An ancient letter is sometimes the finest approach to achieving this job. For example, you may need to send an application in a formal letter or send it in person to your banking office to conclude a bank account. You won’t have to wait or wait in line, talk to customer support, and hope the account is swiftly canceled – you may submit the letter and finish with it. Even though a letter is unnecessary, a paper trail will provide you peace of mind if there are any mistakes or difficulties. Use the following text as a template and, if required, fill out the information within brackets.

Sample Letter to Close Bank Account Template

Dear [Bank Representative],

I am writing to inform you that I would like to close my bank account with your institution. My account number is [insert account number].

The reason for closing the account is [insert reason]. [You can include details about why you are closing the account, such as moving to a different bank, changing your financial situation, or any other relevant information.]

I kindly request that you provide me with the necessary information and procedures for closing the account. If there are any forms that need to be completed or documents that need to be submitted, please let me know so I can arrange to provide them as soon as possible.

I would like to ensure that any outstanding balances or fees are settled before the account is closed. Please inform me of any steps that need to be taken to ensure that this process is completed smoothly.

Thank you for your attention to this matter. I appreciate the services that your bank has provided me during the time that I have held this account.

Sincerely,

[Your Name]

Sample Letter to Close Bank Account Formal Template

Download the Free Sample Letter To Close Bank Account in doc and pdf format:

Close bank account letter template in doc

Close bank account letter template in pdf

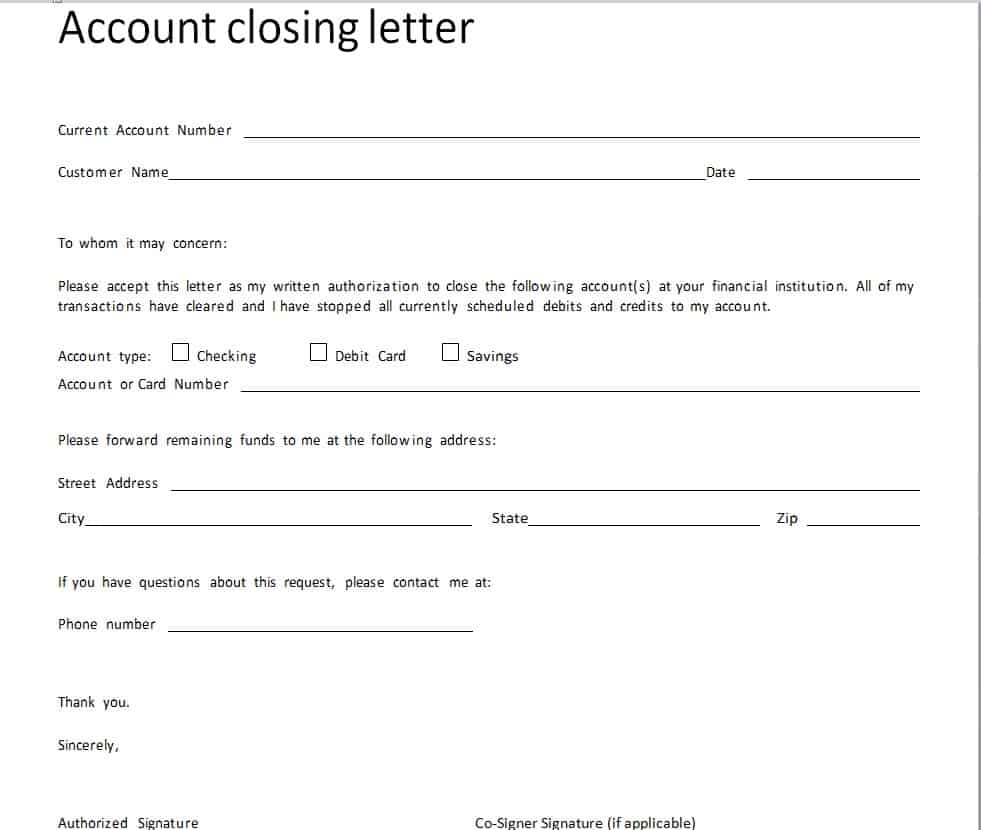

Screenshot:

Sample Letter to Close Bank Account Because of Inactivity

Dear [Bank Representative],

I am writing to inform you that I would like to close my bank account with your institution due to inactivity. My account number is [insert account number].

I have not made any transactions or accessed the account for an extended period of time and have decided to close the account. I believe this is the best course of action to avoid any unnecessary fees or charges that may be incurred due to the account remaining inactive.

I kindly request that you provide me with the necessary information and procedures for closing the account. If there are any forms that need to be completed or documents that need to be submitted, please let me know so I can arrange to provide them as soon as possible.

I would like to ensure that any outstanding balances or fees are settled before the account is closed. Please inform me of any steps that need to be taken to ensure that this process is completed smoothly.

Thank you for your attention to this matter. I appreciate the services that your bank has provided me during the time that I have held this account.

