In business, entrepreneurs try to increase the value of their service or product. Even freelancers try to improve services, communication., and value.

First, what is the definition of value?

Value is the quality that renders something desirable or valuable. In business, value implies the amount of money that can be received for something.

What are the value drivers?

Value drivers are ideas, activities, or capabilities that add value to a product or service to increase its value to consumers. They can also add value to an item, administration, or brand.

All the more explicitly, a value driver alludes to those exercises or abilities that include productivity, lessen hazards, and advance development as per critical objectives. Such objectives can incorporate expanding investor value, serious edge, and client advance.

Value drivers examples

All value driver examples can be divided into three categories: growth drivers, efficiency drivers, and financial drivers. Examples of value drivers are capital access, market environment, financial performance, reputation, , c, etc.

Value drivers are elements within a business that improve its economic worth or lead to enhanced performance. They can vary across industries, but the following are some common examples:

- Revenue Growth:

- The ability of a company to increase its sales or revenue over time.

- Strategies for revenue growth can include expanding into new markets, launching new products, or acquiring new customers.

- Profit Margins:

- The ability to control costs effectively and improve profitability.

- Efficiencies in supply chain management, operational efficiency, and pricing strategies can drive profit margins.

- Customer Satisfaction and Loyalty:

- The likelihood of customers returning and recommending the business to others.

- High-quality customer service, loyalty programs, and addressing customer feedback can drive this.

- Innovation:

- It develops new products, services, or processes that meet evolving customer needs or provide a competitive advantage.

- R&D (Research & Development) investments and a culture that promotes creativity can fuel innovation.

- Market Share:

- The portion of the total sales in an industry captured by a company.

- Competitive pricing, branding, and marketing strategies can help improve market share.

- Operational Efficiency:

- We are reducing waste, streamlining processes, and maximizing resource utilization.

- Lean methodologies and continuous improvement initiatives are key drivers.

- Talent Management and Employee Satisfaction:

- Attracting, retaining, and developing the best talent in the industry.

- Employee training programs, competitive compensation, and a positive workplace culture can drive this value.

- Brand Strength:

- The recognition, trustworthiness, and value associated with a company’s name and image.

- Branding campaigns, public relations, and social responsibility efforts can help bolster a brand’s strength.

- Scalability:

- The ability of a business to expand its operations or sales without a corresponding linear increase in costs.

- Investments in scalable technology and modular operational processes can facilitate growth.

- Risk Management:

- It identifies, assesses, and mitigates potential threats to a business’s profitability or existence.

- Insurance, diversified revenue streams, and robust compliance programs can help manage risks.

- Capital Efficiency:

- The effectiveness with which a company uses its capital to generate returns.

- This can be improved through optimized asset management, prudent investment decisions, and effective capital allocation strategies.

- Regulatory Compliance:

- Adhering to industry-specific laws and regulations ensures the company avoids legal penalties and reputational damage.

- Compliance training and monitoring systems are crucial for finance, healthcare, and energy industries.

- Supply Chain Management:

- Efficiently managing the flow of goods and services, from raw materials to end customers.

- Strategic partnerships, inventory management systems, and logistics optimization can drive this value.

Value Drivers Examples in Freelancer Business

In the context of freelancing, value drivers refer to those elements that enable freelancers to create more value in their work, enhance their offerings, attract more clients, and ultimately increase their income and reputation. Given the personal nature of freelancing, many of these drivers are intertwined with individual skills, adaptability, and branding.

Here’s an in-depth review of value drivers in the freelancer business, complete with examples:

- Expertise and Skill Set:

- Depth and breadth of knowledge in a particular field.

- Example: A graphic designer well versed in digital and print design can offer comprehensive services, from web design to business card creation.

- Portfolio and Past Work:

- Demonstrating quality, versatility, and style through previous projects.

- Example: A freelance writer with a diverse portfolio containing blog posts, technical articles, and creative pieces showcases adaptability to different writing needs.

- Professional Reputation and Reviews:

- Positive feedback and endorsements can boost credibility and attract more clients.

- Example: A freelance developer with stellar reviews on platforms like Upwork or Toptal can command higher rates and attract quality clients.

- Communication and Interpersonal Skills:

- Being responsive, understanding client needs, and managing expectations.

- Example: A freelance consultant who consistently updates clients on project progress and addresses concerns promptly.

- Adaptability and Continuous Learning:

- Keeping up with industry trends, tools, and technologies.

