Most SaaS products don’t fail because of bad technology. They fail because no one knows they exist. Every day, founders ship well-built apps, AI tools, and micro-SaaS products—only to discover that getting customers is harder than building software. Blog posts promise “growth hacks,” Twitter threads repeat the same advice, and paid ads burn money without traction.

The truth is simpler and harder at the same time:

there are only a few acquisition strategies that actually work, and they work because they are executed with discipline, timing, and clear economics. This article breaks down six proven ways real SaaS companies get customers, based on businesses generating anywhere from $20K to over $300K in monthly recurring revenue. These are not theories or frameworks invented after the fact. Each strategy is backed by a real example, showing exactly how demand was created, validated, and scaled.

Some of these companies built momentum before launching. Others rode existing waves of attention. Some won through SEO and AI search. Others scaled using high-ticket offers and paid ads.

You don’t need to use all six strategies. In fact, most successful SaaS products rely on one or two done extremely well.

The goal of this guide is simple:

to help you recognize which acquisition model fits your SaaS, avoid wasted effort, and reach your first (or next) customers faster.

Below are the six strategies, explained one by one, with real examples and practical insights you can apply immediately.

-

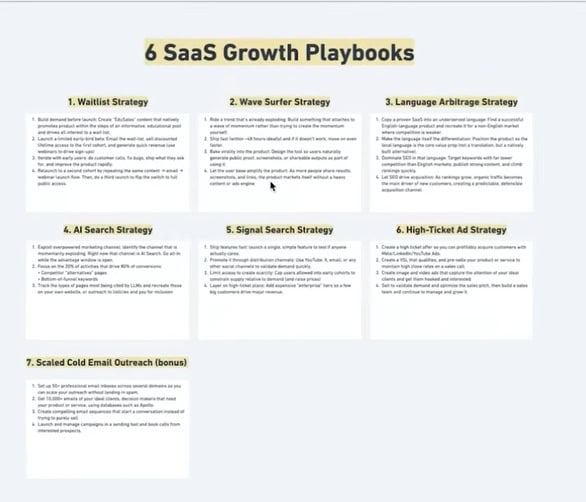

Waitlist & pre-launch demand

Build demand before launch by publishing value-driven content, sending people to a waitlist, and launching with a limited beta (early-bird pricing or capped access), which creates scarcity, validates demand, and gives you your first paying users fast. -

Trend-jacking (wave-surfing)

Ship a simple product extremely fast around a trending topic or viral conversation, piggyback on existing attention, and design the product to be shareable so users spread it for you organically. -

Language or geography arbitrage

Take a proven SaaS idea that works in English markets and recreate it for another language or region (e.g. French, German, Spanish), where competition and SEO difficulty are much lower but demand already exists. -

SEO + AI search dominance

Create a small number of very strong “bottom-of-funnel” pages (alternatives, comparisons, best-of lists) so your SaaS gets recommended by Google and AI tools like ChatGPT and Perplexity, which convert far better than traditional search traffic. -

Feature-led content & YouTube distribution

Launch with one standout feature, explain it publicly through YouTube videos, threads, or Loom demos, and let education-based content drive high-trust inbound users—even with a small audience. -

High-ticket ads with sales funnels

If you have (or can create) a higher-priced plan, use paid ads to send traffic to a video sales page or demo funnel, pre-qualify leads, and close fewer customers at much higher value instead of chasing low-priced subscriptions.

Watch whole video:

Waitlist & Pre-Launch Demand: How Cleo and Mentions Reached $20K–$60K MRR Before Public Launch

Most SaaS products fail not because of bad code, but because they launch without demand. The waitlist & pre-launch demand strategy solves this by reversing the process: you build interest, validate willingness to pay, and generate revenue before the full product is public. Two clear real-world examples of this approach are Cleo and Mentions, both bootstrap SaaS products that scaled to meaningful MRR within weeks.

The core idea

Instead of building in isolation and hoping users show up, you attract attention first, collect emails through a waitlist, and then launch to a limited beta with real pricing. Scarcity, early access, and direct customer feedback drive fast validation and revenue.

