In the recent article, we showed How Much Cash Can You Deposit in an ATM, either checks or bills. Have you ever had the incident of not going to the bank yourself but needing to deposit a check urgently? Many people believe that it is unnecessary to use checks in the current age; however, we beg to differ.

The conventional method of handing over checks to the bank teller and seeing how the bank account changes or grows has its vibe. You feel excited seeing the deposited amount of money, and the fact that you could do it yourself makes the experience worthwhile. However, we are often busy or do not have time to go to the bank.

Can I Deposit a Check for Someone Else?

Yes, you can deposit a check for someone else. In this case, sign your name on the top line, then write “Pay to the order of [recipient name]” underneath. However, some banks do not allow this practice, so check whether the procedure is allowed.

Cashing someone else’s check is illegal, but you can deposit a check for someone else!

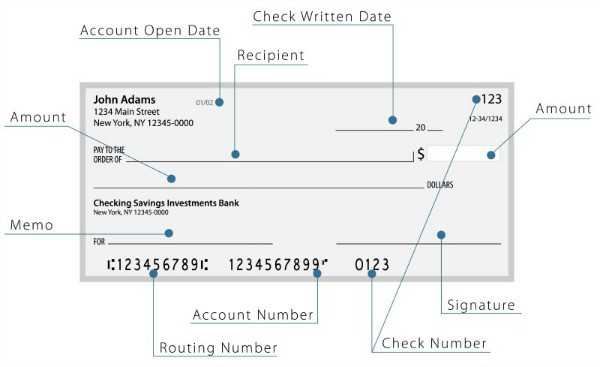

You can deposit the check on behalf of someone, and your check can also be deposited by someone else. However, some things may require financial scrutiny; for example, the bank teller may see the signature and check whether it is the same as in all the checks, or they may also make a phone call to identify whether the check sent is genuine or not. All of this is to check the authenticity of the checks only. Otherwise, there is not a big issue in depositing the checks on behalf of someone.

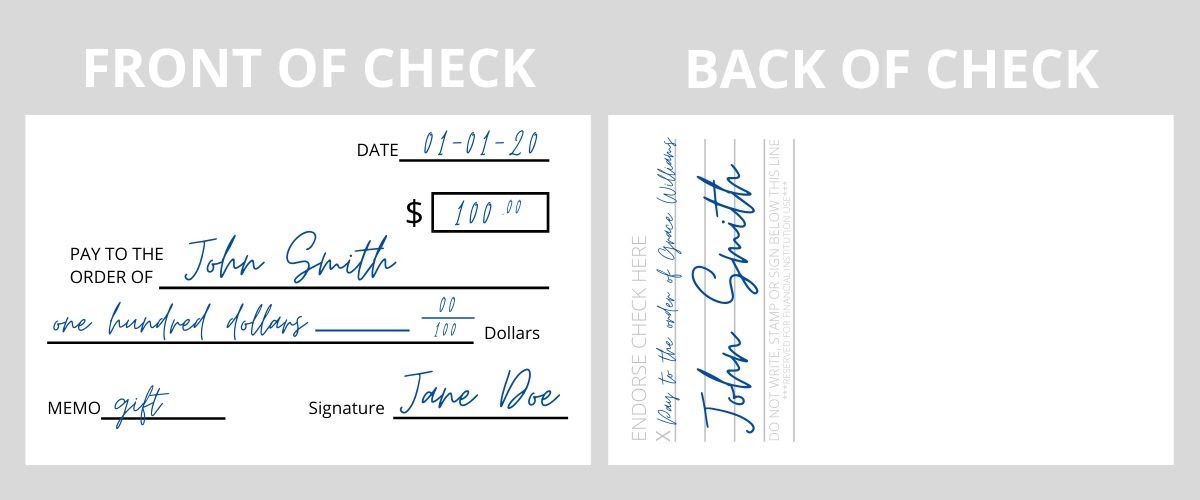

Below you can see how you can deposit a check for someone else but with their acceptance on the back (“Pay to the order of “on the check):

What Happens If you Deposit Someone Else’s Check?

If you deposit someone else’s check bank will approve that check if you are doing a favor to your family member, child, or friend. The best practice is for the person whose name is on the check to write “Pay to the order of (your first and last name)” underneath their endorsement. In that case, the bank will know that both parties approve the transfer of ownership for the check.

When you endorse a check to someone else, please follow these tips:

- Using Slips for depositing cash: The most common and easy-to-use method is to ensure that the check’s payee is writing the check or the deposit slip themself. In this way, you confirm that there are no discrepancies and differences in handwriting that may cause an identity issue for the bank. You should also receive a slip after depositing the check in the bank to have a confirmation and a reference number to make the tracking convenient. The bank teller will get and deposit the slip after checking all the required information.

- Writing the words for deposit only: when the payee fills out the deposit slip, you can ask them to write the words for deposit only in place of the endorsement area. In this way, it will be confirmed that the slip is made for depositing in the bank. You can write these words on their behalf if they cannot write them.

- Signature method: this option is the least recommended and safe while making a deposit. In this method, you sign the deposit slip and hand it over for checking in the bank. However, discrepancies may arise as bank tellers can accuse anyone of signing and copying the title. Therefore, this method is the least reliable one, and the above two are used commonly.

Depositing someone else’s check without their permission or authorization is illegal and can lead to serious legal consequences. Here are some possible outcomes that could occur if you deposit someone else’s check:

- The bank may reject the deposit: If the name on the check does not match the account holder’s name, the bank may refuse to deposit the check and return it to the issuer.

- The funds may be frozen: If the bank accepts the deposit and discovers that the check is fraudulent or the funds are unavailable, they may freeze the funds in the account and investigate further.

- You may be charged with a crime: Depending on the circumstances, depositing someone else’s check without their permission or authorization may be considered forgery or fraud, resulting in fines, jail time, or both.

- You may be sued: The person or company whose check you deposited may choose to sue you for theft or other damages, which can result in a civil judgment against you.

In summary, depositing someone else’s check is illegal and can have serious consequences. It’s essential to only deposit checks made to you or that you have permission to deposit from the person or company whose name is on the check.

Now, let us see how I deposit a check written to my child:

Can I deposit a check made out to my child?

Yes, parents are allowed to deposit checks made out to their children. In that case, parents must write the child’s name on the back of the check followed by the word “minor” and then endorse it with the parent’s signature right below the minor’s name.

Can you deposit a check with two names on it?

Yes, you can deposit a check with two names on it. First, however, all payees must endorse the checks, in this case, two signatures. After that, any person or party named on the check can deposit it into their bank account.

Is it illegal to deposit someone else’s check?

No, it is not illegal to deposit someone else’s check. However, if the check is not endorsed to you, it is unlawful to cash someone else’s check.