- Example: A digital marketer who continuously updates their skills with the latest SEO techniques or social media algorithms.

- Pricing Strategy:

- I set competitive yet profitable rates based on skill level, demand, and market conditions.

- Example: A freelance photographer who offers event package deals tailored to different client budgets.

- Networking and Relationship Building:

- Creating connections that can lead to referrals and repeat business.

- Example: A freelance event planner who networks with vendors and venues to get better client deals and gain referrals.

- Branding and Self-Promotion:

- It is creating a personal brand that resonates with target clients and markets oneself effectively.

- Example: A freelance illustrator with a distinct artistic style and active Instagram presence that showcases their work and personality.

- Operational Efficiency:

- We are streamlining administrative tasks and using tools to manage projects effectively.

- Example: A freelance translator using software like Trello to manage multiple projects and deadlines.

- Reliability and Consistency:

- Delivering quality work on time, every time.

- Example: A freelance video editor who always meets deadlines, ensuring clients can launch their campaigns as scheduled.

- Diversification of Services:

- We are offering complementary services or packages to cater to broader client needs.

- Example: A freelance web designer who provides content writing or SEO services.

- Niche Specialization:

- Carving out a niche can lead to becoming an expert in a particular area, allowing for premium pricing.

- Example: A freelance writer specializing in medical content catering to healthcare providers and institutions.

In the world of freelancing, personal branding, quality of work, and relationships are paramount. By focusing on and enhancing these value drivers, freelancers can ensure sustainable growth, client loyalty, and a reputation that sets them apart in the crowded freelance marketplace.

What are the value drivers of a company?

The value drivers of a company are:

- Technology

- Product/Service Offering

- Marketing Strategy and Branding

- Market Environment

- Human Capital

- Financial Performance

- Economies of Scale

- Customer Base

- Capital Access

What are marketing value drivers?

Marketing value drivers are:

- Strong brands

- Discounting

- Marketing investment

- Marketing costs

- Customer loyalty

- Strategic relationships

- Market selection,

- Differential advantage

Why are value drivers significant?

Value drivers will cause an organization’s items to appear superior to its rivals. Allowing several value drivers can support its influence on the commercial center. They will additionally impact shoppers’ decisions to buy that item. According to the shopper, these give recognizable attributes that organizations can use to make their items more alluring.

- Performance Enhancement:

- Value drivers help businesses identify areas of strength and improvement, guiding them towards better operational efficiency.

- Strategic Decision Making:

- By understanding value drivers, leaders can decide where to allocate resources and which strategies to pursue.

- Increased Profitability:

- Many value drivers, such as operational efficiency and customer satisfaction, directly contribute to better margins and higher profits.

- Competitive Advantage:

- Focusing on and optimizing key value drivers can set a business apart from competitors.

- Investor Attraction:

- Investors look for businesses that understand and optimize their value drivers, as it often indicates sustainable growth and profitability.

- Enhanced Stakeholder Value:

- By improving the critical value drivers, businesses can deliver increased value to shareholders and all stakeholders, including employees and customers.

- Guided Growth:

- Value drivers provide a roadmap for businesses to expand in a manner that’s consistent with their strengths and market opportunities.

- Risk Mitigation:

- Recognizing and focusing on value drivers related to risk management can help businesses anticipate, prepare for, and navigate potential challenges.

- Resource Optimization:

- Understanding value drivers helps businesses prioritize where to invest time, money, and effort for maximum return.

- Long-term Sustainability:

- Businesses continually refining and optimizing their value drivers are more likely to adapt to market changes and ensure long-term success.

- Clarity in Communication:

- Articulating value drivers provides employees, stakeholders, and the market with a clear message about the business’s values and future direction.

- Measurement and Monitoring:

- Value drivers provide quantifiable metrics that businesses can track over time, ensuring they stay on course and achieve their objectives.

To persistently enhance items and administrations, organizations ought to continually check the market to be the first to exploit changes sought after and shopper conduct. Value drivers don’t need to identify with an item legitimately. For example, the notoriety of having extraordinary client support can be a value driver for an organization.

What is the value driver examination?

Value driver investigation is a significant establishment for vital arranging, helping the board sort through their activities to characterize necessary critical switches. If, for instance, development drivers are essential to a specific firm, the executives can guide the key to zero in on development methodologies.

A value driver examination, often called a value driver analysis, identifies, assesses, and optimizes the key elements that drive value in a business.

