As a freelancer, you can work for manufacturing companies, solve problems, and make calculations for them. But whether you are an accountant or programmer, you need to understand the term manufacturing overhead. Manufacturing overhead is a term used in business-oriented firms, and it means Indirect Cost.

What Is Manufacturing Overhead?

Manufacturing overhead, also known as factory overhead, factory burden, or production overhead, represents manufacturing operations costs that include costs incurred in the manufacturing facilities other than direct materials and direct labor costs, such as Indirect costs.

When there is mass production, there are calculations for each unit and how much each unit bears the expenses in their productions. Tools are used to calculate the production cost or the manufacturing cost per unit for any business or factory with a massive volume of units. By calculating one unit production cost, it is pretty easy to estimate mass production and the resources that will be needed. Following are the tools for the calculations that are primarily used:

Manufacturing Overhead can be calculated using the following:

- Property taxes on the production facility

- Depreciation equipment used in the production process

- Rent on the factory building

- Salaries of maintenance personnel

- Salaries of manufacturing managers

- Salaries of the materials management staff

- Wages of building janitorial staff

- Salaries of the quality control staff

- Supplies not directly associated with products (such as manufacturing forms)

- Utilities for the factory

These are factors that play a role in advancing the manufacturing process. Since they are all equally important for producing units, and due to these factors, you can calculate the per-head cost of each unit. Most importantly, overhead manufacturing costs include the hard-to-define costs of making products. However, they still need to be calculated when it comes to marketing. This is called the Indirect cost.

What Are The Manufacturing Overhead Examples?

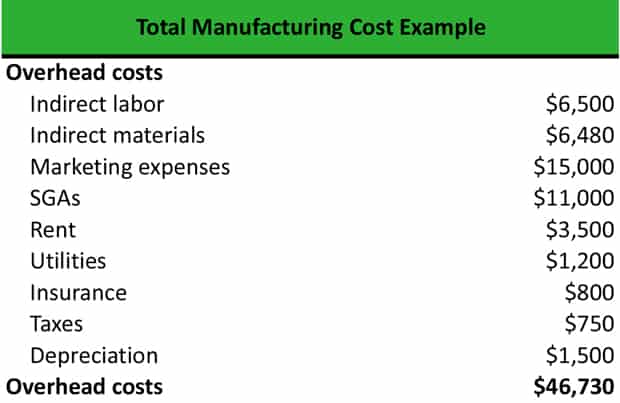

The Manufacturing Overhead Example calculation is given in the table below, where indirect costs are summarized.

Manufacturing Overhead Formula

In most accounting costs and systems, firms’ accountants apply the manufacturing overhead to the goods produced using a standard overhead rate.

A Manufacturing Overhead Formula can be created when the budgeted manufacturing overhead cost is divided by a standard output or activity level. Total budgeted manufacturing overhead varies at different typical output levels. However, it does not differ in direct proportion to output.

Why Does Manufacturing Overhead Matter the Most in Companies?

Manufacturing overhead matters the most in companies because when managers calculate manufacturing overhead, it is easier to reduce unnecessary expenses while growing the company’s net revenue.

Of course, knowing the manufacturing cost, whether direct or indirect, allows you to relate the product and its production to the available resources. This can quickly help the company or other manufacturing firms estimate and reduce the extra expenses where applicable.

And yes, the cost of accounting and calculation is included under the manufacturing head as indirect costs since it does not directly link product manufacturing to finished products.