Endorsing a check to a third party can be a great way to manage funds and pay bills quickly and conveniently. Supporting is signing your name on the back of a check to be accepted by another person or entity. While it may seem like a simple task, there are specific steps you must take to endorse a check over to someone else correctly.

A three-party check represents a check written to one person but signed over to another to deposit or cash. For example, your mother writes you a $50 bill. You take that check and sign over the rights to the review to your brother. Your brother can cash the check as a third party.

Please read our article Where Can I Cash a Third-Party Check?

How to endorse a check to a third party?

To endorse a check to a third party, write “Pay to the Order of” and then write the Third Party’s Name Below Your Signature. The crucial thing is to write the name of the person you are signing the check over (third-party) to in the endorsement area under your signature.

Steps to endorse a check to a third party:

- Turn the bill over so that the back is facing you.

- Write the name of the third party on the endorsement line.

- Add the phrase “Pay to the order of” before the third party’s name.

- Next, sign your name on the line that says “Endorse here.”

- Finally, give the check to the third party.

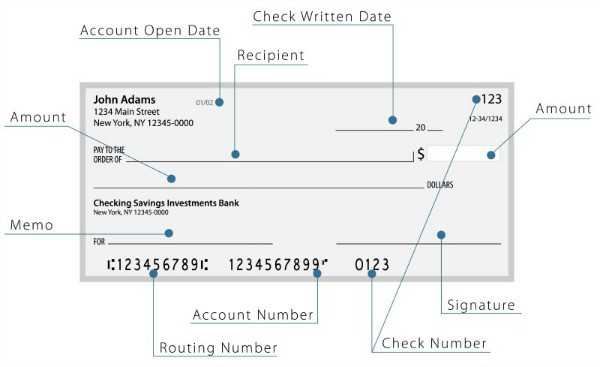

The first step when endorsing a check is to locate the endorsement line on the back. This is typically located below where your signature appears on the front side of the check and should include instructions such as ‘Endorse Here’ or ‘Sign Here.’ Before signing, you should double-check that all information printed on the face of the check is correct, including your name, address, account number, routing number, and dollar amount.

Once you have verified this information, sign your full name and any additional instructions for the recipient to cash or deposit it – such as ‘Payable To [Recipient Name]’ or ‘For Deposit Only.’ If multiple people are involved in receiving funds from this transaction, add their names in succession with similar instructions. Everyone must apply signs only after they have read all other signatures, so everyone is aware and agrees with what they are signing up for before proceeding.

In some cases, banks may require additional documentation from both parties involved to endorse the check to someone else. This may include proof of identity from both signers, such as driver’s licenses or passports, along with any other necessary documentation that their financial institution has required. Both parties must provide these documents before cashing, as failure to do results in processing times or even cause problems if not handled properly.

An everyday norm is depositing a received check to the respective bank account and procuring cash at the same spot by providing valid documentation and verification cards. However, you may need to reroute without a valid bank account by cashing the check at the issuing bank or any check-cashing retailer. You can also operate ATMs to cash a check if you do not possess your identification card by assigning someone else to do it. To cash a check without a bank account, you will need two forms of photo verification.

You can also visit the local branch of the bank through which the check has been dispensed. The bank agent or representative will assist, track the account, and cash the check quickly by ensuring enough funds are available. However, the person who has been issued the check must visit the bank branch to avoid scams or deception, as the banks need to verify the person signing the check.

Therefore, you need to endorse the check physically in front of the bank representative, which can be done on the back of the check, generally mentioned as “Endorse Here” printed on it. If you are cashing a check without a personal bank account, you must sign your name and put the identification number on the back or in the endorsement area. You may also be required to submit your fingerprint in the endorsement area for detailed verification. A small fee is also applied if you are not a legal account holder. Otherwise, the bank may refuse to cash the check.

Many retailers and merchandisers provide check-cashing accommodations and a small fee, except for big businesses such as Walmart, which may giwhichup the fee if the check receiver transfers the check amount to one of their prepaid store cards. Other options include payday loan shops and check-cashing stores that may be willing to give cash for a check.

The small businesses will give cash and a flat rate or a small percentage of profit from the check amount. In addition to that, a fingerprint will also be required as proof of identification. Big merchandisers such as Walmart can give you cash for the government-issued check or payroll, provided you have a valid photo ID and Social Security number, and a small fee of four dollars.

The banks do not readily provide cash for those people who do not have valid bank accounts. Therefore, the non-customers are less likely to be accommodated because they are more likely to lose money if they receive a duplicitous check. However, if the bank representative still decides to cash a check conveniently, then be prepared to submit a small service fee. You can also try opening a checking account at the bank, which is free of charge, allowing you to cash third-party checks conveniently without any document hassle.

Finally, once all signatures have been added and proper documentation has been provided, you can mail or deliver the endorsed check directly to its recipient. Ensure you track who has endorsed which reviews and where they were sent out, just in case it issues later. By following these few simple steps, you can ensure that your payment process runs smoothly when endorsing checks over to third-party entities.