In the world of financial uncertainties, financial complexities have forced millions of households to be enclosed in debt by either a person or a financial institution. Individuals indulge in personal loans if they are subjected to an emergency expense or consolidate debt. However, personal loans are unsecured and are returned timely with new interest through installments. Most lenders and financial institutions will look at the creditworthiness and financial strength and appraise other aspects to calculate your standing and determine the interest rate. The simplest definition of acquiring a loan includes borrowing money from the lender and returning the settled amount through a specific interest rate. This creates a win-win situation for the borrowers and those in need of cash. Typically, loans are procured to merge debt to pay utilities, bills, emergency expenses, funeral arrangements, and large purchases such as buying an asset, car, and property.

What is Equity With Loan in trading?

Equity With Loan Value represents the number of funds you have available for trading. Equity With Loan Value equals your settled cash, plus the market value of your positions, minus margin requirements.

Equity With Loan in trading = Total cash value + stock value + bond value + fund value + European & Asian options value

Equity with a loan may refer to raising funds by selling stock. Specific private individuals and companies may raise cash to meet short-term financial needs or fund long-term goals. A company productively sells ownership in exchange for money when selling shares.

What is Home Equity With Loan?

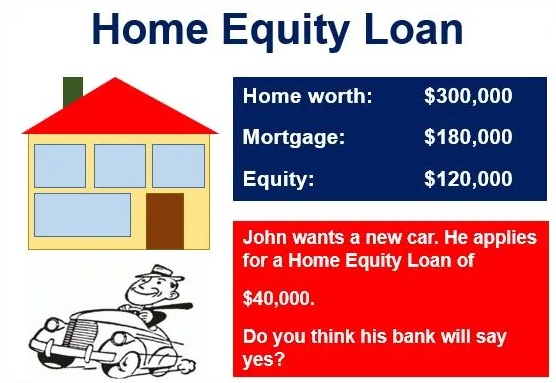

A home equity loan is defined as a loan category in which the borrower utilizes the equity of their homes as collateral value. The equity loan amount is identified by the property’s total worth, which an appraiser further finalizes from the lending institutions. It is also known as the second mortgage, as individuals who borrow the money leverage the equity by placing the value and worth of the home on the table. The loan and its terms are tied by the property value through which payment for large-scale expenses, education, and purchasing become reasonable and achievable.

Therefore, a home equity loan accesses a lump-sum amount of loan that is procured by the equity of your property. The typical repayment duration is around 30 years available to the borrowers through predetermining and settled interest rate, which is currently added on 5%. The interest rate could also decline depending on the creditworthiness and financial background. If you are interested in acquiring a home equity loan for 2021, you can utilize the average 5% interest rate. Furthermore, the home equity loan is used for many purposes. Most importantly, they are obtained and remunerated through high-interest debt or funding for large-scale home reconstruction processes and renovations. To be eligible for a home equity loan, it is essential to have 15 to 20% off your home and property work equity.

What is a Home Equity Loan, and How Does it Work?

A home equity loan allows individuals to borrow money by leveraging the equity in a home. The loan may be returned as a monthly installment payment after calculating the total cash to be paid back. The home equity loan is secured by a person’s home and can be used to settle a debt or cover significant expenses like education, home improvements, or vehicle purchase. The interest rate and monthly installments are fixed, ensuring the repayment plan is carried out.

The difference between a home’s present market value and a mortgage balance may be used to calculate the home equity loan amount. Home equity loans come in two types:

- The Fixed-rate Loans

- Home Equity Lines of Credit (HELOC).

Fixed-Rate Loan

Individuals who take out fixed-rate loans receive a single lump-sum payment. The loan can be paid back overtime at the agreed-upon interest rate. The interest rate does not change with market conditions and remains constant during the loan’s duration.

Home Equity Line of Credit (HELOC)

A HELOC (Home Equity Line of Credit) can be a variable-rate loan similar to a credit card. HELOC may allow a person to take out a portion of the bank’s pre-approved amount. The loan may be offered as part of a package that includes a credit card that allows a person to make loan withdrawals or pay with checks.

