Engaging in daily activities without a binding bank account or a personal financial platform is challenging and may create obstacles while carrying out financial needs. Despite that, more than 30 million US residents are surviving without a personal bank account and are still successfully dealing with financial undertakings and monetary transactions. According to the latest FDIC assessment, many US households are ‘under banked’ or ‘unbanked’ pursuing financial communications through cash-based consumption. It is also a fundamental requirement for economic survival today; therefore, learning to function without a bank account is imperative.

Specific changes in the banking industry and financial platforms make supervising bank accounts difficult. Many US residents are seriously considering transitioning to cash-based consumption because of the increasing bank fees and stringent requirements. Many residents own a checking or savings account and sometimes utilize pawnshops and wages to fulfill their financial needs. You will most likely survive without a personal bank account, but you may face difficulties cashing a third-party check if someone hands it out to you. In this situation, you will be required two follow a different route to acquire cash which may be problematic but not impossible.

What is a three-party check?

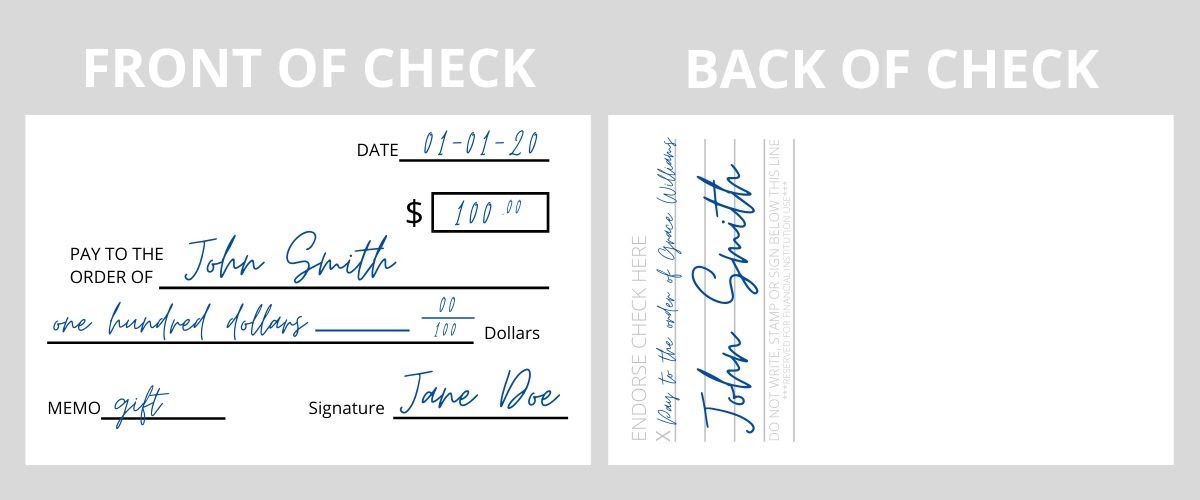

A three-party check represents a check written to one person but signed over to another to deposit or cash. For example, your mother writes you a $50 bill. You take that check and sign over the rights to the check to your brother. Your brother can cash the check as a third party.

A three-party check is a type of check that involves three parties: the person who writes the check (the drawer), the person who receives the check (the payee), and a third party who is authorized to cash or deposit the check (the endorser).

Here’s an example of a three-party check scenario:

Let’s say John owes $1,000 to Mary for a loan she gave him. However, John doesn’t have the cash on hand to pay Mary back. So, John writes a check to Mary for $1,000, but he makes the check payable to both Mary and a third party, let’s call him Tom.

Mary then endorses the check by signing it back, adding “Pay to the order of Tom,” and handing it over to Tom. Tom then deposits or cashes the bill, and the funds go into his account. Tom may deduct a fee or commission for his service.

This type of check is sometimes used when the payee doesn’t have a bank account or doesn’t trust the drawer to provide sufficient funds. Involving a third party offers additional security and guarantees that the check will be paid.

Third-party check to cash you can do in any bank, but it may require both parties to be present or have photo ID if fraud is suspected. Additionally, with third-party check cashing, you can cash off the bank at some grocery stores, check-cashing stores, money services, and credit unions.

Where Can I Cash a Third-Party Check?

- Banks or Credit Unions: Many banks and credit unions will cash third-party checks if you have an account with them, but they may charge a fee or require that you meet specific criteria.

- Check Cashing Stores: Many check-cashing stores and chains, such as ACE Cash Express, Check Into Cash, and Speedy Cash, specialize in cashing checks and often cash third-party checks.

