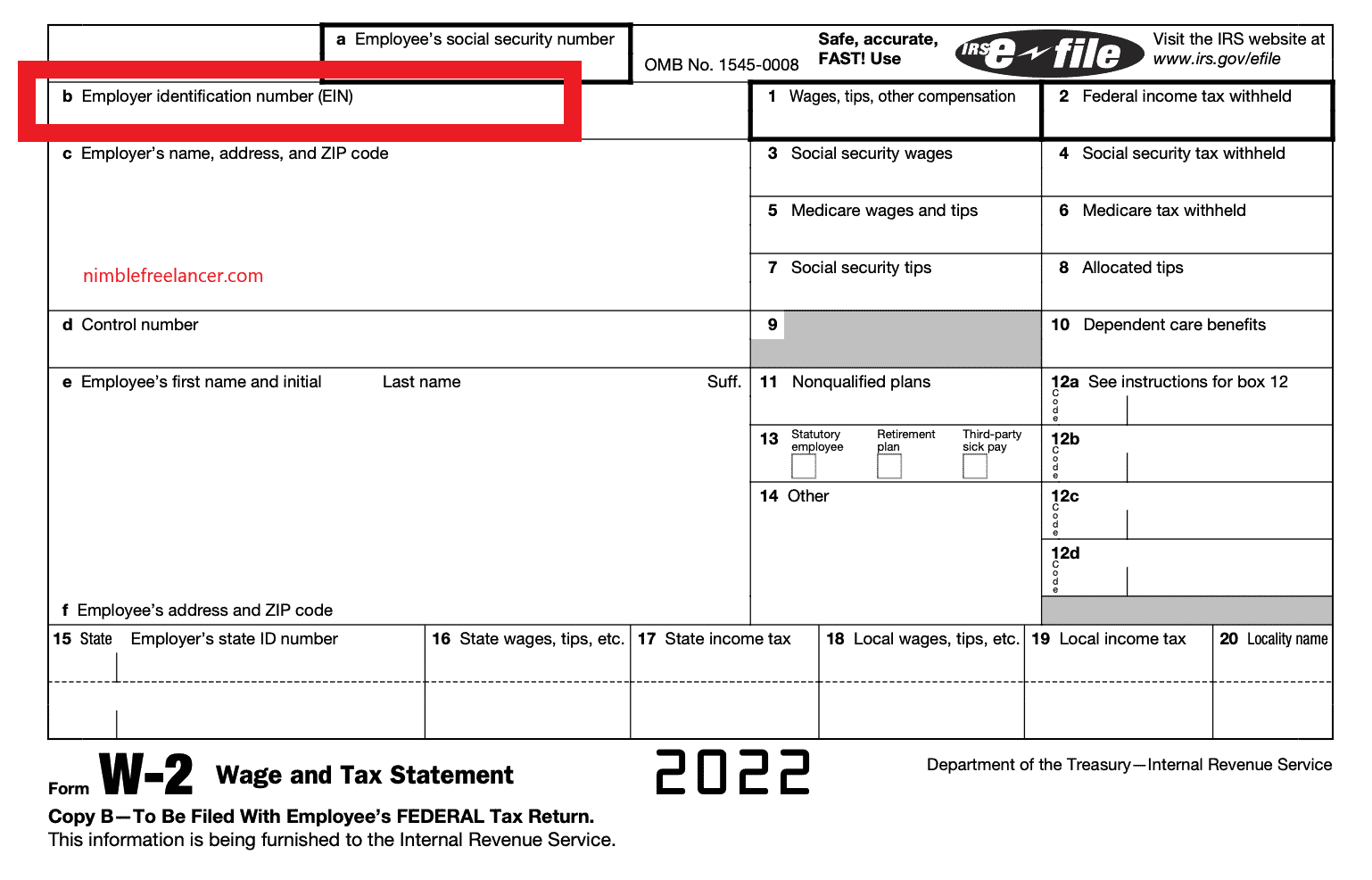

The Wage and Tax Statement, typically known as Form W-2, is an Internal Revenue Service tax form for United States residents and citizens to report and document wages paid to its employees and their taxes deducted from the total wages. This form is specifically for employers who have hired several employees and are paid monthly through daily salary or other monetary compensation as part of the employment contract.

