The Vanilla Visa account is an advanced payment card. It indicates this because you deposit funds into it when you buy it. It’s advertised as a gift voucher, but there are numerous Vanilla wallets, many of which also act as pre-paid card transactions. This page is about gift cards available in values spanning from $10 through $250 and up. Prepaid credit cards contain such a number and an expiry date displayed on the top and reverse, and these can be utilized for exact locations as convenient payment methods.

The quantity of funds placed or charged onto the account determines the card’s monthly payment or the max amount debited. The card becomes worthless because other funds are placed on it once the amount has been depleted. As the consumer continues to add cash to the account, a preloaded debit card should be used continuously. This may, nevertheless, be subject to a monthly charge. Those other prepaid cards aren’t just about prepaid credit cards, even though the phrases are sometimes used indiscriminately. A prepaid checking account, which requires an application, a credit check, and issuance acceptance, works similarly to a standard credit card. The user can keep an open account, get mortgage payments, and so on. The most significant distinction is that the account’s authorization is conditional on a registration fee for the issuers if even the user defaults on their repayments.

The purpose of Vanilla Cards

Although you’re not using a credit or debit account, you can use it to conduct financial transactions. This wallet is recognized everywhere Visa is recognized, allowing anyone to give a gift card and not limit yourself to a single merchant.

You can’t purchase almost as much as the amount you’ve placed onto the account, so there’s no fear of going overdrawn. This may assist consumers in reducing their expenditure.

Cashier checks are sometimes used as starter accounts for teenagers already discovering how to choose credit and debit cards appropriately.

How to Activate My Vanilla Visa Gift Card?

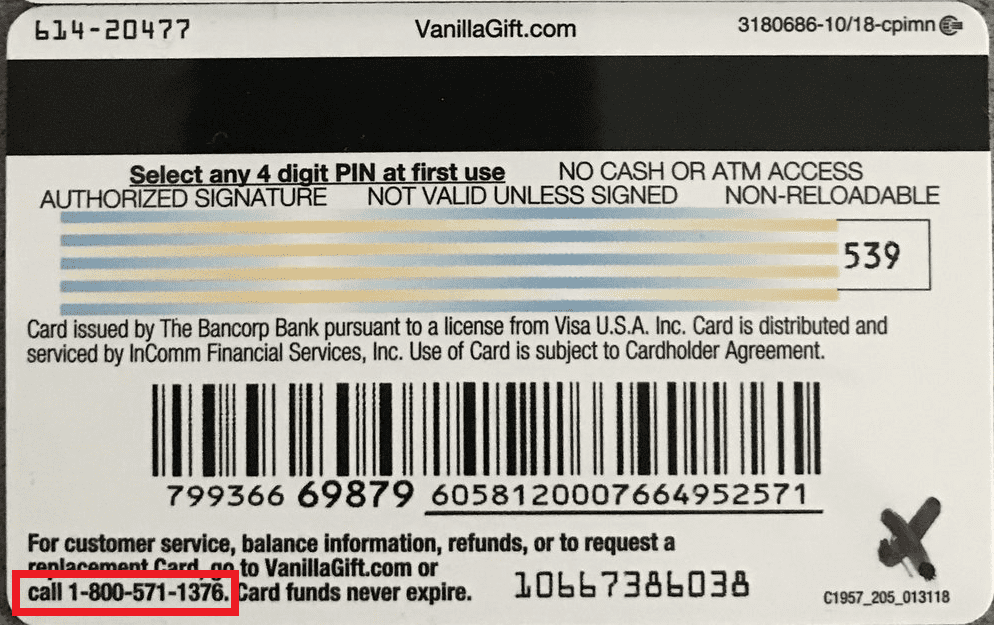

To activate Vanilla Visa, call a toll-free number 1-800-571-1376 from the back of your card or visit the activation website online. However, if you got your Vanilla card directly from VanillaGift.com, your credit card will be ready for use immediately.

You can always check your debit card on the website.