- Retail Stores: Some retailers, such as Walmart, Kroger, and 7-Eleven, have check-cashing services that may allow you to cash a third-party check.

- Mobile Deposit: Many banks and credit unions offer mobile deposit services that allow you to deposit a check using your smartphone or another mobile device. However, they may have restrictions or fees for depositing third-party checks.

- Prepaid Debit Cards: Some prepaid debit card providers such as Green Dot, Netspend, and Serve may allow you to deposit a check onto the card and access the funds that way.

- Money Orders: If you cannot cash a third-party check, you may be able to purchase a money order with the check and then cash it at a bank or other location that accepts them.

It’s always a good idea to check with the institution or location beforehand to confirm their policies and any fees associated with cashing a third-party check.

What banks cash third-party checks?

Third-party checks you can cash at:

- Bank of America

- BB&T

- Citibank

- Connexus Credit Union

- First National Bank

- HSBC

- M&T Bank

- Navy Federal Credit Union

- PNC Bank

- SunTrust Bank

- TD Bank

- U.S. Bank

- Fifth Third Bank

- KeyBank

- Regions Bank

- Santander Bank

What Check Cashing Stores cash third-party checks?

- ACE Cash Express

- Check Into Cash

- The Check Cashing Store

- Money Mart

- Speedy Cash

- PLS Check Cashing

- Advance America

- Moneytree

- Check City

- Cash Store

- Check ‘n Go

What Retail Stores cash third-party checks?

- Kmart

- 7-Eleven

- Publix

- Albertsons

- Safeway

- Kroger

- Meijer

- WinCo

- Food Lion

- H-E-B

- Fred Meyer

- Giant Eagle

What Mobile deposit services cash third-party checks?

- PayPal

- Ingo Money

- Bank of America Mobile Banking

- Chase Mobile app

- Wells Fargo Mobile app

- Citibank Mobile app

- Capital One Mobile app

- TD Bank Mobile app

- US Bank Mobile app

What Prepaid Debit Cards are third-party cash checks?

- Netspend

- Bluebird by American Express

- Walmart MoneyCard

- Green Dot Prepaid Visa Card

- AccountNow Prepaid Visa Card

- RushCard Prepaid Visa Card

- Brink’s Prepaid Mastercard

- Mango Prepaid Mastercard

- PayPal Prepaid Mastercard

- Western Union NetSpend Prepaid Mastercard

What Money order services third-party cash checks?

- Western Union

- MoneyGram

- USPS Money Orders

When it comes to cashing third-party checks in the United States, a few different options are available. Generally speaking, most banks will cash third-party checks, although there might be restrictions depending on the bank. For example, many banks limit how much a third-party check can be cashed once. Additionally, some banks may require additional documentation or verification before allowing someone to cash a third-party check.

Many grocery stores and big box retailers also offer to check cashing services. These services tend to charge higher fees than banks but may be more convenient for those who don’t have access to a bank account or don’t want to wait in line at the bank. Grocery stores and big box retailers typically require the person cashing the check to provide valid identification and proof of address, such as a driver’s license or utility bill.

Plenty of private businesses also offer to check cashing services across the country. These businesses usually charge high fees for their services, but they generally don’t have any requirements beyond providing identification for the person cashing the check. However, it’s important to note that these businesses often won’t accept certain checks or limit how much money can be received from any individual check. So, it’s best to research before using one of these services.

Finally, many credit unions and community banks also offer to check cashing services. Credit unions and community banks generally accept third-party checks without extra paperwork or restrictions. However, they may require an initial deposit from new customers before allowing them to cash their first check. Nevertheless, the fees associated with these services tend to be lower than other options, making them a good choice if you’re looking for an affordable way to cash your third-party checks quickly and conveniently.

How to cash a third-party check without a bank account?

To cash a third party without a bank account, you can do it in the bank if you are the person whose name is written on the check. In that case, you will quickly cash the check using a photo ID. Additionally, you can cash outside the bank in a credit union such as Connexus Credit Union or Navy Federal Credit Union.

You must demonstrate that the third-party check is issued to you; therefore, providing personal documents and verification records is imperative as part of a bank’s policy. It is required to show that the name on the check is yours to prevent fraudulent activity. If you intend to go to the issuing bank or cashing place, you must submit two forms of picture identification before beginning the process. Verification documents include a driver’s license or a state-issued ID card, a passport, a military ID, and a debit card with a recent picture you can deposit physical or paper checks using Cash App but not all users. You can read more about this topic in our article where can I load money on my cash app card?