not earn money and make your dreams come true?