This form must be delivered to the employees by the employer before 31st January. This deadline allows taxpayers to have ample time of around two months to prepare for their income tax returns before April 15, the income tax due date. The form is also used to file FICA taxes to the Social Security Administration. To summarize, the W-two form laid out by the IRS is a form that formally documents and organizes the earnings of employees in addition to supplement information involving the total amount of tax paid and withheld from the paychecks. The employees receive this form in January or February.

Can You Get Two W2s from the Same Employer?

Yes, you can get two W2s from the same employer. Usually, you will get multiple W-2 forms if you work in more than one location for the same employer.

If you work for the same employer in multiple locations or roles, you may receive more than one W2 form from them. For instance, if you are a government employee who works part-time for the local government and a state kindergarten, you may receive two W2 forms from your employer. This is because each of these roles is considered a separate job, even though you’re doing the same work for the same employer.

Regardless of whether you receive one or two W2 forms from your employer, it’s essential to carefully review all the information listed on these forms and report any inaccuracies or errors to your employer immediately. Additionally, if you’ve paid any income taxes throughout the year and think that you might be entitled to a refund, it’s also a good idea to file your taxes as soon as possible so that you can get any money back that you are owed.

Overall, receiving multiple W2 forms can be a bit confusing at first. Still, with careful review and attention to detail, it is possible to understand and use this critical tax document effectively. So if you find yourself in this situation, take some time to understand the information on your W2 forms and get your taxes filed as soon as possible so that you can get back any money that may be coming to you!

While having multiple W-2s may seem convenient initially, there are some potential downsides. For one, it can make tax reporting more complicated, as you must account for all of your income when filing your taxes. Additionally, having more than one W-2 can lead to confusion about which form to submit with your tax return since it’s not always clear which form corresponds to which job.

If you do receive multiple W-2s from the same employer, it is essential to carefully review each form before submitting them with your taxes. By taking the time to ensure that your forms are accurate and complete, you can help prevent any problems or confusion later on.

Do you have to file all W2s?

Yes, you need to file every W-2 you receive on your tax return, even if you file tiny money amounts. This is because all of your W-2s must be entered on the same tax return, and on each W2, you need to have a Social Security number, and that income was reported to the IRS by the employer.

Can you file two W2 forms?

Yes, you can file two W2 forms if you work for two employers. In this case, you will send to the IRS both W2 documents simultaneously (not separately). You are obligated to report multiple incomes.

The amount sent to the federal government through income tax depends on the total income generated from single and multiple sources. If you have more than one W-2 Wage and Tax statement demonstrating the total revenue, you would not be required to pay a higher tax than having one W-2. However, if you have multiple W-2s, you may have to alter the total tax withheld mainly due to the withholding allowances you claim on the total earnings before 2022.

If you have multiple W-2s, there is no need to be concerned, as you would not have to pay increased taxes compared to those with a single employer throughout the year. As an employee, fill out a W-2 form appropriately and file the paperwork similarly to those with a single W-2 form. The tax rates and annual tax deductions will not be influenced.

What to do if you have 2 W2s?

If you have 2 W2 forms, you work for two employers and must report both incomes to the IRS. However, if you get from the same employer two W2 forms with the same amount, it is usually a mistake, and you need to notify the IRS about this error and send only 1 W2 form.

If I have two w2, can I file them separately?

No, you can not file them separately. Usually, if you have 2 W2 forms, you work for two employers, and you need to send both W2 documents simultaneously because you are obligated to report all your income.

W-2 and W-4

As an employee of an organization or a company, you would be given a W-2 form each year by the company. However, to continue the process, the employer would ask you to fill out IRS form W-4, the Employees Withholding Allowance Certificate, before filling out the W-2 form. This needs to be filled out as it is a part of a new employee package given out to the employees at hiring. However, if you have experienced modifications in your current financial standings, you can also request a new W-4 form and submit it to the employer.