Here are the bullet points explaining the concept:

- Identification:

- The first step involves recognizing the potential value drivers specific to a business or industry.

- Quantification:

- You assign measurable metrics or KPIs (Key Performance Indicators) to each identified value driver.

- Prioritization:

- Ranking value drivers based on their impact on business performance and strategic importance.

- Benchmarking:

- To gauge performance, you compare a company’s value drivers against industry standards or competitors.

- Assessment:

- We evaluate each value driver’s current effectiveness and performance in the business context.

- Gap Analysis:

- We are identifying discrepancies between the current state of value drivers and desired outcomes or industry best practices.

- Optimization Strategies:

- We are developing plans and initiatives to enhance the performance of identified value drivers.

- Monitoring & Review:

- It continuously tracks the performance of value drivers over time and adjusts strategies as necessary.

- Feedback Loop:

- We use insights from the monitoring phase to refine and adapt the value driver examination process for future iterations.

- Stakeholder Involvement:

- It engages key stakeholders, such as employees, management, and investors, to gain insights and ensure alignment on value drivers.

- Alignment with Business Strategy:

- They ensure the identified value drivers align with the broader business strategy and objectives.

- Outcome Evaluation:

- We assess tangible impacts from optimizing key value drivers, such as increased profitability or market share.

The value driver examination provides a structured approach for businesses to hone in on the elements that significantly contribute to their success, ensuring they remain competitive, profitable, and aligned with their strategic goals.

So, value drivers guarantee that the procedure is grounded in the truth of working execution. Distinguishing value drivers is a three-advance cycle: • Develop a value driver “map” of your business • Test for value driver sensitivities • Test for controllability.

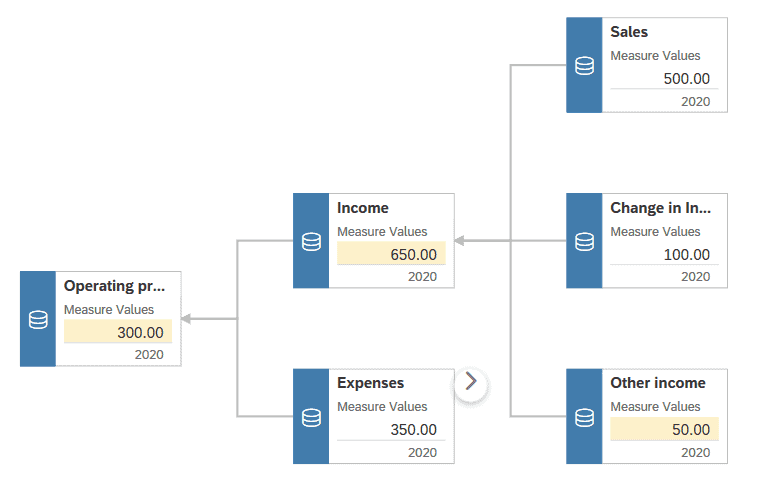

What is the value driver tree?

A “value driver tree” represents a flow diagram that plots all the factors that lead to business value creation and how they relate. Value driver managers can discover this using value driver tree analysis.

Example of value driver tree in SAP Analytics Cloud

Overseeing value drivers

Corporate administration has a continuous command to expand investor returns. In any case, while raising investor value is a significant corporate goal, it isn’t explicit and responsible enough for working administration, who should likewise realize which factors most impact value and which elements can be most effectively influenced. We call these variables “value drivers,” and they are the essential focal point of organizations that prevail regarding boosting investor value.

Value drivers are the components that will probably have the best effect on an organization’s prosperity, and they are explicit to various enterprises and organizations.

For instance, the value drivers spurring a medical services organization to move specific business measures from on-premises to cloud-based frameworks would be unique concerning those propelling an assembling organization looking to actualize computerized fabricating innovation connection distinctive information storehouses and cycles of the assembling lifecycle. Deciding on a genuine value driver requires considering long-haul gains and not getting influenced by popular processes or advancements that don’t include absolute value or are just momentary wins.

There are various significant value drivers, regardless of weather types, such as development drivers, operational drivers, monetary drivers, or levels, such as nonexclusive or specialty unit explicit.

When the activity is needed to understand a specific value driver – for instance, overseeing stock turns or factors that influence working capital – the value driver must be characterized at an express and comparable level. For example, a C-level leader has overall knowledge and elevated-level obligations different from a cutting-edge director’s. Yet, each can do significant value-driving activities.