The amount borrowed and the interest rate may determine the monthly installments; you can re-borrow the amount repaid, much like a credit card. HELOCs, like fixed-rate loans, have a predetermined tenure. This means that the outstanding balance must be paid in full at the end of the loan term.

How a Home Equity Loan Works:

A home equity loan may be similar to a mortgage. The lender uses the equity in residence as security. A combined loan-to-value (CLTV) ratio of 80% to 90% of the home’s appraised value determines how much a homeowner can borrow. However, the borrower’s credit score and payment history may determine the loan amount and interest rate. In easier words, the loan amount may be determined by the house’s value.

How Long Does it Take For Cash to Settle in Interactive Brokers?

For cash to settle in interactive brokers, the period may take up to three business days after one sells stocks. All funds should be available.

How Much Collateral is Needed to Short a Stock?

About 25% to 150% of collateral may be needed to short a stock. To keep the short position open, the investors may retain sufficient equity in the account to present as security for the margin loan, starting with at least 25%, according to exchange rules.

Why is Settled Cash Negative?

If the amount of cash-settled is negative, the cash is being borrowed, and interest rates are attached to the loan.

How Long Do You Have to Repay a Home Equity Loan?

A person may make fixed monthly payments until the loan is paid off. Most periods might range from five to twenty years, although a home equity loan can take thirty years to repay.

Can You Pay off Equity Loan Early?

Yes, paying off the equity loan early may be possible. After you’ve taken out an equity release plan, you’re free to move. You can sell all or part of your house and get a lifetime equity release… However, it’s crucial to note that an equity release lifetime mortgage is intended to last the rest of your life or as long as your health permits you to live in your primary house.

- Also, if you pay off your loan during the first three to five years of the repayment plan, specific lenders may charge you a prepayment penalty. A prepayment penalty could be an unexpected tax if you sell your house, refinish, or want to pay off debt early. Before you decide to pay off your loan early, double-check with your lender.

- Typically you may not face a prepayment penalty for contributing a small amount above the required monthly payments. Still, you should read your loan agreement carefully and discuss the terms with your lender before deciding.

Can I Sell My House if I Have Equity Release?

Yes, you can sell your house if you have an equity release. A lifelong mortgage, for example, is a type of equity release instrument that may be repaid at any time and in any way. If you’ve taken out an equity release plan, you could be concerned that you won’t be able to sell your house. You can still relocate or downsize, thankfully.

Whatever your reasons for migrating, you should be able to sell your current property and purchase a new one after taking out an equity release plan – but certain things to keep in mind.

If you have a lifetime mortgage or a home reversion program with an Equity Release Council member, the council could agree to let you move to a suitable alternative property.

Is Equity Loan a Good Idea?

Yes, an equity loan can be a good idea. But, because a house secures home equity loans, vital to carefully examine the benefits and drawbacks of borrowing. A home equity loan may be viable if a person utilizes the cash to enhance a house or consolidate debt at a lower interest rate. On the other hand, a home equity loan can be a wrong decision if the equity loan will overburden your finances or if it will merely serve to reorganize debt.

A home equity loan might not be the best option if you’re using the money to help fix day-to-day deficits in your household or living budget.

What is the Purpose of a Home Equity Loan?

The purpose of a Home Equity loan may include:

- Home equity loans are a convenient way to get money and can be valuable tools for prudent borrowers. Low-interest rates and possibly tax deductions make home equity loans a good alternative if you have a stable, reliable source of income and know you’ll be able to repay the loan.

- Home equity debt may also be used to make long-term investments. The trick is to borrow at the lowest feasible interest rate and keep in mind that borrowers who do not repay these loans may face foreclosure.

What are the Advantages and Disadvantages of a Home Equity Loan?

The advantages of home equity loans:

- Home equity loans have fixed interest rates rather than variable rates, and the monthly payment can be foreseeable

- In the installment, a large purchase can be made.

- A home equity loan’s interest rate is majorly lower than credit cards or other loans.

- Funds can be received on time after signing loan documentation within a few days.

- Deducting the interest on home equity, a person may be eligible to do this. Advised to contact a tax1 advisor.