This involves getting married, divorced, adding a new family member, or if your spouse loses or begins a new job, you need to mention the details in the new W-4 form. This will come under the withholding allowances letting the employer know your conditions and financial situation to determine how much income tax to deduct from a particular paycheck. Again, as an employee, you must mention withholding allowances to allow your employer to define your case and take away tax based on the declared budgets.

What if I have two W2 forms from different employers?

To File Yearly Tax Returns With W-2 forms from multiple employers, you need to send all your W2 forms simultaneously to IRS because you are obligated to report all your incomes. In this case, if you have two W2 forms from different employers, send all two W2 forms simultaneously and notify all your gains IRS.

As an employee, it is your responsibility and civic duty to mention the withholding allowances to the employers. The employers must highlight the total income paid to the employees and the tax amount subtracted on form W-2. As for those who have worked under multiple employers, then as an employee, you would have more than one W-2 form. This involves working with more than one employer, a change of job during the tax year, and working two jobs per day. If you are in a joint relationship, you can also file a legal joint return with the spouse who must be employed. In this situation, the number of W-2 forms depends on the number of employers a couple worked with during the tax return period.

How to File Yearly Tax Returns With Multiple W-2 forms From the Same Employer?

If you are confused about the tax filing process for multiple W-2 forms, then the process would be similar to a single W-2 form with slight adjustments. The process involves transferring and mentioning the total amount in all the W-2 states. For example, you would need to file form 1040, which is the US Individual Income Tax Return, and mention the amount in Box 1 one highlighting your daily wages, monthly salary, and other financial reimbursements provided to you by the employer on the W-2 form and then transfer the total amount to line 7 on form 1040.

You also need to submit all the W-2 documents for multiple employers as part of the tax filing process, and for that, you would have to wait until you accumulate all the W-2 forms to commence the tax filing process. Employers are given the deadline of 31st January to provide W-2 forms to their employees. If the employers have not yet distributed the W-2 form by the end of the first week of February, then you need to contact the employer. If you still have not received a W-2 form by February 15, then call 800-829-1040, the IRS call center, and an IRS agent will contact the employer to pursue the process.

Understanding withholding allowances

Your yearly tax may be influenced depending on the total number of compensations on the W-4 form. For example, the W-2 allowances mentioned on the W-4 conditions may affect the total tax amount, resulting in you not paying complete taxes throughout the year. The IRS may require you to pay an additional tax upon filing returns.

I have 2 W2S from the same employer:

What if I have multiple W2 forms from the same employer?

If you have multiple W2 forms from the same employer with the same amount, usually it is a mistake, and you need to report to IRS and send only 1 W2 form. However, sometimes your employer can send you two W2 forms if you work from a different location for him, and then you need to report all your income to IRS.

The IRS has modified tax filing and guidelines for those with multiple W-2 and W-4 forms starting in 2022. The IRS has canceled the concept of adding withholding allowances to the W-4 form to increase credibility and transparency and to introduce precision to the withholding system. As part of the latest update by the IRS, you would only require a single W-4 worksheet to mention the claims instead of filing more than one W-4 worksheet for each employer. The removal of withholding allowances was initiated in 2020 To simplify tax filing for ordinary people and employers.

As an employee, if you have not received a W-2 form from the employer, then you are still required to file a tax return. Failing so, employers will be required to pay a filing penalty. If you want to avoid the filing fee and need to file the tax return without the possession of a W-2 form, then you can still carry on with the process by submitting the last paystub from the tax year along with the IRS form 4852, which is a substitute form for the W-2 form. As an alternative, this form will assist you in tax filing until you receive the W-2 form, which is the required form. This online form will allow you to check the wage and tax information.

In a nutshell, the legal inclinations and tax laws for employees of multiple employees are the same for those who work for those working on a single job. Therefore, keep yourself updated on the latest tax updates and choose to keep track of slight modifications and adjustments laid out by the tax department.

Conclusion

Overall, it is important to be aware of the possibility of receiving multiple W-2 forms from a single employer in certain circumstances, as this may affect how you report your income on your taxes. Generally, it is best to consult with a tax professional or the IRS directly if you have any questions or concerns about receiving multiple W-2 forms.