Loan officers are vested with a wide range of responsibilities and authorities. A loan officer with less experience would adhere to the requirements, but a loan officer with more experience would be able to discover mitigating situations that would offset inaccurate information.

Loan officers need to approve SBA loans.

What is an SBA loan?

SBA or Small Business Administration loans represent small business loans partially guaranteed by the government. All financial institutions that issue loans have protection and lower risk with SBA loans.

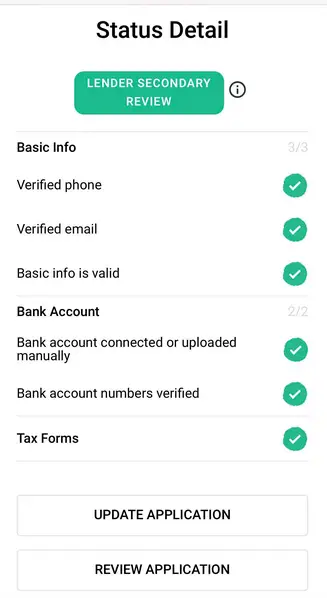

If you use an SBA online platform such as womply.com, you can see in your application this message:

“L” under secondary review”

“What Does Lender Secondary Review Mean?

Lender Secondary Review is the procedure for issuing a business SBA loan. Several loan officers must provide additional secondary opinions and recommendations for loan denial or approval during this standard process.

Loan authorities must ensure that all loans are seen in the same light and prevent some loans with the same characteristics from being approved and some loans rejected. Additionally, loan officers must check if the SBA flags your loan because you have a duplicate PPP loan. Sometimes, people apply for the same loan several times online, and officers must reject duplicate loans and accept only one.

The second review procedure guarantees that each loan is reviewed the same way as the others. This plan does not aim to make a terrible loan; instead, it aims to ensure that all borrowers have an equal chance of being approved for a loan. Loan officers at one bank were given the authority to support and advise the refusal of loans.

A second review officer (the credit policy officer) reviewed all hostile actions and had to sign off on them. She was selected because she evaluated loans from all officers, distinguished between excellent and poor loans, and had the knowledge and authority to discuss the loan with the original decision-maker.

If there isn’t a second review, the bank may receive two applications with the same information. Depending on the loan officer’s level of experience, one of the applications might be approved while the other is turned down. This presents a problem.

The form serves as a guide to guarantee that all applicants have equal access to loans. As evidence to regulators that the bank was doing all possible to ensure equality, the form may be added to the bank’s policy of adverse action notification. If the bank chooses this course of action, one should include the second review procedure in the babank’sending policy.

The SBA supports small companies and entrepreneurs. Its objective is to “strengthen and develop the nation’s economy through allowing the formation and feasibility of minor enterprises.” “Capital, contracts, and counseling are the agency’s three Cs.”

“under the Small Business Jobs Act and the Recovery Act, loans from SBA were guaranteed up to 90% to help small firms access financing following the 2008 credit freeze—renowned record lending volumes in late 2010.

The SBA helps deliver 23% of federal prime agreements to minor firms. Initiatives include attempts to target service-disabled veteran-owned, woman-owned, 8(a), and HUB Zone enterprises. The SBA’s Franchise Directory was created in March 2018 to link entrepreneurs to loans and cash.

Each state has an SBA office. The organization also supports:

- About 900 SBDCs (Small Business Development Centers)

- 110 WBCs (WoWomen’susiness Centers)

- More than 1000000 small industry holders use these counseling services yearly.

President Obama stated in January 2012 that he would move the SBA to the position it previously held during the Clinton administration, i.e., Into the Cabinet.

SBA Loans

Guaranteed Loans

This Guarantee Program helps small-business owners start or grow. The initiative offers non-bank and bank loans. The 2010 Act of Small Business Jobs raised these loans from 2 to 5 million dollars. They may cast it for short- and long-term operating capital, debt refinancing, and buying fixtures, supplies, and furniture.

Loan Disaster

- This includes long-term, low-interest loans for landowners and leaseholders to rehabilitate damaged properties.

- Long-term, low-interest loans for Disaster-stricken businesses are usually authorized in 21 days.

- If the Disaster Relief Loan firm fails and closes, the SBA will chase the holder to discharge private possessions to settle a debt. Any tax applied by the IRS will return to the loan debt.

Microloan

The Microloan program lends directly to nonprofit intermediate lenders, who then lend up to fifty thousand dollars to nonprofit childcare facilities and small enterprises. Microloan borrowers get marketing, managerial, and technical help.

Startup programs

SBDCs (Small Business Development Centers)

State and SBA matching funds sponsored 900 centers. SBDCs are usually co-located in community state universities, colleges, and entrepreneurial centers. Cole Browne handles SBA site acquisitions.

OWOB (The Office of Women-Owned Businesses)

It was created in 1979. The initiative empowers women entrepreneurs via outreach, advocacy, support, and education. This Program helps disadvantaged women entrepreneurs compete in contemporary business. And include preparation and advising, capital, finance, marketing support, and federal assistance for women-owned companies.

Act Women’s Business Ownership of 1988 created the WBC Program. To guide aspiring and present women business owners, Congress developed the Demonstration Training Program for those who are economically and socially deprived. The initiative aimed to promote the economy by helping women-owned companies thrive.

WBCs (WoWomen’susiness Centers)

- It is a national system of over a hundred voluntary-private educational centers financed partly by the SBA. Most centers receive less than the maximum annual SBA funding of $150,000.

- WBCs help women establish and expand small companies, but everybody may use their services.

- WBCs help over one hundred thousand women businesspersons flourish by offering training, mentorship, company development, and finance.

- It supports economically and socially deprived folks.

- Provides business training, mentorship, and microloans to 68% of clients.

SCORE

- As a resource partner of the SBA, SCORE was created in 1964. Free mentorship and cost-effective training support over 10 million small business owners. In 2016, SCSCORE’sen thousand counselors helped:

- One hundred and twenty-five thousand clients

- Start fifty-four thousand small companies

- Creating more than 78 thousand non-holding employment

- Its Mentorship program is a fundamental function; in this Program, volunteer, skilled mentors coach small company customers for free.

- SCORE provides cost-effective virtual and physical programs each year.

VBOC (Veteran Business Outreach Centers)

- This SBSBA’sffice maintains 22 VBOCs via endowments and accommodating contracts by administrations that help veteran- and family-owned companies.

- VBOCs give trainers for the SBSBA’soots to Business program.

Strategic innovation

Federal business and contracting programs

8(a) BDP

- This Business Development Program helps economically and socially deprived females and marginalized folks create small companies. Applicants must show social and economic disadvantage via a personal statement and documentation.

- This Program gives disadvantaged businesses nine years to flourish. It has created thousands of employment nationwide, and many successful companies have provided internships, tuition aid, and more. 8(a) enterprises get 5% of the $99B in federal small company contracts annually.

- The SBA, FBI, and IRS identified a fraud conspiracy in 2011. U.S. Army Civilian Workers Corps of Engineers reportedly filed fake invoices totaling more than 20 million dollars and pocketed the cash.