Financial establishments and banking outlets have renovated how money is controlled, handled, regulated, and moved. Having a bank account is not a luxury but a requirement in these times, especially when financial improbabilities are lingering around. This has occasioned an unprecedented financial debacle and potential risks involving mismanagement of money; therefore, as the head of the financial domain, banks have offered robust and reliable ways to provide peace of mind to account holders with maximum convenience. Currently, account holders have the accessibility and possession of current accounts, savings account, retirement plans unveiled by the authorities, with the availability of loans, mortgages ATM, and debit cards, as well as paper checks that help them move money through a less troublesome experience. However, moving money through checks is a tried and tested way to regulate money for less tech-savvy account holders. However, it is not the only way to do so as ATM cards and debit cards owners can perform this task through an ATM and move the money around.

What is the account holder’s name on a check?

The account holder’s name on a check represents the payor. Invariably, the payor writes the bill and presents it to the payee. Payee takes to check to the bank (financial institution) to deposit into an account or negotiate for cash.

Does the memo line on a check matter?

No, the memo line on a check is the least important part of the check. Usually, the memo line represents a space for any notes (in your opinion) about the purpose of the check.

If checks are prioritized for financial transference, then you need to know about the basics of using them. To proceed using one, you need to know how to write one, mention credentials and sensitive information, and deposit it. Displacing money from one entity to another can be convenient if tricks and tips of writing a check are learned. Nevertheless, technology is considered a panacea to perform technical tasks, and it is expected to replace check writing soon. Even then, check writing is a pillar of financial management; therefore, it should be gathered, and the skills should be developed despite its maximum prominence.

Since the banking industry is known to repetitively boost their traits to be a part of the competitive industry, they have learned to establish financial instruments and promote comprehensive ways to commercialize the banking sectors of the world. Because of this, the primitive methods to carry out financial transactions are potentially going old-fashioned. Regardless of this, checks are extensively operated, are prioritized by most of the banking sectors. The prominence may be transitioning, but they are considered an official and effective platform to move money even then. They are considered highly safe for large-scale transactions; however, this is only materialized if check owners or account holders learn to write it correctly, officially, and skillfully.

Checks are the official outlets and tool to pay or transfer money to an entity known as a payee. They come in the shape of a small book and list aspects and components that need to be featured and highlighted by the writer. The checkbook, however, is provided to the account holders upon request of the customer and is delivered to them by the branch. Having a solid understanding of the components of a check, you can straightforwardly receive and deposit it and feel confident about financial transactions.

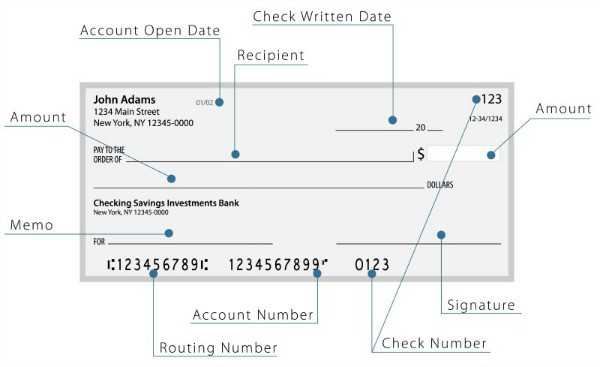

Regular checks are incorporated with pre-printed characteristics that are featured for the users to be filled in. They are placed next to the blank sections that must be meticulously filled out with precise and accurate details. Some categories are easy to follow and need a direct factual answer; however, some request technical solutions with more information and unique additions.

Identifying Parts of a Check

Anatomy of a Check presents these 12 parts:

- Personal credentials: This section on the check requires basic fundamental information about the account holder. The one paying the money to the payee should fill out detailed information to begin with. The individual information involves name, home address, and phone number.

- The payee: The account holder receiving the check has a separate and distinct line on the check. The one paying the money should declare fine points about the individual who is accepting on the other end. The writer is required to pay the individual’s name out of all the organization anticipating the payment. The recipient’s full name should be mentioned to avoid any confusion during the deposit process.\

- The total amount: Apart from declaring the total amount in numerical form, the official check requires it to be written in word format.

- The money category: This requires the total amount of value mention in new numerical form. However, this box is a courtesy box as the amount mentioned in the wording format holds more importance than the numerical digits.

- The memo line: This line is available to write any extra notes about the fundamental and underlying purpose of the check. This space is used to highlight any additional notes on the check. It is optional and not a prerequisite to cash or deposit the check. However, you can still mention informal details for personal documentation.

- The Bank’s American Bank Association number: This number is also present on the check to mention the ABA routing number as it identifies the bank’s funds for the check.

- The date: The account holder is also responsible for mentioning the exact date to remove any confusion.

- The signature area: The account holder is also responsible for verifying the payment by approving it through a unique signature. The payer should sign at the line on the bottom of the check. This is an essential security feature as the signature cannot be duplicated and prevents fraud. It is considered the concluding step of check writing. The signature should be drafted at the end after double-checking all the essential details of the check.

- Bank’s contact information: You will also notice the branch information of your financial institution printed on the check.

- Bank’s fractional ABA number: This is similar to the ABA number, mostly found on the checkbook, but the fraction ABA number is printed in a different format and is usually located on the upper right corner of the checkbook.

- The account number: Your personalized account number will also be mentioned on the checkbook. This will allow the recipient to compare funds coming from a bank account to this number.

- The check number: The check number is found in two spaces on the checkbook. It is placed and printed as a security determinant to identify regular payments and avoid probable deception.

What part of a check is the least important?

Memo line is part of a check that is the least important. Usually, the memo line represents a space for any notes (in your opinion) about the purpose of the check. However, if you do not put information in the memo line, a check is valid.

Should you put a phone number on checks?

Yes, you can put your phone number manually to check if another side (usually in business) requests that. However, you should not print the phone number on the check, and you need to know that this is not mandatory.

The information mentioned above is found on the front page of the regular checkbook; however, the back of the checkbook also needs to be filled out with accurate information. This process is for the writers of the check as they are required to endorse. This process is completed so the check can be cashed or deposited by the recipients. To endorse a check, the writer needs to sign the name on the back and mention additional details to make the process faster and smoother. A signature is a prerequisite; however, you can also mention other information to inhibit scams.