The phone number for activation can be different from the number on our website, so you need to check the number on the back of your card:

When you receive a guaranteed MyVanilla Visa Card, you can receive a long reliever card from a seller or even apply from MyVanilla’s site. Anyway, just like with many Visa credit and debits, you will have to disable it when you can utilize it MyVanilla also provides likewise working MasterCard cards. Once you register online, there is also no buying cost for a MyVanilla card. This could be done by signing up for consideration on MyVanilla’s homepage. If you’re having problems, contact the customer helpline at MyVanilla at (855) 686-9513, besides help. You could use one voucher as other Visa debit cards when your card is enabled. You can use the MyVanilla mobile phone app to insert money to numerous stores such as Amazon and obtain your contractor’s direct down payment and deposit inspections. Resources can also be transferred to yet another card from MyVanilla.

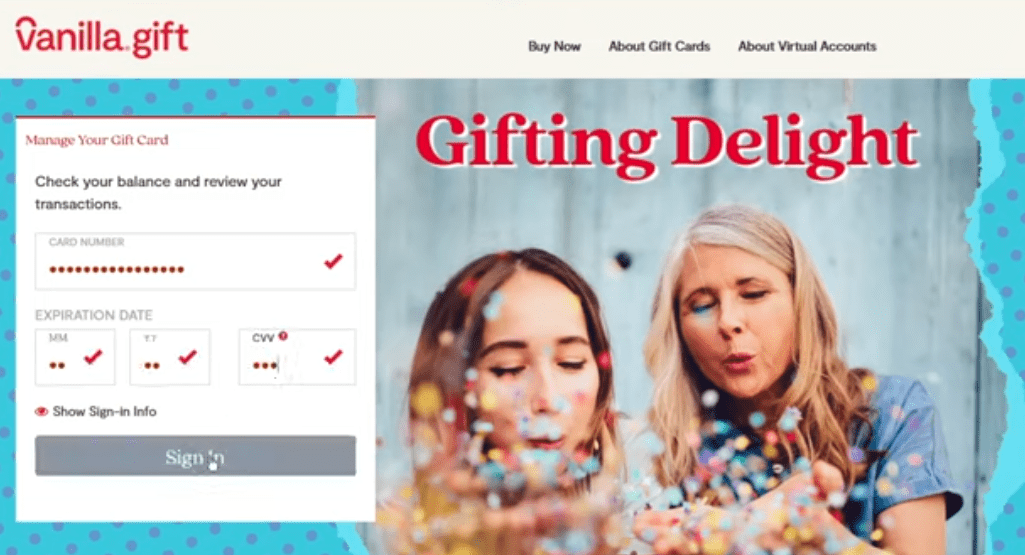

How to Activate My Vanilla Visa Gift Card on the website?

To activate the Vanilla Visa Gift card on the website, do the following steps:

- Visit webpage vanillagift.com

- Choose the option ” Have a Vanilla gift card . Check Balance”.

- Add card details (number, expiration date, CVV)

- Choose the “Register your card” option.

You can read more about VISA gift card PIN on our webpage.

You could find store outlets by using the MyVanilla mobile application to upload cash on the voucher or verify the equilibrium.

Users can use this cash to shop at places where you accept Visa Debit Cards or retract via an ATM when you have a credit or debit card. You probably have to pay several charges on off-network ATMs because ATMs start charging lower service charges. This same visa of MyVanilla is not the only outcome of the vanilla card. Vanilla provides you or folks you purchase besides pre-paid gift cards and can be used everywhere you recognize Visa Cards. Gift cards from Vanilla do not lapse, and cardholders are not needed; therefore, credit checks are not required. Since I bought it, the gift cards must not have been triggered.

You also could see signs of Vanilla Reload adverts, which enable users to add money to one MyVanilla card in different retail outlets. All you have to do is bring your MyVanilla card to the ability to participate in the stores’ cash registry, palm the quantity you want to offer to your acct, and swipe this same caThen; you pack the money on your voucher you consider buying your prepaid card, youYou stack the receipt with wealth on a different bank account, credit card, or rear guard. You could already recharge your prepaid card or even in the shop or financial institution in which you acquired it if you operate low on money repeatedly.

Several other card readers offer basic paper statements so that one’s card receives a pay packet or quarterly revenue immediately. Clients’ Visa Prepaid Document may be charged based on the services. For obvious reasons, the Visa Walmart MoneyCard Basic Prepaid does have a $3 subscription payment and no charges since 2015. When you buy most cards, it is possible to load people, but some need to stimulate the card already when you pile funds.