Step 1: Content that sells without selling (Cleo example)

Cleo did not start by promoting a product. The founders published value-driven content on LinkedIn and X, focused on problems their audience already cared about—such as growing an audience, writing better posts, and increasing engagement.

Crucially, the product was mentioned only subtly, often as a bullet point or a comment rather than the main focus of the post. This “edgy sales” approach built trust because readers felt educated, not pitched. Some posts contained no call-to-action at all, forcing curious users to visit the founder’s profile to discover what was being built.

This content drove people naturally to one action: joining the waitlist.

Step 2: Driving traffic into a waitlist (Mentions & Cleo)

Both Cleo and Mentions used a simple waitlist landing page. The page did not list every feature. Instead, it clearly explained:

-

Who the product was for

-

What problem it solved

-

Why early access mattered

The waitlist created two powerful effects:

-

Validation – thousands of people signed up before launch

-

Scarcity – access would be limited to a fixed number of beta users

By the time Cleo launched, they already had 10,000–12,000 people on the waitlist, meaning demand was proven before the product was fully available.

Step 3: Limited beta with real money (Cleo’s $59 lifetime launch)

Cleo launched its beta to only 500 users. This was not a free trial. It was a paid beta with a strong incentive:

-

Normal price planned: $99

-

Beta price: $59 lifetime access

-

Hard cap: first 500 users only

This did three things simultaneously:

-

Created urgency (“If I don’t buy now, I lose the deal”)

-

Filtered serious users from freebie hunters

-

Generated immediate revenue

The result was explosive. Cleo reached over $60K MRR in roughly 53 days, without ever publicly launching the product.

Mentions followed the same framework and reached $20K MRR in around 30 days using this exact approach.

Step 4: Email warm-up before launch (real Cleo emails)

Before opening access, Cleo sent countdown-style emails to the waitlist:

-

“9 days until launch”

-

“7 days until beta access”

-

“1 day left – 500 spots only”

These emails were not aggressive sales pitches. They were written as short stories and progress updates, explaining why the product existed and what problem it solved. A webinar was also offered for people who wanted a deeper walkthrough, but most sales came directly from the launch email itself.

The emails built anticipation, not pressure.

Step 5: Early users as product collaborators

Once the first 500 users joined, the founders booked dozens of calls with customers. Each co-founder spoke directly with at least 50 users.

These conversations answered critical questions:

-

Which features mattered most?

-

What was confusing or unnecessary?

-

Why did users decide to pay?

This feedback guided the next iteration of the product and messaging.

Step 6: Relaunch with higher pricing (second beta)

After improving the product, Cleo reopened access at a higher price:

-

First beta: $59 lifetime

-

Second beta: $79 lifetime

-

Planned public price: $99/month

Each cohort:

-

Increased perceived value

-

Reduced risk

-

Improved product quality

Importantly, Cleo still had not launched publicly when they crossed $60K MRR. Everything happened through waitlists, beta launches, and controlled access.

Why this strategy works so well

The Cleo and Mentions examples show why the waitlist & pre-launch demand strategy is so powerful:

-

Demand is proven before scale

-

Revenue arrives early

-

Scarcity drives action

-

Feedback improves product-market fit

-

Marketing and product evolve together

Instead of asking, “Will anyone buy this?”, you already know the answer before launch.

Wave-Surfer Strategy: How TrustMR Reached ~$24K MRR by Riding a Viral Trend

Some SaaS products don’t need long pre-launch phases, waitlists, or months of content. Instead, they grow by riding an existing wave of attention. This is known as the Wave-Surfer (or Trend-Jacking) Strategy, and a clear real example from the text is TrustMR.

TrustMR reached ~$24K MRR in roughly 30 days by shipping fast, attaching itself to a viral conversation, and building virality directly into the product.

The core idea

Instead of trying to create demand, you find demand that already exists, then build a product that plugs directly into that conversation. Attention comes first, product second.

