CSC Loan Servicing, otherwise known as the Customer Service Center, is a specialized unit of the United States Department of Agriculture (USDA) Rural Development that provides loan and grant services to rural areas throughout the United States, Puerto Rico, American Samoa, the U.S. Virgin Islands, and the Pacific Trust Territories. This loan servicing aims to help individuals who live in rural areas access appropriate financial tools to help them meet their goals and objectives.

The CSC was established in October 1996 and has since serviced as many as 650,000 government loans and grants from U.S. Treasury funds. It offers various services for rural borrowers, including loan management, payment processing, customer service support, collection efforts on delinquent accounts, training programs for borrowers seeking financial assistance from USDA Rural Development, and other helpful resources.

The CSC works with lenders to ensure they comply with all USDA regulations regarding loan origination, servicing, and collections so that borrowers receive reliable and competent service throughout the life cycle of their loan or grant agreement. The unit also helps lenders investigate any discrepancies found during loan servicing operations so they can take corrective actions to remain compliant with USDA regulations.

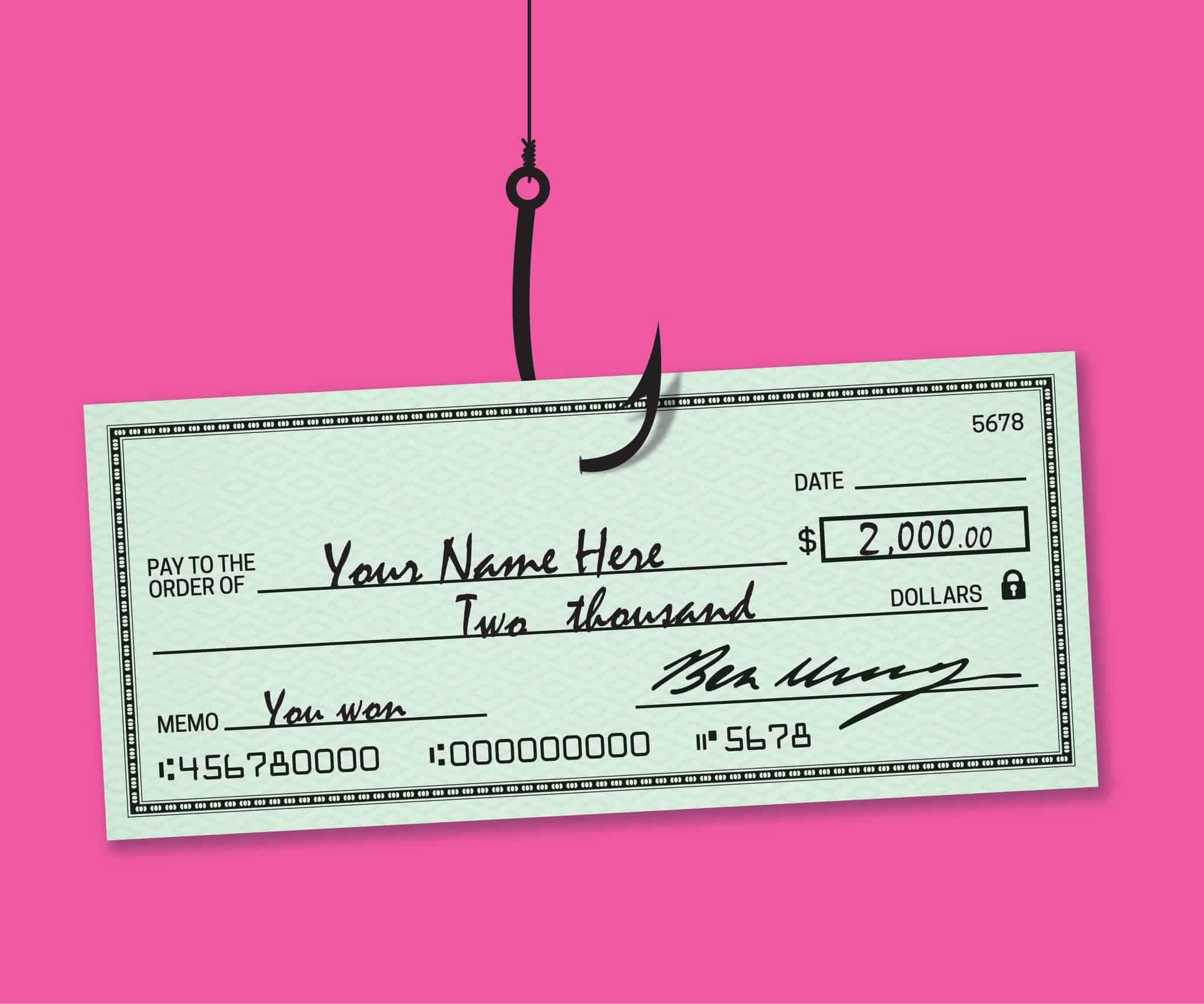

You got a check from CSC loan servicing as the unsolicited loan offer. Usually, when you receive such a check in the mail, you should avoid cashing in. If you cash or deposit the CSC loan servicing check, you will be bounded by loan terms, which usually include high-interest rates for multiple years.

You should avoid unsolicited financial aid offers!

In addition to providing support for lenders’ processing needs related to loans or grants made under USDA Rural Housing Programs (Section 502), CSC also assists with loan origination activities through its Loan Origination System (LOS). The LOS processes initial applications received by lenders and routes them through various review points within USDA’s chain of command before funding decisions are made on each application. Once approved by USDA’s designated staff members at each review point, the loan is sent to CSC for final approval before disbursement of funds for the borrower’s use. CSC also handles post-closing activities such as preparing closing documents and recording fees required by state laws before disbursing funds to applicants’ lenders when needed.

Overall, CSC Loan Servicing provides a great deal of assistance to rural borrowers who may not have access to traditional banking institutions due to where they live or their current income levels; it serves an essential role in helping these individuals obtain appropriate financing solutions so they can achieve their personal goals.