Milestone payments are a common practice in the world of freelance work. They allow freelancers to manage their workload better and ensure that they get paid for the work they do. In this article, we’ll discuss what milestone payments are, why they’re essential for freelancers, and how to manage your milestone payments best.

For example, suppose a client hires a freelance web designer to create an eCommerce website. In that case, the designer might use milestones such as “design home page” or “set up payment gateway” to indicate progress toward completion. At each stage, the client will compensate the freelancer for their work.

What is Milestone Payment?

A milestone payment is a specific payment made in stages or installments based on achieving particular project milestones or objectives. It is often used in freelancers’ project-based contracts or agreements, particularly in construction, software development, or consulting services, where projects are usually completed over time.

Typically, milestone payments are based on predefined milestones agreed upon by the parties involved. For example, in a construction project, the milestones might include the completion of excavation work, the foundation, and the roof. Once each milestone is achieved, the contractor can request payment for that portion of the work completed.

Milestone payments are often used to ensure that the project progresses as planned and that the work is completed satisfactorily. They also help to minimize the financial risk for both parties by breaking up the payments into manageable chunks rather than paying for the entire project upfront.

Milestone Payments Example

Here’s an example of how milestone payments might be used to pay a freelancer who is developing a $1000 website:

- Agreement on milestones: The client and the freelancer agree on specific milestones that must be completed before payment. For this example, let’s say there are three milestones: a. Milestone 1: Design of the website – $300 b. Milestone 2: Development of the website – $500 c. Milestone 3: Testing and deployment of the website – $200

- Payment schedule: The client and the freelancer agree on the payment schedule, which in this example will be as follows: a. Milestone 1: $300 payment upon completion and approval of the website design. b. Milestone 2: $500 payment upon completing and accepting the website development. c. Milestone 3: $200 payment upon completion and approval of testing and deployment.

- Work begins: The freelancer starts work on the project, keeping the milestones and payment schedule in mind.

- Milestone 1 completed: Once the freelancer has completed the website design, they submit it to the client for approval. If the client approves the plan, the freelancer receives the $300 payment.

- Milestone 2 completed: After completing the website development, the freelancer submits it to the client for approval. If the client approves the development work, the freelancer receives the $500 payment.

- Milestone 3 completed: After testing and deployment, the freelancer submits the final version of the website to the client for approval. If the client approves the website and is ready to launch, the freelancer receives the last $200 payment.

In this example, the freelancer receives payment in installments after each milestone is completed and approved, reducing the risk of not being paid for their work. The client also benefits from this approach because they can ensure that the project is progressing as expected and that the work meets their requirements before making each payment.

Why Are Milestone Payments Important?

For freelancers, milestone payments are more than just an exchange of money; they also provide structure and security in client working relationships. Since milestone payments are prearranged and predictable, it helps both parties know when payments should occur and how much money is expected at each step throughout the project. This guarantees that the freelancer will get paid for their work and helps them stay organized and motivated along their journey. Additionally, these regular installments give clients peace of mind by allowing them to pay only after each stage is completed—rather than all at once— thus reducing financial risk while ensuring quality results within agreed-upon deadlines.

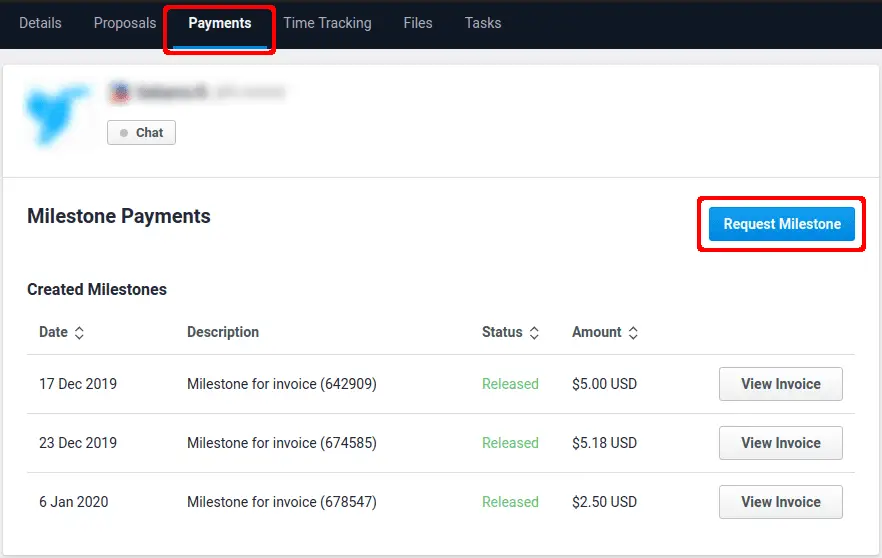

How To Manage Milestone Payments?

Managing milestone payments doesn’t have to be complicated; here are some tips on how you can make sure everything goes smoothly:

- Start by establishing clear terms with your client before beginning any work; agree on expectations for deliverables, timelines for completion, payment amounts per milestone, and payment method before starting any project

- Keep detailed records of all communications between yourself and your client regarding payment plans

- Ensure you understand exactly what tasks must be done at each milestone so there’s no confusion about when you should receive payment.

- Establish clear timelines for project completion so you can reasonably estimate when your next installment will be due.

- If possible, set up an automated system that allows your clients to make payments directly into your account (many services like PayPal offer this option)

- Send follow-up reminders several days before upcoming milestones so clients don’t forget their obligations.

By using these strategies—as well as any other measures that suit your particular situation—you can effectively keep track of your milestones and ensure successful negotiations with clients every time!

A milestone payment is made in stages or installments based on achieving specific project milestones or objectives.