This strategy works best when:

-

A topic is already trending

-

People are emotionally invested (frustration, anger, curiosity)

-

No obvious product exists yet to solve the problem

Step 1: Spot a viral pain point (Peter Levels tweet)

The wave for TrustMR started with a viral tweet by Peter Levels, one of the most followed indie hackers on X. He complained publicly about fake MRR screenshots being shared on social media and how impossible it was to verify who was real and who was faking success.

This tweet went viral because:

-

Many builders felt the same frustration

-

Accusations of “fake revenue” were already common

-

Trust is extremely important in the SaaS/indie hacking community

The demand already existed — it just wasn’t organized into a product yet.

Step 2: Ship immediately (48-hour build)

Within 48 hours of that viral tweet, TrustMR was live.

This is critical:

The founder did not over-engineer features, polish UI, or wait for validation. He shipped a minimal product that solved the exact problem being discussed:

-

A database of verified MRR screenshots

-

Proof that revenue claims were real

-

A public page users could share

Speed mattered more than perfection because the conversation was happening now, not in six months.

Step 3: Piggyback on existing virality (quote-retweets)

TrustMR didn’t need a large audience. Instead, the founder:

-

Quote-retweeted viral posts

-

Responded directly inside trending threads

-

Positioned the product as the solution to the complaint

This worked because quote-retweets on X amplify reach dramatically when tied to an existing viral post. The traffic came from the wave itself, not from paid ads or long-term SEO.

The product became part of the conversation.

Step 4: Build virality into the product itself

TrustMR was designed to be shared.

Every user who verified their MRR:

-

Wanted to post the verified screenshot publicly

-

Linked back to TrustMR

-

Drove new users automatically

This is the key difference between TrustMR and many failed SaaS launches:

sharing was the main feature, not a marketing afterthought.

The product didn’t just benefit from virality — it required virality to work.

Step 5: Monetize attention, not subscriptions

TrustMR faced a common issue with viral products:

Lots of traffic, but low intent to pay monthly subscriptions.

Instead of forcing subscriptions, the founder monetized attention:

-

Selling advertising placements

-

Offering limited sponsorship slots

-

Creating scarcity in ad inventory

Early advertisers paid less, later advertisers paid more, reinforcing urgency and social proof. This model worked because the audience was extremely high-value: founders, builders, and SaaS operators.

Why this strategy worked

TrustMR succeeded because it:

-

Solved a visible, emotional problem

-

Shipped at the exact moment demand peaked

-

Used existing virality instead of creating its own

-

Embedded sharing directly into the product

-

Monetized attention realistically

Many founders miss the timing window. TrustMR didn’t.

When to use the Wave-Surfer strategy

This strategy is ideal if:

-

You can build fast

-

You monitor trends daily

-

You are comfortable killing ideas quickly

-

You want fast validation instead of slow compounding growth

It is not ideal for:

-

Deep enterprise SaaS

-

Long sales cycles

-

Complex workflows requiring months of development

Language Arbitrage Strategy: How Teachizy Reached ~$65K MRR by Rebuilding a Proven SaaS in French

Not every successful SaaS idea needs to be original. Some of the fastest-growing products are localized versions of ideas that already work. This approach is called Language Arbitrage, and Teachizy is a clear real-world example.

Teachizy reached around $65K MRR by taking a well-known SaaS model (online course platforms like Teachable or Kajabi) and rebuilding it specifically for the French-speaking market.

The core idea

Instead of competing in crowded English-speaking markets, you take a proven SaaS concept and adapt it to another language or geography, where:

-

Competition is lower

-

SEO is easier

-

Users prefer local tools

-

Large platforms often ignore local nuances

Language becomes the moat.

Step 1: Copy what already works (no invention risk)

Teachizy did not invent online course software. The founders looked at:

-

Teachable

-

Kajabi

-

Thinkific

These platforms were already validated at scale, meaning:

-

There was clear demand

-

Pricing models were proven

-

Features were well understood

Teachizy’s innovation was not the product model, but who it was built for.

