In the world of business, mergers and acquisitions are common. Companies often merge or acquire another company for various reasons, such as expanding their market reach, eliminating competition, accessing new technology or talent, or gaining a more robust financial foothold. However, these transactions can be incredibly complex, requiring extensive research, negotiation, and due diligence. This is where M&A advisors come in.

M&A advisors, or mergers and acquisitions advisors, provide guidance and support to companies throughout the entire M&A process. These individuals or firms typically specialize in helping companies with either mergers or acquisitions, although some may provide services for both.

M&A advisors play a critical role in facilitating successful M&A transactions. They help companies identify potential M&A targets, conduct due diligence to analyze the target’s financials, operations, and business strategy, negotiate terms and conditions of the transaction, and manage the integration of the two companies after the deal closes. M&A advisors also provide critical insights on industry trends, regulatory landscapes, and valuations, which help companies make informed decisions and maximize the value of their transactions.

The increasing importance of M&A advisors has also led to the growth of firms specializing in M&A advisory services. These firms range from boutique consulting to large multinational companies with extensive M&A expertise. Examples of well-known M&A advisors include Goldman Sachs, JP Morgan, and Morgan Stanley.

When selecting an M&A advisor, companies should consider several factors, such as the advisor’s experience, reputation, and expertise in the relevant industries. Additionally, M&A advisors should possess strong communication and negotiation skills and demonstrate a deep understanding of regulatory requirements and financial analysis.

M&A advisors range of services

M&A advisors, mergers and acquisitions advisors, or investment bankers are professionals or firms that provide strategic advice and assistance to companies involved in mergers, acquisitions, divestitures, or other corporate transactions. Their primary role is to help clients navigate the complexities of the M&A process and achieve their strategic objectives.

M&A advisors offer a range of services to their clients, which may include:

- Strategic Planning: Advisors work closely with clients to understand their business objectives and develop a strategic plan for mergers, acquisitions, or divestitures. They assess market conditions, industry trends, and potential targets or buyers.

- Target Identification and Screening: Advisors help identify potential acquisition targets or suitable buyers based on the client’s strategic goals. They conduct research, perform financial analysis, and evaluate potential synergies to determine the best fit.

- Valuation: Advisors provide valuation analysis to determine the target company’s fair market value or the acquired assets. They use various methodologies and financial models to assess the value and negotiate favorable client terms.

- Due Diligence: Advisors assist in conducting thorough due diligence on the target company or assets. This involves evaluating financial records, legal documents, contracts, intellectual property, operational processes, and other relevant information to identify potential risks and opportunities.

- Negotiation and Deal Structuring: Advisors play a crucial role in negotiating the transaction terms, including the purchase price, payment structure, warranties, representations, and other deal-specific provisions. They strive to maximize value for their clients and ensure a favorable outcome.

- Deal Execution and Project Management: Advisors guide clients through the transaction process, coordinating with legal, tax, and other professionals to ensure a smooth and efficient deal closing. They manage the timeline, documentation, regulatory compliance, and other aspects of the transaction.

- Post-Merger Integration: In mergers or acquisitions, advisors may assist with post-merger integration strategies, helping the client seamlessly merge the acquired company’s operations, systems, cultures, and workforce.

M&A advisors typically have extensive experience in finance, accounting, corporate law, and deal-making. They leverage their industry knowledge, networks, and negotiation skills to provide valuable guidance throughout the M&A process. The services provided by M&A advisors vary depending on their client’s specific needs and the nature of the transaction.

Buy Side M&A Fees

Buy Side M&A advisor’s fees are usually 1%-5% for retainer buy-side fee and from 2%-10% success buy-side fee. Usually, percentages decrease drastically on deal values of more than four million dollars.

In the context of mergers and acquisitions (M&A), buy-side advisory fees represent the compensation paid to financial advisors or investment banks hired by the buyer in a transaction. The acquirer incurred these fees for the advisory firm’s services throughout the M&A process. The buy-side fees are separate from the fees paid to the sell-side advisors who represent the seller.

Buy-side fees are typically structured in the following ways:

- Advisor Retainer Fee: At the beginning of the engagement, the buyer may pay a retainer fee to secure the advisory firm’s services. This fee is usually a fixed amount and covers the initial work involved in the transaction, such as preliminary analysis, due diligence planning, and target identification.

