The Small Business Administration (SBA) is dedicated to helping small business owners start and grow their businesses, but can non-citizens benefit from the same opportunities? While the SBA has specific regulations regarding foreign ownership, non-citizens can get approved for funding.

Can a Non-US Citizen Get SBA Loan?

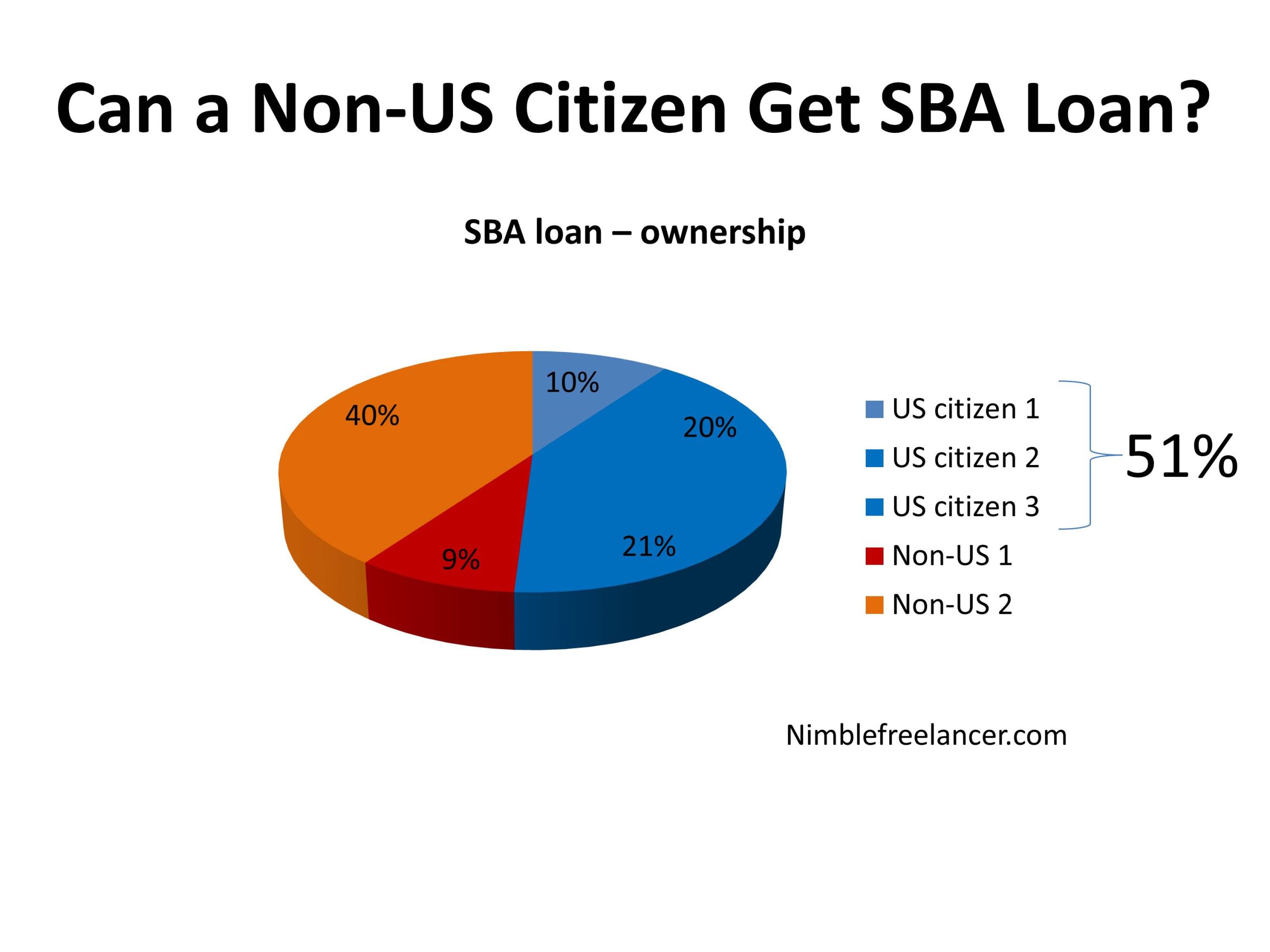

Yes, Non-US citizens can get SBA Loans, but only if the business is owned by 51% of U.S. citizens. In that case, Non-US residents can have a maximum of 49% business ownership.

For example, if your partner is a US citizen and he has 51% of the business, and you have as a non-US citizen 49%, your company can apply for an SBA loan.

Steps on how to apply for an SBA loan with your partners as a Non-US person:

- Determine the type of SBA loan that suits your business needs. SBA offers several loan programs such as 7(a), microloans, CDC/504, etc. You can check the SBA website or consult with an SBA-approved lender to determine which loan program is right for you.

- Ensure that your business meets the eligibility criteria for the selected loan program. Generally, the company must be for-profit, operate in the United States, have a reasonable owner investment, and demonstrate the ability to repay the loan.

- Complete the SBA loan application and gather the required documents. You must provide information about your business, personal financial information, business financial information, and collateral.

- Work with an SBA-approved lender who can process your loan application. You can find an SBA-approved lender on the SBA website or through local resources.

- Provide documentation to show your ownership structure, including the non-US citizen’s 49% ownership and the US person’s 51% ownership. This may include legal documents such as partnership, operating, or shareholder agreements.

- Work with the lender to provide additional documentation as needed and answer any questions they may have about your application.

- Wait for the lender to review your application and make a loan decision. The timeline for loan approval can vary depending on the lender, loan program, and the complexity of the application.

- If approved, sign the loan documents and receive the loan funds. Be sure to use the funds only for approved business purposes and make timely payments as required by the loan agreement.

Regarding SBA loans, there are limits on how much of a business’s total equity a foreign investor can own. The maximum amount of ownership for non-citizens is 49 percent. This is because most control and decision-making need to remain with U.S. citizens or permanent residents. If foreign investors own more than 49 percent of the company’s total equity, then the SBA will not approve the loan.

However, foreign investors are still encouraged to invest as they can own up to 50 percent in some instances where they do not exert control over the business’s operations and management decisions. Other limitations may also apply depending on certain unique circumstances of each case; therefore, it’s essential to work closely with an SBA banker and review all documents carefully before signing any agreements or contracts.

Non-citizens who have applied for legal permanent residence (LPR) status may also be eligible for SBA financing if they meet all other eligibility criteria, such as credit score requirements and good character references. In addition, applicants with LPR status must present proof that they intend to stay in the United States indefinitely to be eligible for SBA funding opportunities.

Due to its commitment to supporting small businesses with great potential regardless of citizenship status, the Small Business Administration has put regulations that allow non-citizens access to potential funding sources – just like US citizens – so long as all criteria are met. Their ownership does not exceed 49 percent of a business’s total equity stake. Working with an experienced bank or banking team specializing in small businesses can help ensure all foreign investments remain compliant with these regulations while ensuring successful approval from the SBA for any future loan applications!

Please read our article about SBA Loan Status Disbursed Current. Additionally, learn more about Bankruptcy Clear SBA Loans!