After the disbursement procedure, you may not have paid your loan in full. For this reason, you must know precisely how and when you will be reimbursed for your company loan. SBA 7(a) and Public Lead finances are disbursed in “well-ordered payout” rather than one lump sum.

Business loan money is disbursed in installments because lenders want to ensure you are responsible for your usage. Having you spend your dosh and investors’ capital before finance reserves are utilized assists them in manipulating you.

For your project and company to stay on schedule and be prepared for the following finance disbursement, there are specific measures you must take.

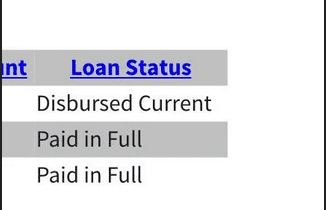

What is the meaning of SBA Loan Status Disbursed Current?

Suppose you see that on the platform caweb.sba.gov, your status changed to “Disbursed Current,” SBA had released the SBA loan fund. Your transaction is in the procedure; usually, from 2 to 5 business days, you can see funds in your bank account.

How are lenders able to keep track of the money they lend?

Lenders closely monitor the distribution of loans based on the info you supplied in your advance request. As a result of your loan application’s financial assumptions, the lender will ensure that you’re spending your loan money as planned. Make sure you’re paying for everything you said in your application. They’ll do a follow-up.

The budget of your lease credit and part of your development expenditures, among other things, will likely be paid for by you or your investors. Any potential investor investment must be in your company’s bank account, and you must have paid out all (or almost all) of it before they instigate disbursing funds to your firm.

When an SBA loan status shows “Disbursed Current,” the loan has been approved, and the funds have been transferred to the borrower’s bank account. “Current” indicates that the borrower is up-to-date with their loan payments and has not fallen behind.

In other words, “Disbursed” means that the loan has been fully funded, and the borrower has access to the loan funds, while “Current” means that the borrower is making timely payments on the loan.

It’s important to note that small businesses typically use SBA loans to finance various expenses, such as working capital, equipment purchases, real estate acquisition, and more. The lender sets the loan terms and repayment schedule, but the SBA guarantees a portion of the loan to minimize the lender’s risk.

Disbursements from your lender often fall within this time frame:

In most cases, these loan payments are sent straight to your building contractor based on the bills they have submitted to your lender. They might be reimbursed to your company if you paid the bills in early payment as of your professional account, in which case you will get the money immediately. As the building work progresses, the investor will want specific evidence demonstrating the progress made and how much of the project has been completed.

Consider the costs of machines, tools, furnishings, and fittings when calculating the total cost. If you purchase or lease your devices and machines early in the building process, you won’t have to worry about them being paid for afterward.

Currently, the extent of every single contract (each section of machines and tools) is less than the construction-related transactions. As a result, lenders prefer to concentrate on compensating lots of expenses incurred by your company rather than immediately compensating your suppliers. Proof of purchase from the retailer is required, as well as a duplicate of the company payment or credit card receiving that proves the fee was received, to complete this process.

Both operating capital and initial beginning costs may be covered by business financing. When we talk about “working capital,” we’re referring to the money you get from a loan to protect your business’s ordinary running expenses until your sales growth to the point where you can afford to pay them.

This amount of your company financing isn’t reliant on completing specific deals since working capital covers several modest and regular needs. Once a month or four times a year, working capital payment is more common, with lenders checking your yield and forfeiture account to determine how close you are to breaking even.

Is there a reason why PPP loan payments take so long to arrive?

You can see SBA Loan Status “Disbursed Current” for several reasons.

You may ask your firm to wait for the first loan distribution if it cannot demonstrate that the equity funds received at the time of loan closure have been totaled. It would help if you acted with extreme care, given the circumstances. Ensure your company pays for the expenses previously expected to be safeguarded by your fair pledge as soon as feasible. To ensure the smooth operation of your business, you must maintain precise records of the payments made by your clients. You can demonstrate that the funds have been distributed and that there will be no delay in the development process.

Always communicate with the company that is providing you with the loan. If your funds are running low and you are getting close to using all your cash, you may be eligible for loan disbursements (with some remaining in your account). Because your investor will verify that the whole amount of money you advised be used for investments has been invested before the loan closes, most of the work that needs to be done after the loan closes is concentrated on ensuring that these funds are put to good use.

The following are some of the potential causes of delays after the first disbursement:

Let’s imagine that your construction money is being used for reasons that aren’t appropriate; if this is the case, you may not be able to secure a new loan since there isn’t enough documentation to show how you will use the cash (e.g., disbursements prepared to commence the professional to the commercial vendors)

If you want to ensure that your distributions are made on time, you must keep correct records, stick to the plan you came up with initially, and handle your finances carefully.

Keeping in contact with your mortgage lender

Assuring timely money distribution begins with regular communication with the loan terminating and disbursement group. There is no problem that the terminating loan group can’t handle. They’ll advise you on managing modifications to your plan and record your money practice in a way your funders will accept.

The Pursuit of one’s goals may be beneficial.

Are you interested in learning more about the services that minor corporate investors like Pursuit can provide? We offer over fifteen different small business financing packages to help your small company succeed now and in the future.