The disadvantages of home equity loans:

- The possibility of losing the home may be evident because it is used as collateral for a home equity loan.

- High outstanding credit may be needed to get approved. Consumers with good to ultimate credit get the best deals. If there is no exceptional credit, there is a low possibility of getting a home equity loan.

- Possibility of getting kicked out of a home and get evicted. A person risks losing a home if a breach of payment occurs.

Can You Use Equity to Pay off Mortgage?

Yes, a person with enough equity may pay off a mortgage provided the terms are followed. However, a Home Equity Line of Credit (HELOC) can be used to pay off a mortgage.

Can I Use the Equity in My Home as a Downpayment?

Yes, you may use Equity as a downpayment. Suppose there is enough available equity in your current home. In that case, the money may be used from your Equity to make a down payment for another home or even buy another home without a mortgage.

How is Equity Calculated?

To calculate equity, a person may check the net difference between the total asset and its total liabilities. However, Equity is used in fundamental analysis to determine net worth. Equity can be found on a balance sheet and a visible entrance line for total equity on the right side of a balance sheet.

Total equity effectively represents how much a person or company assets may have leftover if they ran out of business immediately. Equity is the difference between a home’s appraised value, the amount owed on the mortgage, and any other loans against the house.

Home equity lenders

To acquire and check your eligibility for home equity, you can select the following Lenders.

Spring EQ

The term for home equity is fixed for 30 years and requires an estimated monthly payment of about $433. The spring EQ is categorized as the country-wide premier non-financial home equity services that easily appoint loans quickly and conveniently. There is no pressure, and the process is relatively easy for beginners, as fewer official documents are required. You can receive cash in less than 15 days after submitting only four papers. Full appraisal is unnecessary, and the lenders can quickly pay from 5 to 30 years. As far as the APR disclosure is concerned, it will be about 4.75% and 13.153%. The APR is determined on the exact loan amount after careful consideration of background and creditworthiness, including property value documents information and income at the time of application.

The Figure home equity line services consist of an open-end platform where a total hundred percent loan amount is withdrawn at the time of application. The amount withdrawn at the time of application is resolved at a fixed rate. The borrower can also make an extra withdrawal during the drop period to repay the balance on the line. However, a new interest rate will be determined for that additional withdrawal of funds. This interest rate will be considered that of the date of departure, and the process will run based on an index in collaboration with the prime rate published in the Wall Street Journal. Figure provides home equity loans starting from $15,000 and going up to 2 $50,000. Approval for the home equity line is given in a short period but in considering an income and employment status. It takes about five working days to finance the loan with the help of an online notary. If you are interested in taking a home equity loan service, you should hire a financial/debt advisor to analyze the deductibility rate of the interest.

Other best home equity lenders in 2021 are as follows

Discover: Provide loans with meager rates

BMO Harris Bank: it has different loan options for borrowers

KeyBank: this has multiple loan options for borrowers with limited equity

Flagstar Bank: it has flexible loan options and payment terms

What Can I Do with Equity?

What can be done with equity include:

- Home Improvement: Equity may be used for home improvement and is one of the popular reasons homeowners take out home equity loans or HELOCs. Besides making a home more comfortable, home improvements could raise the home’s value and attract extra interest from prospective buyers when sold.

- College costs: Another usefulness of a home equity loan is to sponsor a college education if the lender permits. Parents can decide to fund their children’s education with a home equity loan. Using home equity to pay for college expenses can be reasonable, a low-interest option if found better rates.

- Debt consolidation: A person may use a home equity loan to pay a high-interest debt at a lower cost. Homeowners sometimes use home equity to settle personal obligations, like car loans or credit cards; you may use home equity if you have a reasonable amount of unsecured debt with high-interest rates and have problems making the payments. However, this may be considered risky.

- Emergency expense: Home equity can be helpful when emergency expenses occur. Costly emergencies such as large medical bills. However, this is only an option if you provide a backup plan or know that a financial situation is temporary. But, using a home equity loan to cover an emergency can cause serious debt if there is no intent to repay.

What is the Monthly Payment on a $100 000 Home Equity Loan?