Step 2: Go fully native, not just translated

Teachizy positioned itself as:

-

100% in French

-

Built in France

-

Designed for French creators

This was not a simple translation. The branding, copy, onboarding, help docs, and tone were all native. Identity mattered.

For many French users, buying a French-made product:

-

Feels more trustworthy

-

Feels culturally aligned

-

Avoids English-first UX friction

This emotional alignment gave Teachizy an advantage over global competitors.

Step 3: Exploit SEO “easy mode” in another language

One of Teachizy’s biggest growth drivers was SEO in French.

Compared to English:

-

Keyword competition was far lower

-

High-intent keywords were still available

-

Many pages ranked with minimal backlinks

Keyword research showed a “sea of green”:

High search volume + low difficulty — something rarely seen in English SaaS SEO today.

As a result, Teachizy ranked quickly for:

-

Course platform keywords

-

Creator tools

-

Online training solutions in French

SEO became their number-one acquisition channel.

Step 4: Geography + language = stronger trust

Teachizy didn’t just sell in French — it leaned into being local:

-

“Made in France” messaging

-

Targeting French creators and businesses

-

Understanding local regulations and expectations

This matters because users often prefer:

-

Local support

-

Local pricing expectations

-

Local compliance and norms

Global SaaS tools often feel “foreign” at the edges. Teachizy filled that gap.

Step 5: Scale without fighting giants

By avoiding direct English-market competition, Teachizy:

-

Didn’t need massive ad budgets

-

Didn’t fight established brands head-on

-

Didn’t rely on influencer marketing

Instead, they built steadily through:

-

SEO

-

Word-of-mouth

-

Local credibility

That’s how they scaled to ~$65K MRR without being a global giant.

Why this strategy works so well

Language arbitrage works because:

-

Demand already exists

-

Competition is weaker

-

SEO compounds faster

-

Users trust native tools more

-

Big SaaS companies often ignore localization depth

You are not inventing demand — you are unlocking underserved demand.

When to use the Language Arbitrage strategy

This strategy is ideal if:

-

You speak (or can support) another language

-

You want long-term, stable growth

-

You prefer SEO over paid ads

-

You don’t want to fight crowded US markets

It is less ideal if:

-

Your SaaS depends on global network effects

-

Localization is extremely complex

-

You can’t support local customers properly

AI Search Dominance Strategy: How Tally Reached ~$338K MRR by Winning ChatGPT and AI Search

Search is changing. Instead of scrolling through ten Google links, users increasingly ask ChatGPT, Perplexity, or Claude what tool they should use. Tally is a clear example of a SaaS that recognized this shift early and used it to scale to ~$338K MRR.

The core idea

Rather than chasing every marketing channel, Tally focused on becoming the default recommendation inside AI-powered search tools. This strategy combines classic SEO principles with a new reality: AI assistants act as curated advisors, not search engines.

Being recommended by AI is more powerful than ranking #1 on Google.

Step 1: Identify the “overpowered” channel early

At the time Tally scaled, AI search was still underexploited. Few SaaS founders were optimizing content specifically for:

-

ChatGPT

-

Perplexity

-

Claude

Tally treated AI search as an overpowered (OP) marketing channel, similar to how Facebook Ads or early Google SEO worked in past decades.

They moved early while competition was low.

Step 2: Focus only on bottom-of-funnel pages

Instead of publishing hundreds of blog posts, Tally invested deeply in a small number of high-intent pages, including:

-

“Tally vs Typeform”

-

“Typeform alternatives”

-

“Best free form builders”

These pages answered the exact questions users ask AI tools.

The pages were:

-

Long and comprehensive

-

Honest comparisons (including competitors)

-

Structured clearly for easy parsing by AI models

Quality mattered far more than quantity.

Step 3: Become the AI-recommended answer

When users asked ChatGPT or Perplexity:

-

“What is the best free form builder?”

-

“What is an alternative to Typeform?”

Tally appeared repeatedly as a top recommendation.

