When it comes to purchasing a car, there are multiple paths and financing options available to buyers. However, the process can be more complicated for individuals who are self-employed or work as contractors. In such cases, instead of receiving a traditional W-2 form, these individuals receive a 1099 form from the IRS, documenting their income. Among the variants of 1099 forms, Form 1099-A is related to the acquisition or abandonment of secured property. Despite the possible complexity, purchasing a car with a 1099-A form is achievable, but it requires a thorough understanding of the process. Therefore, this article will provide detailed instructions and analysis on how to buy a car with a 1099-A form.

Understanding Form 1099-A

Before we delve into the car buying process, it’s crucial to understand what a 1099-A form is. A 1099-A form is issued when secured property is acquired or abandoned, including foreclosure or repossession. While this form isn’t directly related to income, it could reflect on your financial credibility and influence your ability to secure a car loan.

Steps to Buy a Car with a 1099-A Form

- Evaluate Your Financial Situation: The first step comprehensively evaluates your financial status. This includes your income, expenses, savings, credit score, and outstanding debts. Since a 1099-A form indicates an instance of property abandonment or foreclosure, assessing how this might have impacted your financial standing and credit score is essential.

- Save for a Down Payment: Lenders often look favorably upon buyers who can make a substantial down payment, as this reduces the loan amount and, therefore, the risk to the lender. In addition, as someone with a 1099-A form, making a larger down payment can help compensate for any financial uncertainty associated with your form.

- Gather Necessary Documentation: As a self-employed individual or contractor, you need to prove your income stability to lenders. This could include bank statements, tax returns, or other income documentation forms. The 1099-A form alone will not be sufficient.

- Improve Your Credit Score: A healthy credit score is crucial to securing a car loan. If your credit score took a hit due to the event that led to the issuance of the 1099-A form, you might need to work on improving it before applying for a loan. This could involve paying off outstanding debts, making all future bill payments on time, and avoiding new debts.

- Find a Lender: Not all lenders can finance car purchases for people with a 1099-A form. Therefore, it’s essential to research and find a lender who understands your situation. Credit unions, online lenders, and certain car dealerships may be more flexible than traditional banks.

- Negotiate Interest Rates and Terms: Once you’ve found a potential lender, negotiate the loan terms. Interest rates, loan duration, and monthly payment amounts are all negotiable. Be sure to review all terms before signing any agreements.

- Select Your Car and Complete the Purchase: After securing the loan, you can select your car and finalize the purchase. Do your due diligence on the car’s condition, history, and pricing before deciding.

Practical Example of how to buy a Ford F-150 car with a 1099-A Form

The Ford F-150 is considered a typical American car for several reasons. First, it is trendy and has been among the best-selling vehicles in the United States for many years. Its dominance in the pickup truck segment, which is highly popular in America, contributes to its reputation as a quintessentially American car.

Second, the F-150 symbolizes American culture and values. It embodies ruggedness, durability, and toughness, often associated with the American spirit. The pickup truck has a long history in America, used in various industries and depicted in popular culture.

So, I will make an example below:

- $60K Annual: Suppose your annual income from self-employment is $60,000. You have $5,000 in savings and a credit score of 680. You recently had a foreclosure that was reported on a 1099-A form, but you have no other outstanding debts.

- Down Payment $6500: Based on your income and expenses, you can afford to put down $6,500 as a down payment. This is around 20% of the cost of the vehicle, which can indicate to lenders that you are committed and able to handle the financial responsibility of a loan.

- Gather Necessary Documentation: Prepare your bank statements, the 1099-A form, and tax returns for the past two years. You’ll need these documents to prove your income stability and financial credibility to lenders.

- Credit Score 680: With a credit score 680, you’re considered a good borrower, but the foreclosure reported on the 1099-A form could potentially impact this. Over the next few months, focus on paying all bills on time, avoiding taking on new debt, and possibly seeking the help of a credit repair service.

- Find a Lender: After researching, you will find a local credit union that offers auto loans for self-employed individuals. They know the 1099-A form and will consider your application despite the foreclosure.

- Negotiate Interest Rates and Terms: The credit union offers you a loan with an interest rate of 4.5% for 60 months (5 years). Your monthly payment, excluding taxes and insurance, would be around $507. However, after negotiation, you bring down the interest rate to 4%, lowering the monthly payment to around $493.

- Select Your Car and Complete the Purchase: You select the Ford F-150 worth $33,695 and apply the down payment of $6,500. The loan from the credit union finances the remainder of the price ($27,195). You sign the loan agreement, make the down payment, and complete the purchase.