The monthly payment on a $100 000 home equity loan may be $769.60. To calculate the monthly payment on a $100 000 home equity loan, the month and interest rate will determine the monthly payment. On a $100,000 loan for 180 months at a 4.59% interest rate, monthly payments would be $769.60.

How Do You Know if You Have Enough Equity in Your Home?

To know if there is enough equity in a home requires first identifying the home market value and the remaining balance on a mortgage. Here’s an example of calculating equity:

For instance, a home’s current market value is $600,000, and a person has a $150,000 balance remaining on the mortgage. Remove the $150,000 outstanding balance from the $600,000 market value, and you have:

$600,000 – $150,000 = $450,000. Here, the home equity is $450,000.

How to apply for total equity?

If you are interested in acquiring a home equity loan, you should check the available credit, calculate the word of home equity, and assess the existing debt you have on your plate. You will require to underline financial and personal information documents as follows.

- The Social Security

- Amount paid for child supporter and alimony

- Employment record

- Income evidence for the last two years

- Tax return

- W2 statements and forms

- Pay stubs

- Property ownership documents

- Insurance declarations

- Mortgage

- Valuation of home

Before proceeding, understand the payment of fees and closing of the loan life. In addition to the overall expenditure, borrowers or applicants would also be required to pay the origination fee or the applicable subscription, closing costs, extra fees for delayed monthly loan payments, and prepayment penalty.

A solid financial background and creditworthiness are prerequisites to acquiring a home equity loan. You may have difficulty approving the loan if you have bad credit and unverified financial experience. However, It is not impossible as you need to understand and comprehend the requirement of different lenders. Some lenders may accept borrowers with low or bad credit scores; however, you must meet the following criteria to qualify for a home equity loan.

Applicants should have at least 15% to 20% home equity.

It would help if you also had a minimum credit score of 620 and a maximum debt ratio to the income level of 43%.

Borrowers should have a definitive and timely payment history with secured employment status.

How Long Does it Take For a House to Build Equity?

A house to build equity may take around four to five years. This allows the house to increase in value enough to be worth selling. However, avoid an interest-only loan to make home equity a little faster. Various ways are provided to build equity in a home more quickly. The process involves either increasing a property’s value, decreasing a mortgage debt, or combining both. Below are a few options available to homeowners.

What Builds Equity in a Home?

Here are things that could build equity in a home:

- Avoiding an interest-only loan: with no portion of payments going to the primary during the beginning loan term, equity build-up may occur.

- Instead of a 30-year mortgage: request a short-term home loan. See if a higher payment can be reduced to 15 or 20 years. This can save money in interest payments.

- Make a more significant down payment: The more upfront put down, the less required to borrow, putting an individual ahead.

- Choose a house in a top-quality location: choose a home in an area that will increase value over the years. Homes located near good enough schools, not far from functions like shopping or churches, and nicely kept town areas are more likely to increase in value.

Why is Home Equity Loan Rates So High?

Home Equity loan rates may be high because of the high-interest rates compared to a standard mortgage. A loan lender’s risk is more significant, so the interest carries higher rates than traditional mortgages. If the home goes into shutdown, the lender with the home equity loan does not get paid until the first mortgage lender is paid.

What Percentage Can You Borrow on a Home Equity Loan?

The percentage borrowed on a home equity loan may be around 80% to 85% of the home’s value, deducting what was owed on the mortgage. However, qualification requirements for home equity loans vary by lender, but here’s an idea of what may need to get approved:

- Home equity of at least 15% to 20%.

- A credit score of 620 or higher.

- A debt-to-income ratio of 43% or lower.

- The lender may also require an appraisal to confirm a home’s fair market value to determine how much a person may be eligible to borrow.

Can You Negotiate Home Equity Loan Rates?

Yes, you may negotiate home equity loan rates when looking to get a loan; usually good to negotiate with the lender if a good deal isn’t presented to you. Lenders are often ready to accept a negotiation to a certain extent and can give lower rates because a home equity loan has the house’s backing and makes the loan safe and less risky. The critical consideration in a home equity loan is the interest rate an individual will be charged. However, the interest rate offered by a lender may depend on a few factors, like the credit score, a current mortgage on the house, and the repayment history with banks.