Why this worked:

-

AI tools trust structured, authoritative pages

-

They prefer clear comparisons over marketing fluff

-

They surface fewer options than Google, increasing trust

Traffic from AI search converted 4–17× better than traditional search, according to data referenced in the TXT.

Step 4: Align SEO with AI citation behavior

Tally analyzed which pages AI tools were citing most often and doubled down on those formats.

Their “alternatives” and “versus” pages:

-

Generated most AI citations

-

Drove the highest-intent traffic

-

Became long-term acquisition assets

Instead of chasing keywords, they optimized for being cited.

Step 5: Let AI search compound over time

Once established, AI recommendations became self-reinforcing:

-

More citations led to more visibility

-

More users led to more mentions online

-

More mentions increased AI trust signals

This created a compounding loop similar to early SEO but with far less competition.

Why this strategy worked

Tally succeeded because it:

-

Moved early into AI search

-

Focused on decision-stage users

-

Built deep, authoritative content

-

Optimized for trust, not clicks

-

Let AI tools do the selling

Instead of convincing users manually, Tally let AI assistants recommend them as the best choice.

When to use the AI Search Dominance strategy

This strategy is ideal if:

-

Your SaaS has clear competitors

-

Users compare tools before buying

-

You can create high-quality comparison content

-

You want scalable, long-term acquisition

It is less effective if:

-

Your product is brand new with no category

-

Users don’t search before buying

-

Your value proposition is hard to explain in text

Signal Search Strategy: How LocalRank Reached ~$47K MRR by Launching One Feature and Letting the Market Decide

Not every SaaS needs a full product on day one. Some grow fastest by launching one highly visual, high-signal feature, watching how the market reacts, and expanding only after demand is proven. This approach is known as the Signal Search Strategy, and LocalRank is a clear real-world example.

LocalRank scaled to ~$47K MRR by shipping a single feature first, distributing it aggressively, and letting user response guide the roadmap.

The core idea

Instead of guessing what the market wants, you ship a small but impressive feature, put it in front of your audience, and observe the signal:

-

Views

-

Comments

-

DMs

-

Sales

-

Feature requests

The strongest signal tells you what to build next.

Step 1: Launch one standout feature (LocalRank heatmap)

LocalRank did not start as a full all-in-one local SEO platform. It launched with one feature only: a local SEO heatmap.

The heatmap:

-

Was visually striking

-

Solved a clear pain point for agencies

-

Was easy to explain in a demo

This made it perfect for content-driven distribution.

Step 2: Add distribution immediately (YouTube + X + email)

Instead of quietly releasing the feature, LocalRank:

-

Posted a launch thread on X

-

Published a YouTube demo video

-

Shared it with an existing email list

The result was immediate traction:

-

~$5K MRR on day one

-

Clear proof that agencies wanted the feature

Importantly, YouTube drove most of the revenue, despite having fewer views than X. Trust and explanation mattered more than raw reach.

Step 3: Use YouTube as a trust engine

LocalRank’s founder published simple, unpolished YouTube videos:

-

Screen recordings

-

Feature walkthroughs

-

Use-case explanations

These videos didn’t go viral, but they converted extremely well. Viewers already understood the problem, and the video showed exactly how the feature solved it.

YouTube became 80–90% of total sales, despite low view counts.

Step 4: Artificially cap early access

Once demand was visible, LocalRank:

-

Limited early access

-

Raised prices multiple times

-

Created urgency without hype

This allowed them to:

-

Increase MRR rapidly

-

Filter for serious customers

-

Improve the product with real users only

Prices were raised four times as demand proved strong.

Step 5: Introduce high-value enterprise plans

After validating the feature, LocalRank added higher-priced plans:

-

Entry plans around $20–40/month

-

“Scale” plan around $400/month

-

Enterprise plans up to $1,600/month

This single move increased revenue 4×, without increasing user count proportionally.

The key insight:

A small percentage of users are willing to pay much more for speed, limits, or agency-level access.

Step 6: Let features define the roadmap

Instead of building based on assumptions, LocalRank:

-

Expanded features users asked for

-

Doubled down on what converted

-

Ignored low-signal ideas

The product evolved from demand, not vision documents.

