Having access to financial accounts, services, amenities, and packages are considered a sign of being well-off and financially healthy. In these times of uncertainty, having a well-lit and comprehensive bank account can help serve you the essential functions and financial services, with easy financial transactions that help you in emergency fund preparation. In addition, having a checking or savings account and ATM card, credit card or other packages and electronic outlet provided by the parent bank helps you make an independent decision, remove financial burdens and assist in payment and repairing of loans and debts.

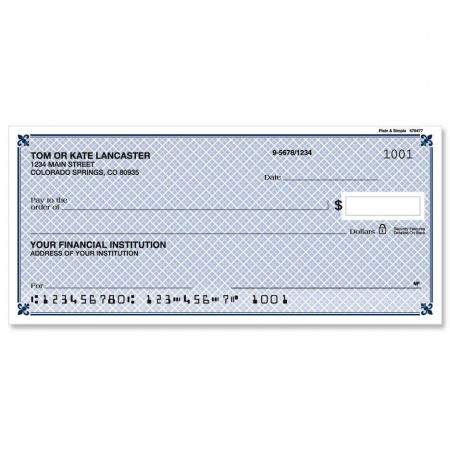

Whenever a new bank account is open, banking authorities are required to provide you the basics of electronic cards and checks to help you with cash withdrawal, transaction, and credit. Bank checks offered by the bank themselves are reliable vehicles for financial payments. However, proper filling of bank checks and understanding the credentials required to fill the checks is essential as failure to do so can lead to bounced checks. As a bank account holder, it is your responsibility to acquaint yourself with the tried and true ways to write the credentials, from where to get them, how to deposit them and how to deal with a financial check on an everyday basis.

The concept of paper checks has not yet diminished in finance and money, although the rising idea of technology may do so in the future. They are considered an official and inexpensive resource for transferring money from one entity to another; however, checks are not written every day as they are occasionally used.

What are single checks?

Single checks represent a book of checks that can be filled out and used as needed. Single checks come in the form of single pages without any duplicates.

What are Duplicate checks?

Duplicate checks or cheque duplicates represent paper checks with a thin printed carbon paper underneath the original check. Usually, a duplicate paper page remains behind, providing you with an exact record of the check that was just drawn.

Duplicate checks are found within your original checkbook to keep track of financial records and the frequent movement of money. As you write and mention the credentials on your actual checkbook, a fragile paper sheet replicates the details, including the payee’s name, the amount in numeric form, and the amount in words in the memo. These thin paper sheets copy the exact wording, and numerical from the recent checkbook are called duplicate checks.

These duplicate, thin sheets beneath your checkbook make it easy to analyze and evaluate your previous and existing payment occurrences. This acts as an official record for your peace of mind and helps you document the exact amount consumed the total amount paid to another person, and the precise movement date. In a nutshell, the entire checkbook is copied, so if any other details are added to the checkbook, you can also locate them on the duplicate checks. The only fact that is not being copied on the duplicate check is your unique and personal signature. However, this is not included to prevent it from being copied to protect the person’s details from theft and forgery.

Duplicate checks are found in the same binding type as an original check. Having the same binding allows these checks to be easily incorporated with the regular ones as they are equal in dimensions. Each paper of standard checks is followed by a thin sheet of paper that acts as a carbon copy and reflects the concept of manual Xerox copy. This copy comes with the same check number, which is typically printed for reference for the manual Xerox copy occurs when pressure is applied on the regular checks through the pen as soon as details are written. In contrast, the rest is copied on the duplicate page. However, it should be noted that the same checks are not provided to anyone for reference.

They are for your accumulation of records and to keep track of all the transactions. You only need to remove the original paper from the regular check. Leave the duplicate sheet attached to the checkbook and do not provide it to anyone. The benefits of keeping an identical sheet for your reference are numerous as you always have an extra copy on hand. Hence, whenever there are minor discrepancies during the checks transaction, you have financial records of everything mentioned on the check-in order to address them.

There is no proper place to purchase duplicate checks as they are always provided along with the check catalog from the back institution. You can also check the catalog on their official website and buy them for your regular checkbooks. In addition, some of the credible online check printers provide these duplicate checks along with regular single checks for a lower amount.

Single vs. duplicate checks

The difference Between Single and Duplicate Checks are:

- Duplicate checks require the use of carbon paper while single does not.

- Duplicate checks are bulky (doubled number of pages) while single checks are not.

- Writers need to press hard against duplicate checks paper, unlike for single checks.

- Duplicate checks provide evidence left behind while there is no evidence left behind in case of loss of a single check.

The duplicate checks offer convenience to the frequent check users as it is the carbon copy. It automatically collects every minute detail and transaction, which can be later used whenever required by the bank or authorities. It is easy to document your transactions and money movements if you have no other way to do so. You do not have to maintain a separate diary and record for this purpose as you have an automatic way to do so, significantly saving your time. You also have offline access to your financial records. Most of the information is available online, which is provided by duplicates. Still, with the help of these thin paper sheets, you can access the same information without logging in using the Internet.

Having a replacement checkbook will increase the weight of a regular checkbook because each page will be divided into two. However, keeping a single checkbook at hand will be lighter and user-friendly. Because of this reason, most of the mobile businessman prefers carrying around single checkbooks rather than heavy pages of duplicate checks. Furthermore, transaction through the same check is considered safer; however, involving a single check is not secure because of any discrepancy or disagreement.

There is existing security and privacy risk associated with duplicate checks. In addition, most of these carbon copy prints personal details and sensitive information so ithat a plethora of problems can materialize n case of theft or forgery,

Checks are used every day for multiple purposes, from paying bills and utilities to purchasing goods and services. Therefore, it is considered a wise option to keep track of each transaction to know the monthly and annual expenditures.