How to use a Vanilla gift card?

To use a Vanilla gift card, you need to swipe your card and enter a 4-digit number as your PIN. In addition, you can use an online visa Vanilla card to buy products at digital wallets such as Apple Pay, Samsung Pay, and Google Pay.

How to transfer Vanilla Visa to the bank account?

To transfer Vanilla Visa to a bank account, you can use PayPal or Venmo digital account to transfer cash from Vanilla Visa to the bank account. Additionally, you can use a service called CardCash.

Does Aliexpress take vanilla visa gift cards?

Yes, you can use Vanilla Visa gift cards to purchase on Aliexpress. Aliexpress will accept your card as a credit or debit card issued by major credit card companies.

Can you use a Vanilla Visa gift card on Steam?

Yes, you can use your Vanilla Visa gift card on Steam. You can pay on this platform and use Steam for playing, discussing, and creating games. Try to set the same ZIP code on the Visa Vanilla card.

Vanilla GiftCards

A gift card seems to be a money transfer card with money placed on it for subsequent government expenditure. It only has a particular quantity of dollars in it. The card will no again be usable after this amount has been depleted. Gift cards, like card payments, have time limits that are sometimes significantly smaller. Gift cards are available in a variety of types. The most straightforward common combination is a closed system card, which is only valid at a specific retailer or store and tells the tale and emblem of that establishment. Some supermarket companies may let you use identical gift cards at every one of one’s locations.

Gift cards were first used in select locations; however, almost all of the main charge or credit card providers, such as American Express, Visa, Discovery, among MasterCard, now provide gift cards that can be used everywhere that ordinary plastics are recognized. Fully accessible cards often referred to as prepaid debit cards, are usually contrasted with prepaid debit cards, mainly when most of them have been dipping.

An exclusive registration fee may apply to some cards. Just about all the merchants, both digital and in-store, provide gift cards as a means for customers to purchase or send money to other people. Traditional and cyber e-gift card gift cards are available, each of which has some characteristics and advantages. If you’d like to acquire gift cards for someone else or oneself over the festive season, it’s helpful to know how they contrast to other financing options.

Many of the more prevalent scam artist tools include gift cards. An attack involving gift vouchers can hit almost any trader. There are several ways for terrorist organizations to use gift cards, from straightforward scam artists to hacking trade share datasets with charges that every other trader ought to know about some of this pattern theft.

In 2018, U.S companies expended approximately $160 billion on donor cards. Gift vouchers have become so widely known that many of us don’t consider buying individuals, providing them, or paying them multiple times. However, some the things such as famous gifts make these card readers apply to daily fraudsters and organized robbers. Gift vouchers should be the first and foremost pseudonymous and undetected.

Every gift card is like an electronic bank card with no perpetual link to a person’s bank details. It is also easy to turn gift vouchers into goods and cashback offers. Valid card users can purchase or shop stuff with their card purchases. To resale or exchange the card significance for crypto-monetary purposes, terrorists can buy things. A gift card is a type of payment that could be used at major retailers, petrol stations, eateries, and other establishments. You put funds over onto cards, but you or the purchaser of the gift card will need to use it at any business that accepts it. There are two types of gift cards open-loop and closed-loop. An accessible gift card that agrees with that branded card product could still be redeemed.

If you’ve had a gift card with both the Visa logo on it, for illustration, you can use this to conduct payments everywhere Visa is authorized. But at the contrary extreme, a shuttered card will only be utilized at a particular retailer if. So if you buy a gift card through Starbucks and Amazon, you or the receiver can only spend it at the store that issued the card.

Virtual and Physical Gift Cards

Gift cards can be tangible, i.e., a plastic card, or digital, i.e., an electronic file. Virtual gift vouchers do not have a physical structure; however, you are given a unique gift reference number that you may use to make payments at shopping websites. The most common type of gift card is still actual cards, although this is projected to alter in the immediate future. Customers can buy physical games and load internet and electronic accounts at businesses like Amazon, Walmart, and TargIn addition, the client can get virtual and analog gift cards from prominent restaurant businesses like Starbucks, Chipotle, and Chilies.