Why this strategy worked

LocalRank succeeded because it:

-

Shipped fast without overbuilding

-

Used distribution as validation

-

Focused on one compelling feature

-

Leveraged YouTube for trust

-

Captured high-ticket customers early

The market clearly told them what to build next.

When to use the Signal Search strategy

This strategy is ideal if:

-

Your SaaS has multiple possible features

-

You want fast validation

-

You’re comfortable shipping imperfect products

-

You can explain value visually

It is less effective if:

-

Your product requires many features to be useful

-

Your audience can’t be reached via content

High-Ticket Ad Strategy: How MailScale Reached ~$100K MRR Using Paid Ads and a High-Value Offer

Most SaaS products fail with paid ads because their pricing is too low to absorb acquisition costs. MailScale avoided this trap by designing a high-ticket SaaS offer first, then using paid ads only after the economics made sense.

By combining enterprise pricing, video sales pages, and paid traffic, MailScale scaled to ~$100K MRR.

The core idea

Paid ads work for SaaS only when customer lifetime value (LTV) comfortably exceeds acquisition cost (CAC). Instead of selling a $20–$50/month tool, MailScale focused on customers willing to pay hundreds or thousands per month.

Ads didn’t create demand — they scaled proven demand.

Step 1: Build a high-ticket offer first

MailScale helps B2B companies scale cold email outreach while avoiding spam folders — a high-ROI problem.

Instead of competing on low pricing, they introduced:

-

Enterprise-level plans

-

“Unlimited” or scale-focused packages

-

Pricing well above typical SaaS tiers

This ensured:

-

Fewer customers needed

-

Higher margins per sale

-

Ads could be run profitably

Without a high-ticket plan, paid ads would not have worked.

Step 2: Use a video sales letter (VSL) instead of demos

Rather than sending cold ad traffic directly to a signup page, MailScale used a video sales letter (VSL).

The VSL:

-

Explained the problem in detail

-

Built trust with the founder’s presence

-

Pre-qualified leads before booking calls

Watching a video is a much smaller commitment than booking a call, but it warms the user almost as effectively.

Step 3: Run simple but focused ad creatives

MailScale didn’t over-optimize design. They:

-

Used simple image and video ads

-

Followed the AIDA framework (Attention → Interest → Desire → Action)

-

Generated creatives using AI tools

They monitored which ads stayed live the longest — a strong signal of profitability.

It took 5–10 ad variations before consistent results appeared.

Step 4: Accept upfront testing costs

MailScale invested around $10,000 testing ads before finding a repeatable system.

This budget allowed them to:

-

Identify winning creatives

-

Dial in messaging

-

Reduce cost per booked call to ~$300

This step is critical: paid ads are not “cheap growth,” they are controlled growth.

Step 5: Close high-value customers, not high volume

Once leads were coming in:

-

Sales calls closed enterprise deals

-

CAC stayed below ~$1,000

-

Each customer generated multiples of that in LTV

At that point, scaling ads became a math problem, not a marketing guess.

MailScale then expanded with sales staff to increase capacity.

Why this strategy worked

MailScale succeeded because it:

-

Designed pricing for ads, not vice versa

-

Used ads to scale validated demand

-

Pre-qualified users through video

-

Focused on deal size over user count

-

Treated ads as an investment, not a gamble

This avoided the most common SaaS ad failure: low pricing with high CAC.

When to use the High-Ticket Ad strategy

This strategy is ideal if:

-

Your SaaS delivers clear ROI

-

Customers are businesses, not consumers

-

You can support sales calls

-

You have capital for testing

It is not ideal if:

-

Your SaaS costs <$50/month

-

You rely on self-serve signups

-

You cannot support sales conversations

- 6 Proven Ways SaaS Founders Actually Get Customers (With Real Examples) - December 17, 2025

- Facebook Ads to Get Followers! - December 27, 2024

- ClickUp vs. Slack - December 20, 2024