- Advisor Success Fee: The primary component of buy-side fees is the success fee, also known as the transaction fee. It is contingent on the successful completion of the M&A deal. The success fee is typically calculated as a percentage of the transaction value, such as the target company’s purchase price or equity value. The rate can vary depending on the transaction’s complexity, size, and industry. It is subject to negotiation and is outlined in the engagement agreement between the buyer and the advisory firm.

The success fee compensates the advisory firm for its expertise, deal structuring, negotiation skills, and successful transaction execution. It is often higher than the retainer fee due to the effort, resources, and risks of completing a merger or acquisition.

It’s important to note that buy-side fees can also include additional expenses, such as out-of-pocket costs incurred by the advisory firm on behalf of the buyer. These may include travel expenses, legal fees, data analysis, due diligence expenses, and other related costs. The buyer typically reimburses these expenses separately.

The details of buy-side fees, including the percentages, terms, and conditions, are typically negotiated between the buyer and the advisory firm during the engagement process. Each transaction may have unique fee arrangements based on factors such as the deal’s complexity, size, and the expertise required from the advisory firm.

Buy Side M&A Retainer Fees

Buy-side advisor Retainer fees can range from 1% to 5% of the expected success fee or transaction value, although this can vary significantly depending on the circumstances. For example, if the success fee is expected to be $1 million, the retainer fee could range from $10,000 to $50,000.

The M&A advisor retainer fee can vary depending on the transaction’s complexity and size, the advisory firm’s reputation and expertise, and the specific terms negotiated between the buyer and the advisor.

Regarding the percentage value, retainer fees are typically a smaller portion of the overall compensation than the success fee.

However, it’s important to note that retainer fees are often negotiated as fixed amounts rather than percentages. For example, the retainer fee could be a specific dollar value agreed upon between the buyer and the advisor. This fixed retainer fee covers the initial work and costs incurred by the advisory firm at the beginning of the engagement.

Based on a percentage or a fixed dollar amount, the specific retainer fee arrangement will be determined through negotiation and outlined in the engagement agreement between the buyer and the advisory firm. Both parties need to agree upon the terms, considering the specific circumstances and requirements of the transaction.