Users can purchase beverages and dinners with these cards by utilizing an application or a memory card in the institution, which speeds up the checking procedure. Users can also use mobile wallet software like Recurring Billing, Apple Pay, or PayPal’s Karma to save credentials for electronic gift cards. Once you’re prepared to purchase, you can choose your virtual gift card as my money transfer service.

Advantages and disadvantages of gift cards and prepaid cards.

If someone doesn’t want to make payments using a credit card, these can become a suitable alternative. Gift cards are a great way to show someone you care during the season, or for some other formal treIn addition, gift cards could help keep track of your expenditures, helpful for avoiding bank overdrafts.

If you don’t know what to get somebody on your present list, gift cards may be a better option because they allow recipients to choose whatever they need. If you decide on shuttered gift cards over accessible gift cards, please remember that the giftee’s choice is limited from which they may use the card number.

Following transactions with a gift card, perhaps there is a tiny quantity of cash leftover that, if not spent, is money wasted, probably due to ignorance or procrastination. To send funds, you can pay purchasing or reload costs. The spending power of shuttered cards is limited. It’s a pain to lose or have a gift certificate stolen, mainly if you didn’t register or retain the gift card information. You can be fined an interest if you don’t use the cards.

Prepaid card payments might arrive with different charges that deplete your bank account. Additional costs, transaction costs, ATM fees, refilling expenses, foreign financing costs, and other costs may apply to you. In addition, you might be paid a fee to check your card’s amount. Workers have had the right to refuse payment by debit card if the charges lower their take-to-home pay.

What is the main difference between prepaid and gift cards?

When assessing the benefits and drawbacks of gift certificates, it’s crucial to distinguish them from preloaded debit or credit cards. Neither can also be utilized to buy things in shops and online. Still, although you can purchase gift cards to donate, a preloaded credit card will be used for daily shopping if you’re not using a bank account or choose not to handle cash or a conventional credit card. Prepaid credit card businesses offer various cards that allow customers to purchase and recharge cards at store outlets.

Customers may make payments to your PayPal bank account, and a were for use wherever MasterCard is recognized using the PayPal Prepaid MasterCard. Credit cards, debit cards, and pre-paid discount coupons are usually better deals than retail chain gift cards. Still, conventional credit cards might have certain perks in terms of value reported on transactions or using card-specific benefits like travel discounts or loyalty promotioPlease remember how they affect your credit score when deciding whether to utilize preloaded credit cards or gift cards for expenditure. They aren’t going to appear on your bank statements. This implies they don’t contribute to the development of your credit record. On the other hand, a conventional checking account can help you create or enhance your credit if you’re seeking a way to do so.

Getting your money every month, maintaining your increase in income, keeping existing credit or debit card accounts active, and restricting how often you request new credit can allow you to improve your credit score throughout the period. It’s a chance to discuss another excellent prepayment card – MyVanilla Users Accept. The cardholders don’t pay a subscription but instead pay a fee for shopping. And let’s look a little closer at his cheque. Yes, the card users would not have to pay an extra fee, as demonstrated.

It’s also suitable for people who won’t shop a lot with cards. The company offers a $0.50 fee when paying with some vouchers without charging extra for cutting costs. This implies that the certificate should be utilized to shop expensively and that such a panel is undetectable. A very fee process is easy for everyday users, as transaction costs are increasing steadily.

A prepaid direct debit works similarly to a gift card in that it enables you to transfer the quantity of cash in your wallet. You can refill the account online or from an Automated teller machine, a partner retailer, or another physical place once the balance has been depleted. Prepaid debit certificates are issued by bankers and marketed by Visa, MasterCard, Discover, and American Express, among other card payment providers. A prepaid debit card might be a good cash substitute. Individuals who may not have a credit card or access to a standard debit card linked to a checking account can use the prepaid debit card; however, rechargeable table debit cards come with many fees, so it’s crucial to pay more for a better offer.

