You might have heard about Venmo, which lets you efficiently manage your money. But what about the other thing you might be thinking of: two Venmo accounts? This is a common question asked by people just starting with Venmo. In this post, we’ll answer it for you. We’ll show you how to create and manage two Venmo accounts and use them interchangeably.

Venmo is an app that lets you efficiently manage your money. It’s similar to bank accounts, but it works a little differently. Instead of having one account you use for your regular transactions and another for your Venmo transactions, you have two. This way, you can easily switch between them when needed. You can also use one Venmo account to store money and another account to spend money.

Can I have more than one Venmo account?

Yes, you can have more than one Venmo account. However, you can only have a maximum of two accounts simultaneously.

Now, let us see how that works:

Can You Have Two Venmo Accounts?

You can have two Venmo accounts using different bank accounts or even the same bank account. However, you are limited to only two personal Venmo accounts.

For example, you can have two different Venmo wallets. One Venmo wallet is for everyday transactions, and one Venmo wallet is for spending money. You can think of it as having two bank accounts. If you have a checking account, you can use it to pay bills, pay loans, and other regular transactions. But if you have a savings account, you can use it to save money, for emergencies, and long-term goals.

Let us see how to set up Venmo:

How do you create and manage two Venmo accounts?

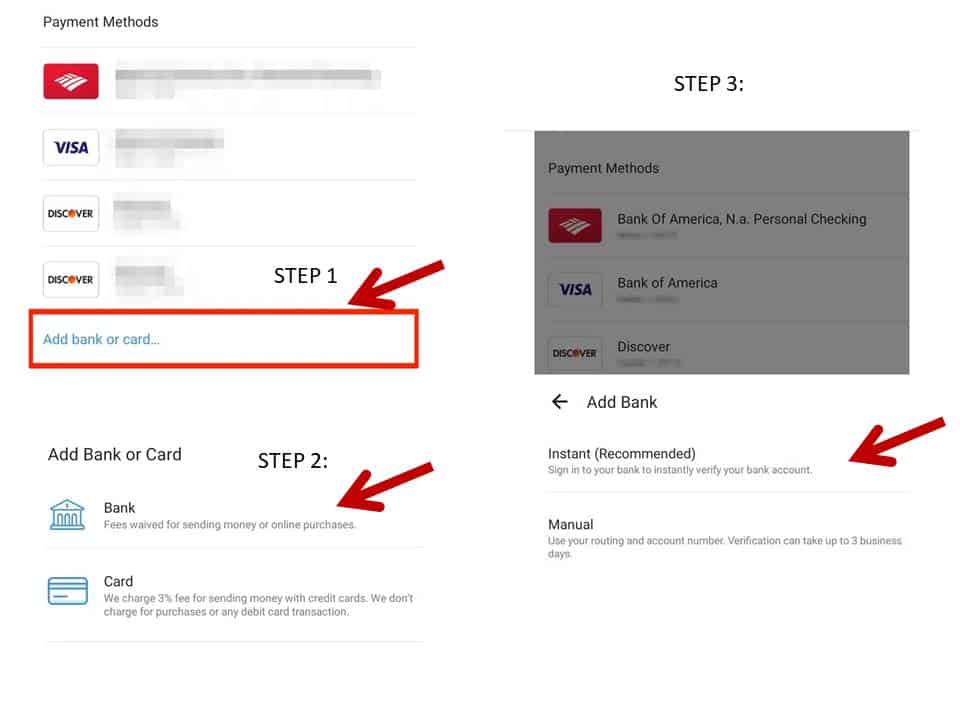

You’ll first need to create a new account to create and manage two Venmo accounts. To do this, go to the App Store and open the Venmo app. Next, click the Accounts tab and the New Account button. The new account will be created with a unique name and password. Once you’ve completed your account, you can begin managing your money.

Two Venmo account benefits.

One of the benefits of using two Venmo accounts is that you can easily manage your money. You can quickly transfer and spend money as needed when you have two Venmo accounts. You can also spend money on different items in one account and save on other things in another. This is a great way to keep your finances in order and ensure your money is safe.

Can you link two Venmo accounts to one bank account?

When you use Venmo, you’ll be asked to create a new account and choose a payment method. After that, you won’t have to worry about which account is used for which payment. Instead, you can use your regular checking account or your Venmo account. The critical thing to remember is that you can interchangeably use either of your accounts.

Conclusion

If you’re like most people, you use two Venmo accounts interchangeably. But what if you only had one? It may not be a big deal if you’re an everyday consumer, but the difference can be huge if you run a business. Venmo is a digital payment system that lets you have two separate Venmo accounts – one for your everyday use and one for your business use. You can use these different accounts to make quick and easy payments or to keep your business account separate from your account so you can make more complex or expensive payments in more detail. If you’re a small business, this can be a lifesaver.

- Facebook Ads to Get Followers! - December 27, 2024

- ClickUp vs. Slack - December 20, 2024

- Mastering E-Commerce Analytics: A Blueprint for Success