Sincerely,

[Your Name]

Sample Letter to Close Bank Account due to Death

Dear [Bank Representative],

I am writing to inform you that my [relationship to the deceased], [Name of the deceased], has passed away on [Date of death]. As the executor of their estate, I would like to request the closure of their bank account with your institution. The account number is [insert account number].

I kindly request that you provide me with the necessary information and procedures for closing the account. If there are any forms that need to be completed or documents that need to be submitted, please let me know so I can arrange to provide them as soon as possible.

I understand that there may be outstanding balances or fees associated with the account. Please inform me of any steps that need to be taken to ensure that this process is completed smoothly and any outstanding balances or fees are settled.

I will provide you with a copy of the death certificate and any other required documentation to assist in the closure of the account. If there are any further questions or concerns, please do not hesitate to contact me.

Thank you for your attention to this matter during this difficult time.

Sincerely,

[Your Name]

While canceling your account, check and double-check to ensure that cheques or automated payments do not automatically pay for your account. Then, change your direct deposit instructions to your new account, and wait until you notice that you have updated your account before closing.

Sample Letter to Close Bank Account Because of Moving to Different Location

Dear [Bank Representative],

I am writing to inform you that I would like to close my bank account with your institution due to relocation. I am moving to a different city and will be unable to access your bank’s services conveniently. My account number is [insert account number].

I kindly request that you provide me with the necessary information and procedures for closing the account. If there are any forms that need to be completed or documents that need to be submitted, please let me know so I can arrange to provide them as soon as possible.

I would like to ensure that any outstanding balances or fees are settled before the account is closed. Please inform me of any steps that need to be taken to ensure that this process is completed smoothly.

I have appreciated the services that your bank has provided me during the time that I have held this account, and I will recommend your bank to others. However, due to my relocation, it is necessary to close my account.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

Sample Letter to Close Bank Account Because of Switching to a Different Bank

Dear [Bank Representative],

I am writing to inform you that I have decided to close my bank account with your institution and switch to a different bank. My account number is [insert account number].

After careful consideration, I have decided that the new bank offers better interest rates, lower fees, and better services that are more suitable for my current financial needs. While I have been satisfied with the services provided by your bank, I believe that this is the best course of action for me.

I kindly request that you provide me with the necessary information and procedures for closing the account. If there are any forms that need to be completed or documents that need to be submitted, please let me know so I can arrange to provide them as soon as possible.

I would like to ensure that any outstanding balances or fees are settled before the account is closed. Please inform me of any steps that need to be taken to ensure that this process is completed smoothly.

Thank you for the services that your bank has provided me during the time that I have held this account. I appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

Empty Bank account

Usually, before you send a letter, shut it, and you should empty your Bank account. In most situations, the money you transfer gets into your hands faster than if you wait for the bank to handle your application. You may send yourself funds online, including fundamental transfers from bank to bank, in numerous quick and freeways. Apps and services for non-banks

The work can also be done with applications and non-bank services

If you do it yourself, you will know when and where to anticipate money. The option is to wait for an e-mail check (that you must deposit before retirement and spend the money). Be careful not to deplete your previous account too fast if charges or costs are incurred. Any price or charge you cannot afford might delay the procedure.

You only have to request (whether written or clicked on the button) to close your bank account. It is not the language that matters most. You need not be instructed to do it “soon” or “soon” since you’ll accomplish it sooner or later than feasible.

Lenders don’t pull their feet unless someone notices and exerts weight. Just make it easy for the individual who opens your email, and it will be faster and more accurate to tell them precisely what to do and where to pay the money. If you have issues against the bank, provide comments individually and wait until you have terminated your account.

Why do people close bank accounts?

Here are some common reasons why people close bank accounts:

- Moving to a different location: When people move to a new place, they may close their existing bank account if the bank doesn’t have a branch or ATM nearby.

- Switching to a different bank: People may close their bank account and move to a different bank if they find that the new bank offers better interest rates, lower fees, or better services.

- Dissatisfied with the bank’s services: If customers are unhappy with their services or fees, they may close their accounts and switch to a different bank.

- Inactivity: Some people may close their accounts if they haven’t used them for a long time to avoid incurring unnecessary fees.

- Merging accounts: People may merge their accounts into a joint account with their partner or spouse and close their accounts.

- Death: When someone passes away, their account may need to be closed by their executor or next of kin.

- Business closure: If someone owns a business, they may need to close their business account if the company is shutting down or being sold.

- Financial hardship: In some cases, people may face financial problems and need to close their accounts to avoid overdraft fees or other charges.

Conclusion

Though not always necessary, adding a further financial protection layer to the hand-signed letter to request an account closure is easy. If there are any problems or errors, the critical information, such as what you asked specifically and where any residual cash should go, is written down and dated – remember to maintain a copy yourself. If it is sometimes tricky, ensure you reach the discrepancies as soon as you realize them. Be straightforward in your customer care discussions, but don’t damage bridges. A clear comment will only make clear communication, not speed up the procedure.