Buy Side M&A Success Fees

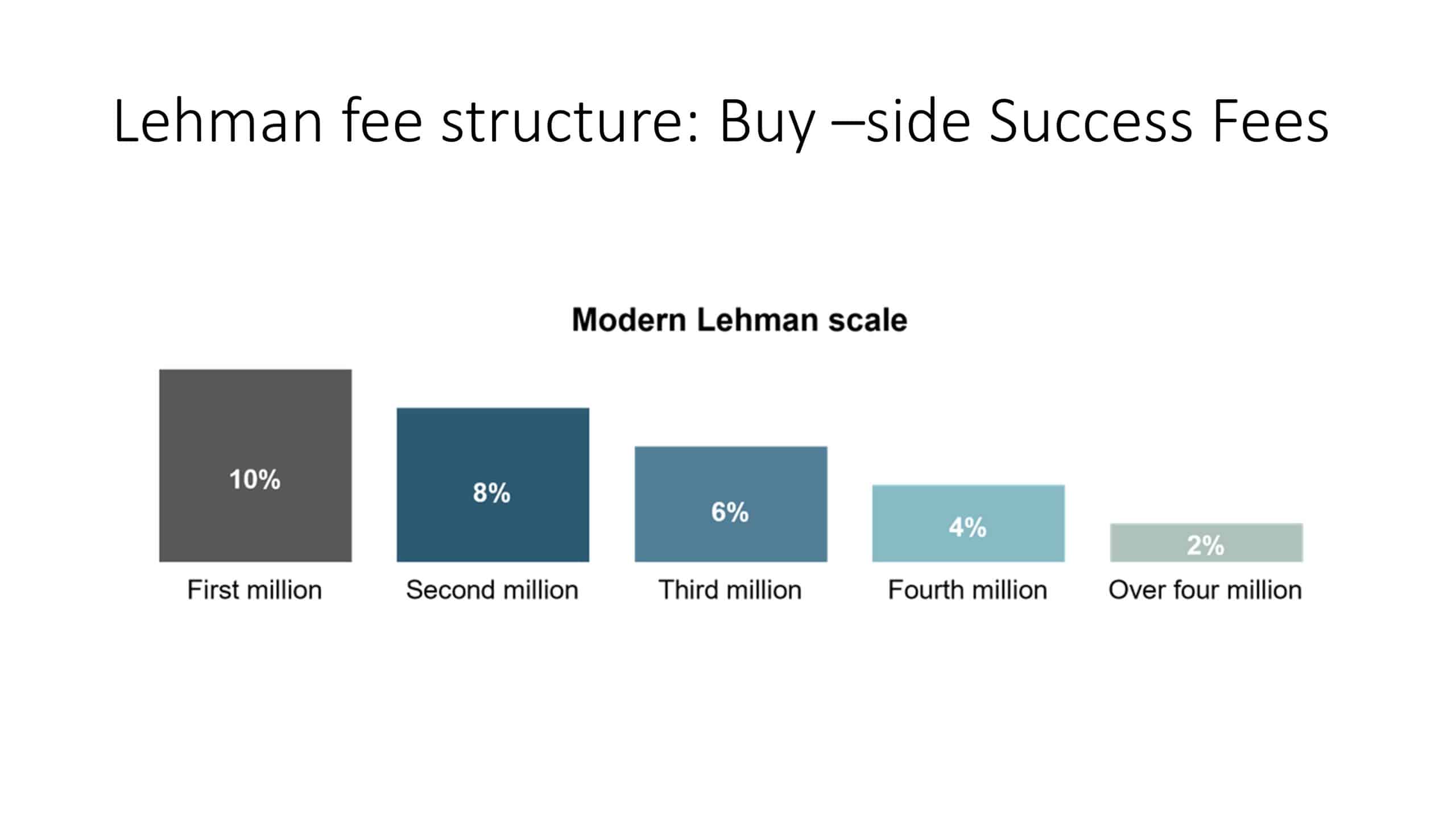

The M&A advisor success fee can vary depending on the specifics of the transaction and the negotiated terms between the buyer and the advisor. However, the Modern Lehman scale you mentioned provides a general guideline for success fees based on the deal value. Here’s a breakdown of the success fees according to the Modern Lehman scale:

- The success fee is typically 10% of the deal value for the first million dollars in consideration. For example, if the transaction value is $1 million, the success fee would be $100,000 (10% of $1 million).

- For each subsequent million dollars in consideration: The success fee decreases by 2% for each additional million dollars. So, for the second million, the success fee would be 8% of the deal value; for the third million, it would be 6%, and so on.

- Once the deal value reaches four million dollars, The success fee remains constant at 2% for any deal value beyond four million dollars.

It’s important to note that the Modern Lehman scale is just one example of a success fee structure and may not be universally applied. Success fees can vary depending on factors such as the complexity of the transaction, industry norms, the reputation and expertise of the advisory firm, and specific negotiations between the parties involved.

When engaging with an M&A advisor, the success fee percentage or the specific dollar value should be clearly defined and agreed upon in the engagement agreement. This ensures transparency and a clear understanding of the financial obligations between the buyer and the advisor.

Conclusion

M&A transactions are complex and require significant expertise to execute successfully. M&A advisors play a critical role in facilitating these transactions and help companies maximize the value of their M&A deals. As M&A activity grows, the demand for experienced and knowledgeable M&A advisors will only increase, further underscoring their importance in business.

After analyzing the background context, it is evident that the buy-side M&A advisor’s fees can range from 1% to 5% for the retainer buy-side fee and from 2% to 10% for the success buy-side fee. However, it is worth noting that these percentages decrease significantly on deals valued at more than four million dollars.

When considering the value a buy-side M&A advisor can bring to a transaction, their fees are often justifiable. These advisors can offer invaluable insights and expertise, from identifying target companies to negotiating and closing deals. This level of knowledge can be precious for small or mid-sized businesses that may not have the necessary resources or experience to navigate complex transactions independently.

- Facebook Ads to Get Followers! - December 27, 2024

- ClickUp vs. Slack - December 20, 2024

- Mastering E-Commerce Analytics: A Blueprint for Success