How to Fill Form 1099-A to Buy a Car

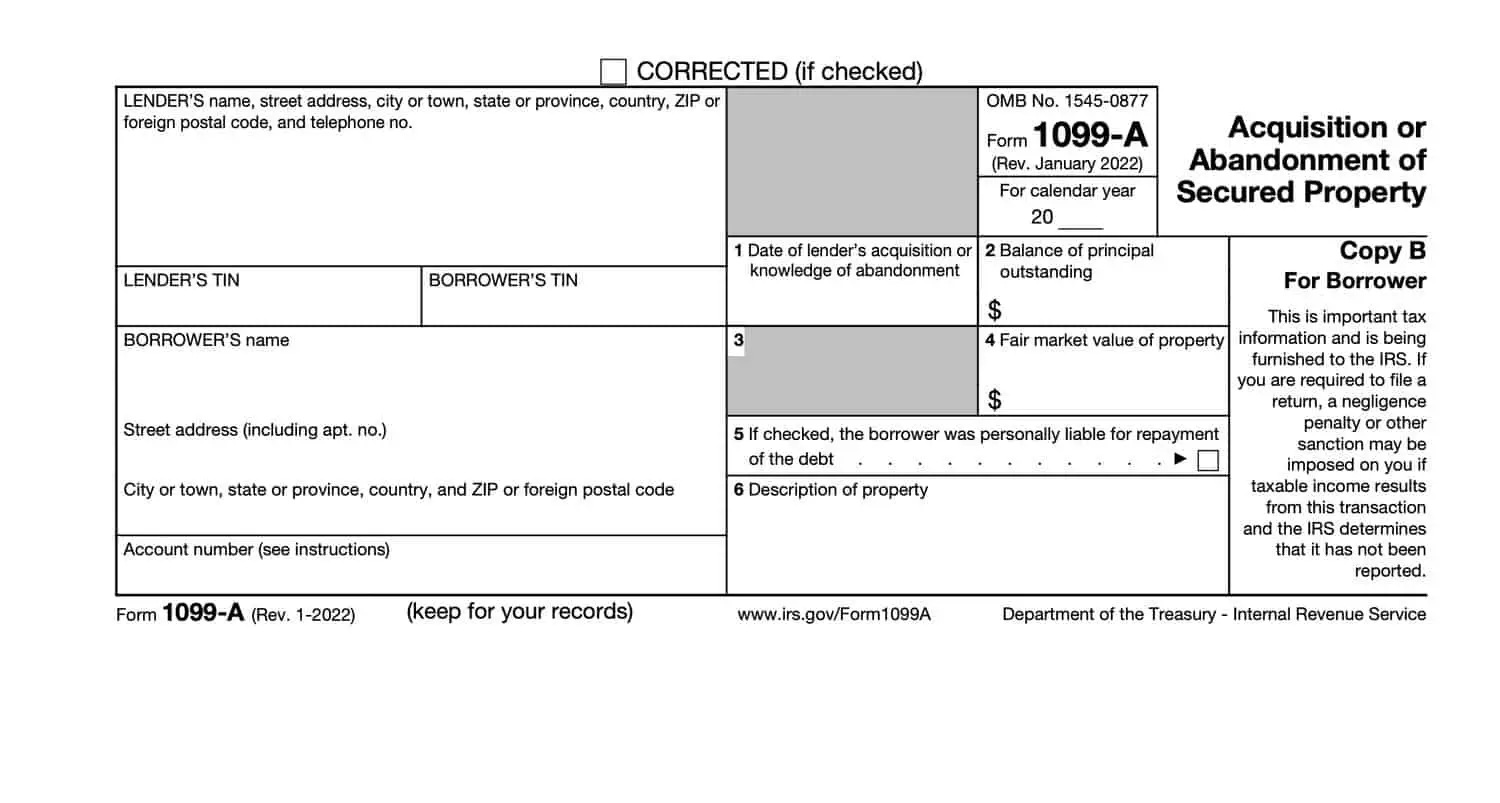

Form 1099-A is the U.S. Internal Revenue Service (IRS) tax form used when the property is acquired through foreclosure or abandoned. This form is sent to the individual who was responsible for the loan. The lender, usually a bank or a similar financial institution, sends a copy of the form to the IRS. The form includes information about the property, the loan, and the circumstances of the acquisition or abandonment.

The person responsible for the loan does not fill out the form; instead, it is filled out by the lending institution acquiring or abandoning the property. But, if you are the lender or you’re doing this on behalf of the lender, here is how to fill out the form:

Box 1. Date of Lender’s Acquisition or Knowledge of Abandonment Enters the date you acquired or knew the property was abandoned.

Box 2. Balance of Principal Outstanding This should be the outstanding amount of the loan which the borrower did not repay. This information should be readily available in the financial records of the lender.

Box 3. Reserved This box is reserved by the IRS and doesn’t require any input.

Box 4. Fair Market Value (FMV) of Property Enter the property’s fair market value. A real estate professional, such as a real estate appraiser, typically determines this. This value can also be based on the selling price in a foreclosure auction.

Box 5. Was the borrower personally liable for repayment of the debt? Check the box if the borrower was personally liable for debt repayment.

Box 6. Description of Property Here, provide a brief description of the property. For real estate, this would include the address. For personal property, provide a description that reasonably identifies the property.

Account Number The account number is required if you have multiple accounts for a recipient for whom you are filing more than one Form 1099-A.

Recipient’s/Lender’s name, address, and telephone number. Complete this section with your institution’s information.

After you complete the form, you’ll send a copy to the IRS and usually send a copy to the borrower. Always consult with a tax professional or advisor when dealing with tax-related issues to ensure accuracy and compliance with all IRS guidelines.

Final Thoughts

While buying a car with a 1099-A form can be challenging due to the perceived financial risk, it’s not impossible. You can navigate the process successfully by following these steps and maintaining a solid financial profile. Always remember each financial situation is unique. Consider seeking advice from a financial advisor or a professional well-versed