Human resources (HR) is a critical component of any successful company. This is because HR plays a central role in attracting, developing, and retaining talented employees who are essential to the success of any organization.

At its core, HR ensures that the right people are in the right roles at the right time. To achieve this goal, HR must effectively assess and recruit new talent, develop existing talent through training and mentorship programs, and create an environment that fosters employee engagement and retention.

Successful companies recognize the importance of investing in their HR capabilities and prioritize initiatives supporting these goals. Whether developing innovative recruiting strategies or creating effective onboarding programs for new hires, businesses must continually invest their human capital in thriving in today’s competitive marketplace.

What is PEO?

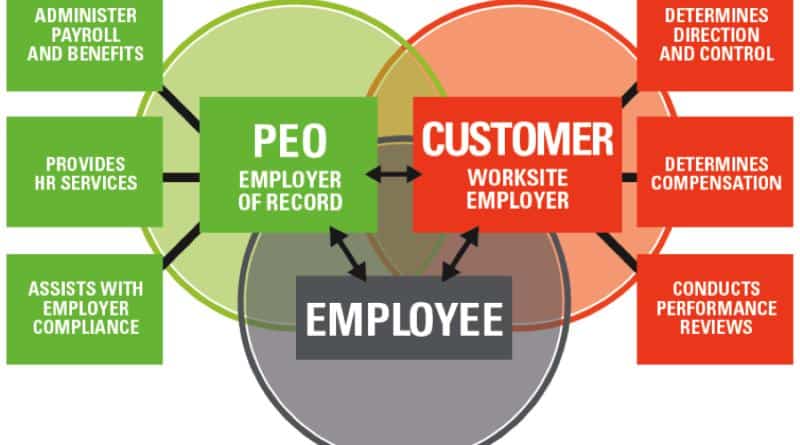

A PEO, or professional employer organization, is a third party that provides HR services for small businesses. Outsourcing these administrative tasks to a PEO allows business owners to focus on growing their business without worrying about managing employees’ daily operational responsibilities.

Many businesses turn to a PEO when they are experiencing growth and are struggling to keep up with the complexities of managing their workforce. By outsourcing these tasks to a PEO, business owners can reduce costs and access higher-quality HR services that help them run their businesses more effectively.

By outsourcing these functions to a PEO, businesses can focus on their core business activities instead of dealing with the administrative burden of managing employees.

Additionally, PEOs often provide access to valuable resources like legal counsel and benefit plan design expertise, which can help businesses stay competitive in the modern economy. Overall, PEOs play an essential role in supporting the ongoing success of small and medium-sized enterprises.

There are currently more than 487 PEOs in operation in the United States alone, serving over 4 million worksite employees from these companies. Most PEOs provide a wide range of services, including payroll processing, benefits administration, worker’s compensation coverage, onboarding and training programs, and more.

Overall, if you are looking for an effective way to manage your workforce while also focusing on growing your business, then working with a PEO might be the right choice.

PEO vs. HRIS

Human resource information systems (HRIS) and professional employer organizations (PEOs) are very different HR solutions, but both play an essential role in managing the employee life cycle.

At its core, an HRIS is a software tool that keeps track of all the data related to your workforce, such as their personal and employment information, compensation, benefits, performance, and more. Meanwhile, a PEO is a company that provides outsourced human resources services on behalf of another business. This can include payroll and benefits administration and compliance with employment laws.

Although they are very different tools with unique purposes, HRIS systems and PEOs can often work together to provide comprehensive support to businesses of all sizes. For example, some PEOs have developed HRIS software explicitly tailored to the needs of their clients.

So which solution is right for you? The answer depends on your specific needs and goals as a business owner or manager. If you’re looking for help managing your employee data or want expert assistance with certain aspects of the employee life cycle, like hiring or training employees, then an HRIS system may be the right choice.

On the other hand, if you want someone else to handle all aspects of managing your employees for you – including payroll and benefits administration – a PEO might be a better choice. Additionally, many PEOs offer employer services assurance corporation policies that guarantee their services in case they close down or cannot meet the terms of their agreement with you.

Ultimately, the best way to decide between an HRIS system or a PEO is by talking to trusted professionals in your area who can help guide you toward the right solution for your needs.

Standard vs. Global PEO

Whether you are just starting or are an established business, a professional employer organization (PEO) can offer a wide range of benefits.

A PEO is an organization that provides support services to businesses, allowing them to outsource many aspects of human resources (HR).

There are two main types of PEOs: standard and global. A standard PEO typically offers services within the same country, while a worldwide PEO provides services across international lines.

This allows businesses to expand into new markets without hiring a whole new HR team or worrying about compliance issues related to foreign employees. Global PEOs may provide all the usual HR services, such as payroll and benefits administration, recruiting, and training. They can also help with other essential tasks like employee relations and performance management.

One of the main advantages of using a PEO is having access to specialized expertise in an area where small businesses may struggle independently. Because they focus on HR so much, they often stay up-to-date with the latest employment regulations and trends in this fast-changing field. Additionally, if you use a global PEO, you benefit from having your HR needs handled by professionals in different countries who understand those markets well. This can be especially helpful for businesses that want to expand internationally but don’t have much experience.

If you’re considering using a PEO for your business, it’s essential to research and compare different providers before making a decision. The best way to start is by reading online reviews from other customers who have used these organizations. You should also check with licensing authorities in your state or province to find out whether any complaints have been filed against specific providers and their track record regarding compliance issues like taxes and insurance coverage. Once you’ve found the right fit for your business, a professional employer organization can be an invaluable resource for helping your company grow and thrive over time.

PEO benefits

PEOs offer a variety of benefits to businesses, including payroll taxes and workers’ compensation insurance. Additionally, PEOs can help companies to obtain health insurance at an affordable price.

- One of the key benefits of working with a PEO is the ability to outsource payroll tax responsibilities. This can be especially helpful for businesses struggling to keep up with the complexities of employment tax laws. By partnering with a PEO, companies can take advantage of their expertise in this area, ensuring full compliance with all tax regulations and avoiding costly penalties or fines.

- Another significant benefit of partnering with a PEO is access to workers’ compensation insurance coverage. This type of insurance protects businesses from liability if an employee is injured on the job, and it is a critical component of any comprehensive risk management plan. The PEO industry has helped standardize pricing and coverage patterns, making it easier for businesses to obtain this essential insurance at an affordable price.

- Yet another critical benefit of using a PEO is the ability to effectively integrate HR software into business operations. With many popular HR software systems designed specifically for PEOs, incorporating these tools into your day-to-day operations can help streamline your processes and improve efficiency across your organization.

Overall, there are many benefits to working with a PEO in today’s competitive business landscape. Whether you’re looking to reduce administrative burdens or save on necessary business expenses like health insurance, a PEO can help you meet your goals and thrive as a dynamic, successful organization.

PEO Drawbacks

PEOs can offer many benefits to businesses but also have some potential drawbacks. One of the main drawbacks is the cost structure of PEOs, which can be a barrier to some companies. Generally, PEOs charge a fee that is a percentage of the total payroll. Businesses with smaller payrolls may see higher fees as a percentage, making using a PEO prohibitively expensive.

Another potential drawback of PEOs is that they take control over employee performance management away from businesses. This can be problematic for some companies that prefer more direct control over these decisions.

To mitigate this drawback, businesses should consider their needs and goals when choosing a PEO. Finding a provider with the right expertise and services to align with your unique needs and requirements is essential. Additionally, it is vital to have clear and consistent performance expectations outlined in an employee handbook so that all employees understand what they are expected to achieve and how they will be evaluated on those expectations.