A prepaid debit card works just like cash and sometimes even faster. It’s a safer way to transport money than, say, a bunch of paper currency. Consumers’ safeguards are also available with prepaid cards, which are not available using money. Internet payments can be made with a prepaid debit card. It can be a more appealing presentation than money. A prepaid direct debit could have been helpful for someone who wishes to stay on a tight schedule or has problems handling credit cards. A prepaid debit card would be used to purchase, typically requiring a credit card or standard debit card.

In several cases, the beneficiary of your payments may not even realize the card is prepaid. Several firms pay their employees with salary cards, which are prepaid debit cards and could be used without a checking account and direct deposit. Prepaid debit cards are now available for many public programs, especially Social Welfare.

Difference between regular and prepaid debit cards

The sum of funds you can use with a standard debit card is determined by how often income you want in the recurring deposit to which it is attached. You must have a checking account too. To use a standard debit out, whereas a prepaid debit card does not require one. The number of funds accessible on a standard debit card will vary weekly as income travels into or out of your savings account. You have a set budget to invest with a prepaid debit card that decreases as you use it and only increases if they recharge the card.

The opportunity cost of prepaid debit cards

If you’d like a prepaid debit card but can’t acquire a traditional credit card even though you have a low payment history or none, you might even want to try a debt consolidation loan instead. Protected cards are simpler to get since you have to throw aside a recoverable security deposit that only the lender uses as protection addition, A protected credit card has the benefit of being able to submit your monthly mortgage repayments to the three most prominent agencies, which can help you develop your creditworthinessWhetherer prepaid or standard debit cards, do not record the transaction to credit agencies does nothing to help you achieve your credit score.

What is the Overview of debit cards and credit cards in general?

There is a similarity in many card payments. These cards often bear the symbol of a significant charge card corporation, such as Visa or Mastercard. They could be used to buy products and activities at merchant example, considered the two people who buy a TV at a local appliance store at $300 each. A default direct debit is used, and a credit card is used for many more.

The consumer of the debit card snaps his card. Your cashier check places a $ 300 deposit on your consideration to waste the cash on TV and stop it from choosing to invest in something more. The shop will have sent the money transfer information to the financial institution within one to 3 days, which transports the financial resources owed to the store by electronic communication.

On the other hand, a debit card draws cash from an atm. A credit card operates based on a line of credit that can still be paid off over time, giving you extra cash to figTheir trustworthiness determines a customer’s credit lines. They can choose how and how to use it. Unfortunately, theyThey are often invoiced every quarter; a bank account may come with an overflow line of credit linked to a client’s savings account to offset overpaying.

The credit card is affixed to a specific percentage of benefits, and the card would be refused if a buyer starts spending more than the loan amount. Debentures seem to be credit cards. Not debit cards. Debit cards. Without an outstanding balance, direct debit users can only probably have spent on everyone’s checking account funds that are accessible. A default debit card is connected to a savings account. A debit card prepayment is not available.

If you need to check your debit card balance, you can read more in our article on how to check your visa debit card balance.

A bank account is connected to the credit line provided by the issuing company. Credit cards help develop your payment tooth for these clients using a conventional credit card. The company generates the buying cost to the principal debt of your credit card because once swiping it. The consumer’s credit card has to repay the corporation by deducting the cost seen on its account until its next invoicing deadline.

What is a debit card?

A debit card may look like a credit card, but it is distinct—the issuing bank uses a debit card for its clients to access money without a money order or transfer. A debit card is connected to your bank account that can be utilized wherever credit cards are allowed. If, for instance, one’s debit card seems to have a Visa symbol, it could be used wherever Visa is required. The bank retains the percentage you had also planned to spend using a debit card.

The funds will be instantly withdrawn from your consideration or retained for 24hrs or more by their financial institution according to the quantity charged and one’s bank. And use an individual email address. You might use someone’s debit card to transfer money from your cheque (PIN). You may be kept asking beside the PIN and might be requested to fill up, comparable to a credit card, and use your debit card for purchasing. A debit card connected to a bank account can be a better alternative than a credit card for those attempting to spend or avoid over-extending themself monetarily. Some debit cards are prepayments, and a mortgage lender loads funds onto another card. Those other cards may be used the same way as the default debit card authorized. But prepayment cards are the only prepayment and are not connected with a savings account by an individual.